This document discusses key issues for wind energy in California:

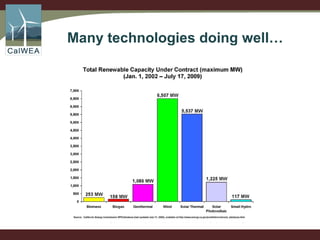

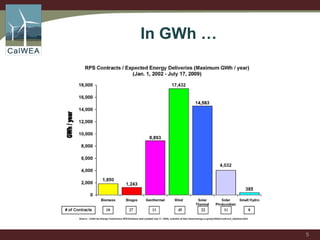

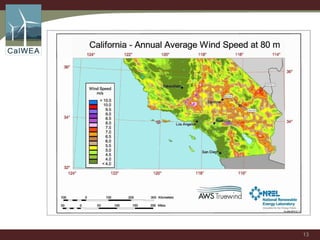

1) Continuing renewable energy goals and policies is needed to achieve 33% renewable energy targets. Wind energy capacity in California has greatly increased but more development is still needed.

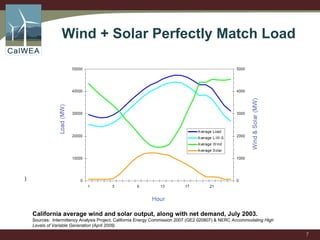

2) Ensuring fair assessment of integration costs and recognizing the capacity value of wind energy, which provides reliability benefits but is not a primary capacity resource.

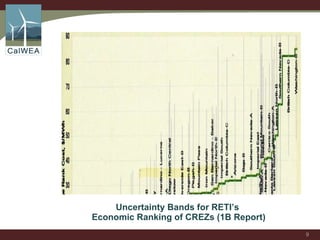

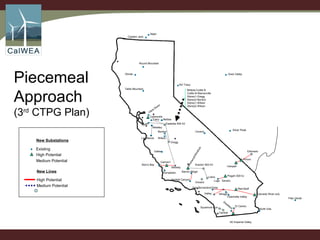

3) Promoting transmission development without prejudging resource areas in order to enable competition between renewable resources on a least-regrets basis.

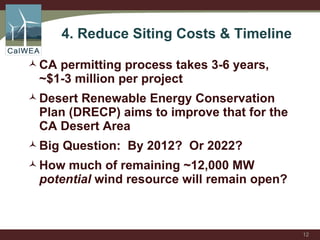

4) Reducing the long siting process and costs for wind projects in order to develop more of California's remaining 12,000 MW of wind potential.