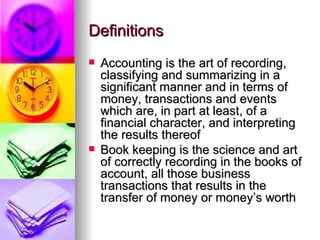

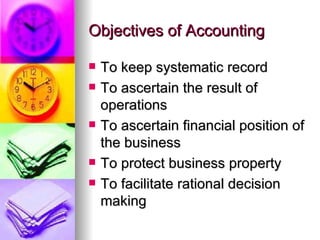

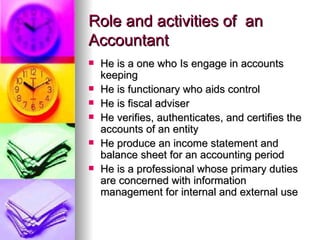

This document provides an introduction to financial accounts and accounting concepts. It defines accounting and bookkeeping, outlines the objectives and users of accounting information. It describes the roles of accountants and common accounting personnel. It also explains key accounting concepts like the accounting cycle, and types of accounts including personal, real, and nominal accounts.