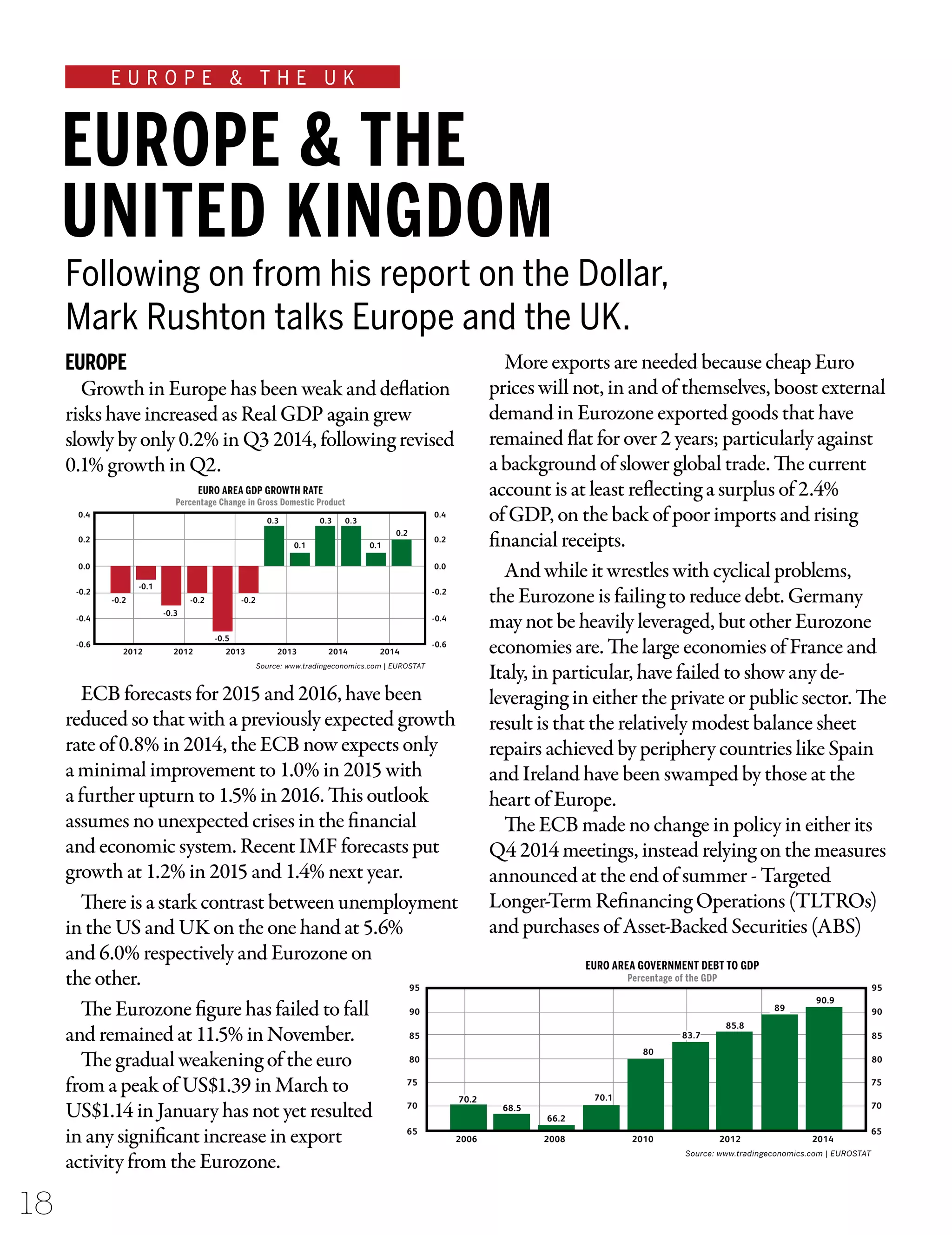

The document provides a seasonal market outlook and review of global markets in Q4 2014 and for the year as a whole. Key points:

- Global stock markets fell sharply in mid-December due to falling commodity prices but recovered by Christmas. The FTSE 100 ended 2014 down 2.7%.

- Mining stocks and food retailers struggled while utility companies performed well, benefiting from growing demand for income and declining rate expectations.

- Commodity prices are expected to remain weak in 2015 due to slowing demand from Europe and China and increased supply, particularly of oil from US shale production.