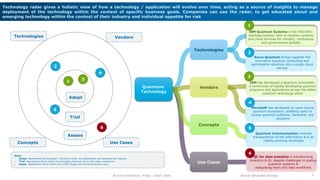

1. Quantum technology is based on principles of quantum mechanics developed in the early 20th century and describes nature at the atomic scale. The second revolution of quantum technology focuses on quantum computing, communications, and sensing.

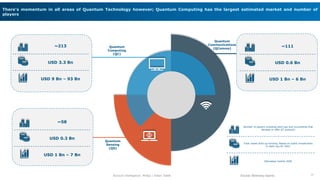

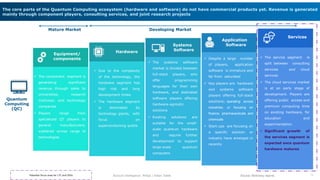

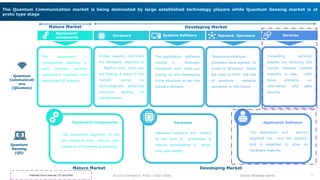

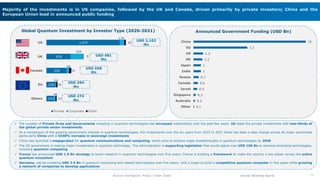

2. The document discusses the maturity levels and market sizes of different segments within quantum computing, communications, and sensing. It also analyzes investments and partnerships in the field of quantum technologies globally.

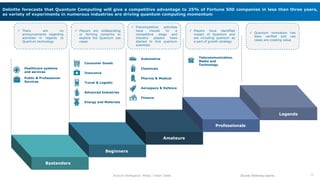

3. Industries like chemicals, pharmaceuticals, automotive, banking and defense are expected to see near term impact from quantum computing capabilities between 2025-2035.