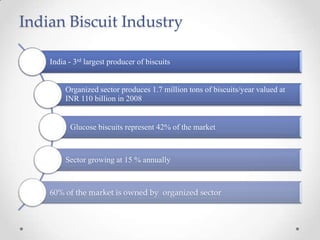

1) India is the 3rd largest producer of biscuits globally, with the organized sector producing 1.7 million tons annually worth INR 110 billion in 2008. Glucose biscuits represent 42% of the Indian biscuit market.

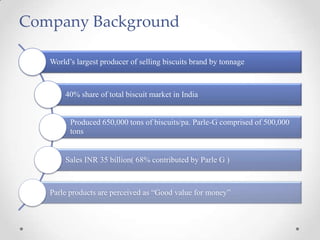

2) Parle Products is the largest biscuit company in India, producing 650,000 tons of biscuits per year. Parle-G alone accounts for 500,000 tons of annual production and 68% of Parle Product's INR 35 billion in annual sales.

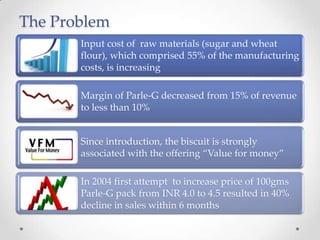

3) Parle faces issues of rising input costs cutting into margins for its flagship Parle-G biscuit. A 2004 attempt to raise Parle-G's price from INR 4 to 4.5