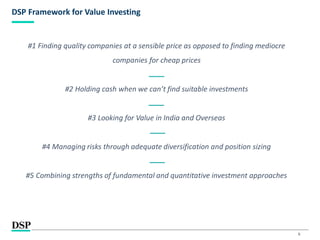

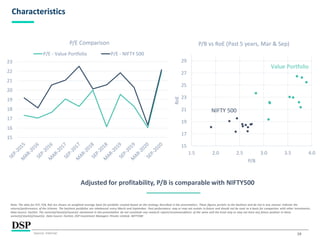

1) The document discusses the investment principles of the DSP Value Fund, which focuses on finding quality companies at sensible prices rather than mediocre companies at cheap prices.

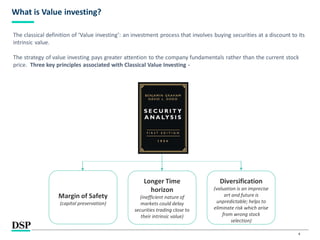

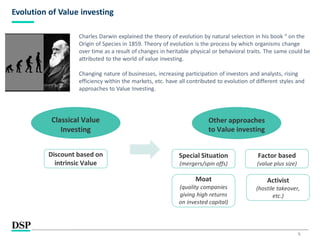

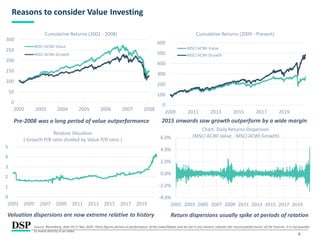

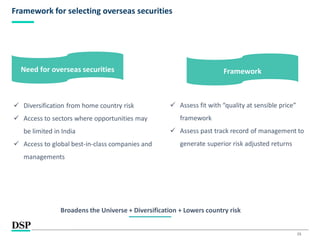

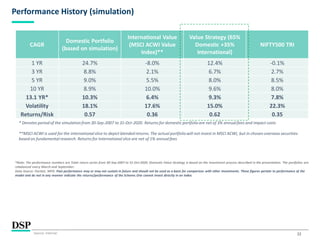

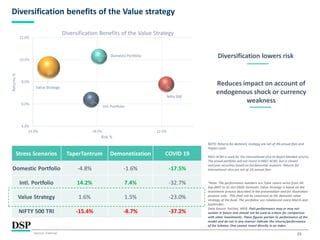

2) It provides an overview of value investing strategies and frameworks, including classical value investing based on intrinsic value and other evolving approaches.

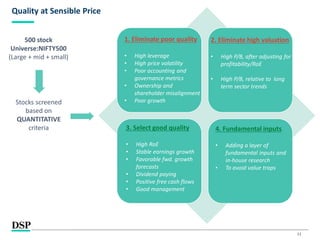

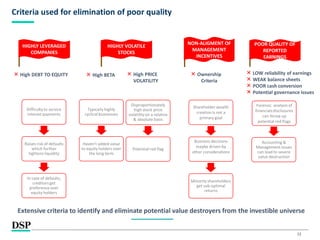

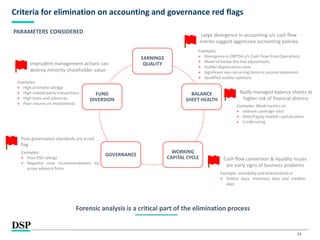

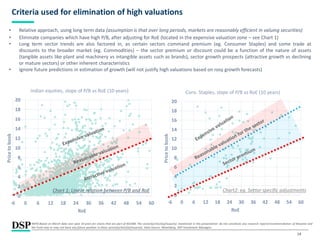

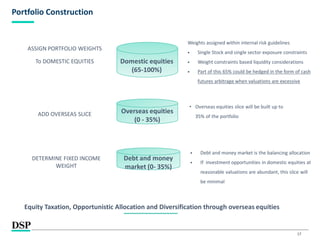

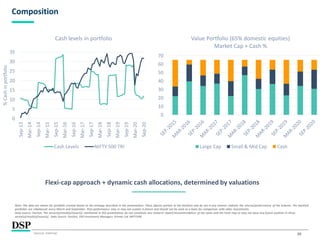

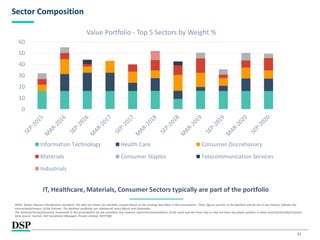

3) The document outlines the DSP Value Fund's investment process, which involves screening companies based on quality criteria, eliminating poor quality and high valuation stocks, and constructing a portfolio with a flexicap approach and dynamic cash allocations based on valuations.

![[Title to come]

[Sub-Title to come]

Strictly for Intended Recipients OnlyDate

* DSP India Fund is the Company incorporated in Mauritius, under which ILSF is the corresponding share class

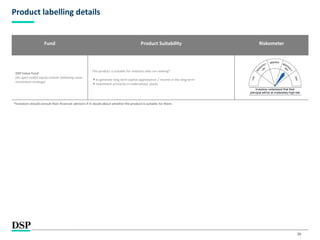

DSP Value Fund

November 2020](https://image.slidesharecdn.com/dsp-value-fund-presentation-201211082608/85/DSP-Value-Fund-1-320.jpg)