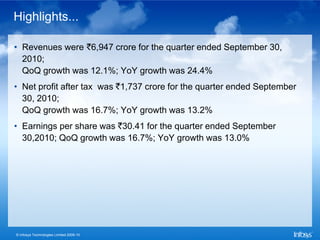

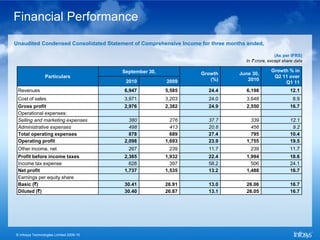

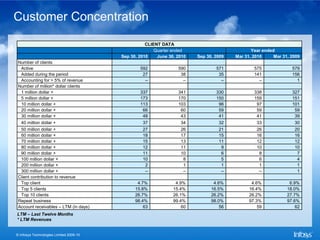

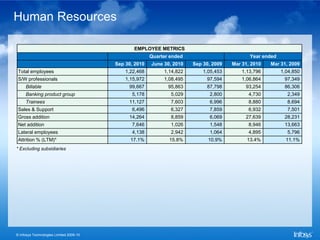

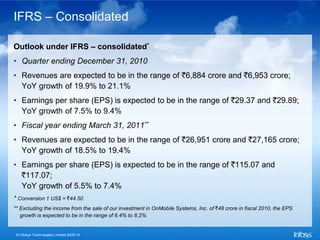

Infosys reported a strong financial performance for Q2 2010, with revenues of ₹6,947 crore, showing a 12.1% quarter-on-quarter growth and a 24.4% year-on-year increase, while net profit reached ₹1,737 crore. The company added 27 new clients and experienced a gross employee addition of 14,264 for the quarter. Looking forward, Infosys expects revenues for the upcoming quarter to be between ₹6,884 crore and ₹6,953 crore, with year-on-year growth projected at 19.9% to 21.1%.