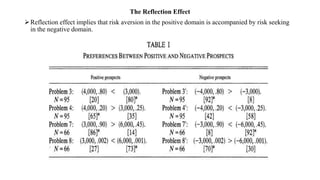

- Prospect theory is an alternative to expected utility theory that aims to better describe how people make decisions under risk or uncertainty.

- It incorporates concepts like the certainty effect, reflection effect, and isolation effect to account for behaviors not predicted by expected utility theory.

- Prospect theory posits that people edit prospects through coding, combination, segregation, cancellation, and simplification before evaluating them.

- Evaluation involves weighing the value of outcomes, where value is assessed based on gains and losses relative to a reference point and is generally concave for gains and convex for losses. Decision weights are applied to outcomes and may differ from actual probabilities.

![Violation Of Expected Utility Theory

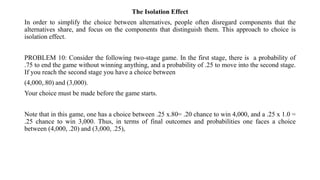

People overweight outcomes that are considered certain, relative to outcomes which are merely

probable which we label the certainty effect

Certainty Effect

Choose between

• A: 2,500 with probability .33, B: 2,400 with certainty.

• 2,400 with probability .66,

• 0 with probability .01

N=72 [18] [82]*

A: 50% chance to

win 1,000, 50%

chance to win

nothing;

B: 450 for sure.](https://image.slidesharecdn.com/prospecttheory-220918123721-c7d660c8/85/Prospect-Theory-pptx-3-320.jpg)

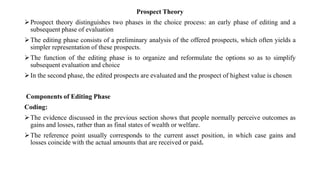

![Choose between

• C: 2,500 with probability .33, D: 2,400 with probability .34,

• 0 with probability .67; 0 with probability .66.

• N =72 [83]* [17]

PROBLEM 1:

• A: (4,000,.80), B: (3,000).

• N = 95 [20] [80]*

PROBLEM 2:

• C: (4,000,.20), D: (3,000,.25).

• N= 95 [65]* [35]](https://image.slidesharecdn.com/prospecttheory-220918123721-c7d660c8/85/Prospect-Theory-pptx-4-320.jpg)

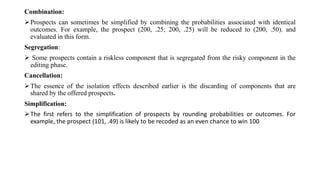

![The certainty effect with non-monetary outcomes.

PROBLEM 3:

A: 50% chance to win a three- B: A one-week tour of

week tour of England, France and Italy England, with certainty.

N=72 [22] [78]*

C: 5% chance to win a three- D: 10% chance to win a one week

• tour of England, France, and Italy; tour of England

N=72 [67]* [33]](https://image.slidesharecdn.com/prospecttheory-220918123721-c7d660c8/85/Prospect-Theory-pptx-5-320.jpg)