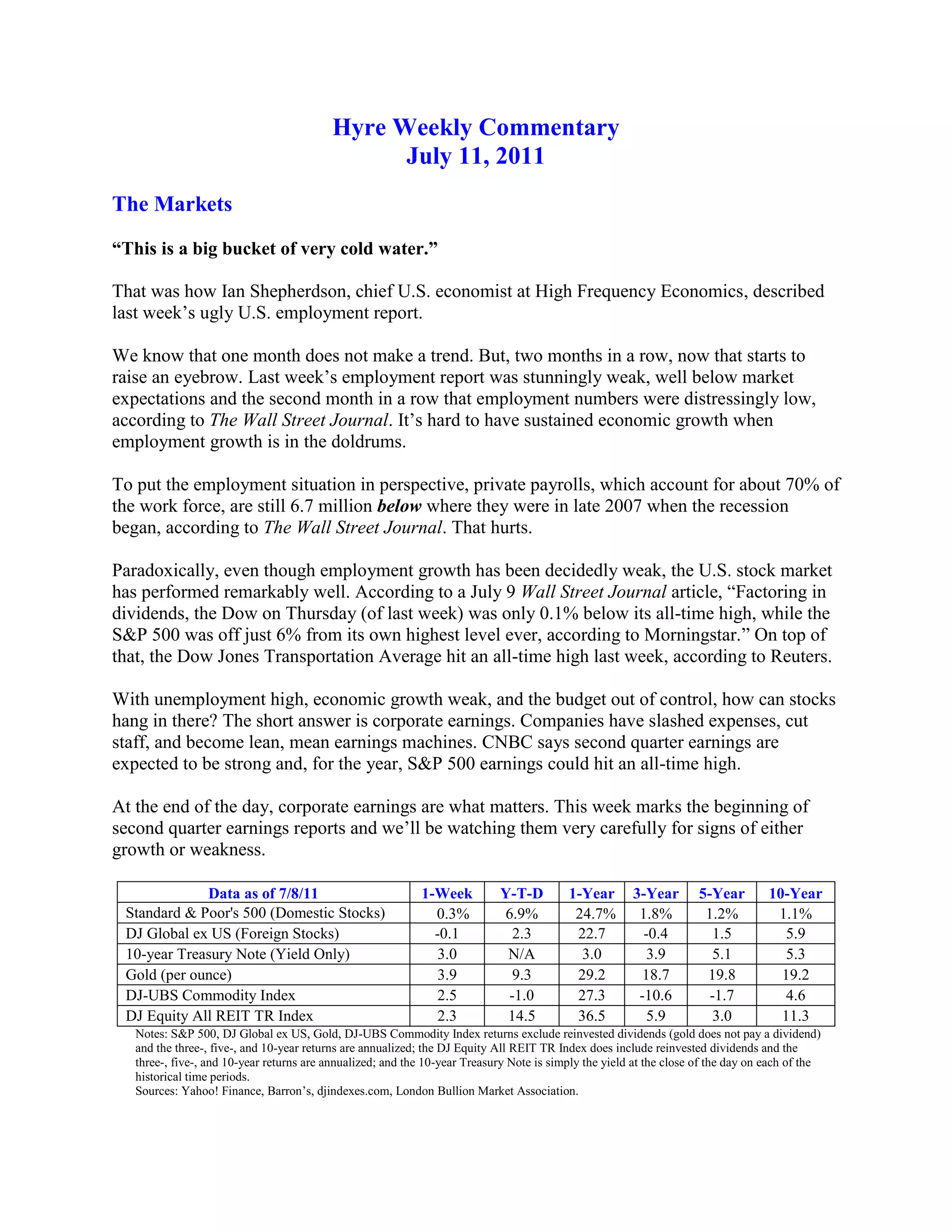

The document summarizes an economic commentary discussing recent weak US employment reports and the disconnect between stock market performance and underlying economic conditions. It notes that while unemployment remains high and growth weak, corporate earnings have remained strong, supporting stock prices. It also introduces a special report on China's economic rise and changing demographics that may challenge continued growth.