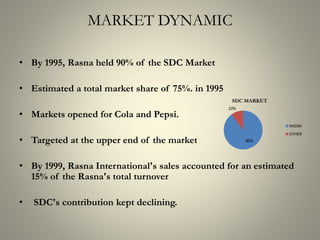

Rasna is a soft drink concentrate brand owned by Pioma Industries based in India. It dominated the market in the 1970s-1990s with its tagline "I love you Rasna". However, it started losing market share in the 1990s with the entry of competitors like Coke and Pepsi. In response, Rasna revamped its strategies in 2002, including repositioning itself, extensive advertising, and improving distribution. The revamping was successful, with Rasna emerging as a mass brand and regaining 93% market share in the Indian soft drink concentrate market by 2009.