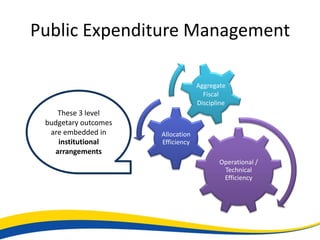

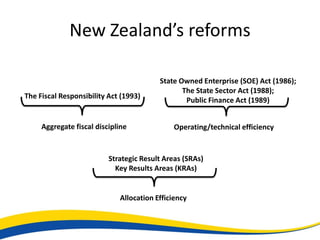

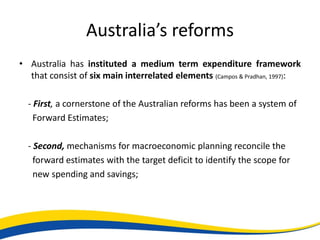

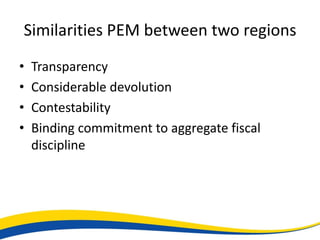

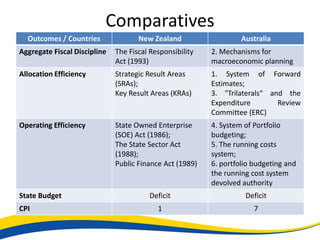

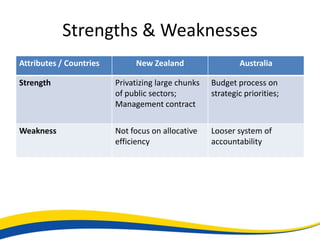

The document compares public expenditure management (PEM) reforms in New Zealand and Australia. Both countries introduced reforms to improve aggregate fiscal discipline, allocation efficiency, and operational efficiency. New Zealand's reforms included establishing state-owned enterprises, abolishing permanent public sector tenure, enhancing transparency through the Public Finance Act, and the Fiscal Responsibility Act. Australia introduced a medium-term expenditure framework focusing on forward estimates, macroeconomic planning, and portfolio budgeting. Key similarities in the PEM reforms of both countries include increased transparency, devolution, contestability, and commitment to fiscal discipline.