1) The document describes the investment strategy and process of the DSP Value Fund, an open-ended equity scheme that follows a value investment approach.

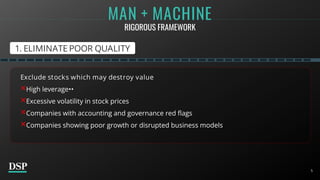

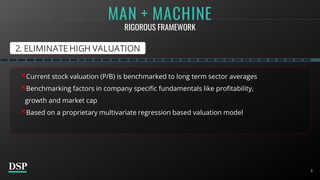

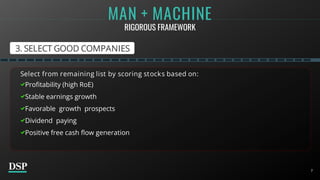

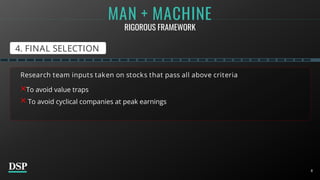

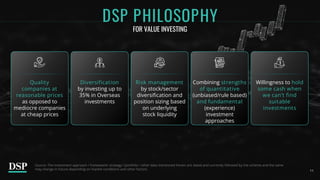

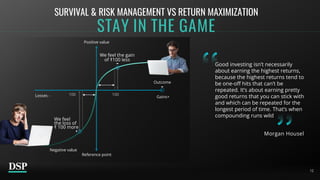

2) The fund uses a rigorous multi-step process combining quantitative screening and fundamental research to identify high-quality companies trading at reasonable valuations.

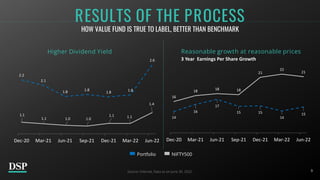

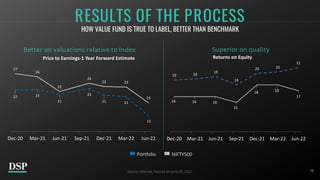

3) This process has led to the fund outperforming its benchmark on metrics like earnings growth, returns on equity, and dividend yield while maintaining a focus on quality and valuation.