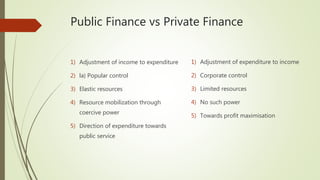

This document provides an overview of financial administration. It defines financial administration and discusses its key components, including public revenue, public expenditure, and public debt. It describes the traditional and modern views of the nature of financial administration. The document also outlines the scope of financial administration and identifies its core areas as financial planning, budgeting, resource mobilization, investment decisions, and expenditure control.