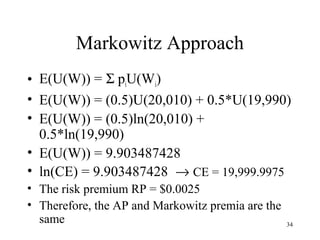

Expected Utility Theory provides a framework for decision making under uncertainty. It assumes individuals will choose the option with the highest expected utility, which is the probability-weighted average of potential outcomes' utilities. Utility functions are unique to individuals and capture declining marginal utility of wealth. Risk aversion arises when the utility function is concave, meaning the expected utility of a gamble is less than the utility of its expected payoff. The risk premium is what a risk-averse individual would pay to avoid risk and attain the certainty equivalent.

![3

2 Goals

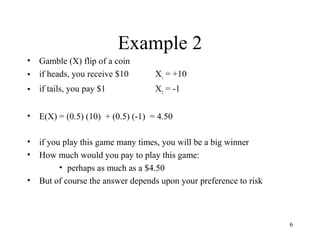

1) Individual maximizes their expected Utility

0.4

0.6

0.3

0.7

10

2

9

4

Asset i

Asset j

E(W) = 0.4(10) + 0.6(2) = 5.2

E[U(W)] = 0.4U(10) + 0.6U(2) = ?

Prefer the one with higher E[U(W)]

E(W) = 0.3(9) + 0.7(4) = 5.5

E[U(W)] = 0.3U(9) + 0.7U(4) = ?

2) Individual preferences over risk and return

y

x

C2

C1

Return

Risk](https://image.slidesharecdn.com/2005fc49note02-141028004827-conversion-gate01/85/2005-f-c49_note02-3-320.jpg)

![5 Axioms of Choice under uncertainty

13

A4.Measurability. (CARDINAL UTILITY)

If outcome y is less preferred than x (y < x) but more than z (y > z),

then there is a unique probability α such that:

the individual will be indifferent between

[1] y and

[2] A gamble between x with probability α

z with probability (1-α).

In Maths,

if x > y > z or x > y > z ,

then there exists a unique α such that y ~ G(x,z:α)](https://image.slidesharecdn.com/2005fc49note02-141028004827-conversion-gate01/85/2005-f-c49_note02-13-320.jpg)

![15

One more assumption

• People are greedy, prefer more wealth than

less.

• The 5 axioms and this assumption is all we

need in order to develop a expected utility

theorem and actually apply the rule of

max E[U(W)] = max ΣiαiU(Wi)](https://image.slidesharecdn.com/2005fc49note02-141028004827-conversion-gate01/85/2005-f-c49_note02-15-320.jpg)

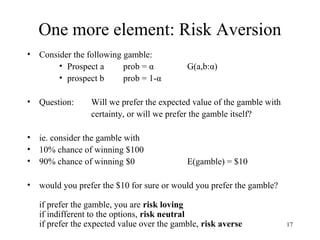

![16

Utility Functions

• Utility functions must have 2 properties

1. order preserving: if U(x) > U(y) => x > y

2. Expected utility can be used to rank combinations of risky

alternatives:

U[G(x,y:α)] = αU(x) + (1-α) U(y)

• Deriving Expected utility theorem, one of the most elegant derivations

in Economics, is tough. Don’t worry about a formal derivation. Just

apply it.

• Remark:

Utility functions are unique to individuals

- there is no way to compare one individual's utility function with

another individual's utility

- interpersonal comparisons of utility are impossible

if we give 2 people $1,000 there is no way to determine who is happier](https://image.slidesharecdn.com/2005fc49note02-141028004827-conversion-gate01/85/2005-f-c49_note02-16-320.jpg)

![20

U[E(W)] and E[U(W)]

• U[(E(W)] is the utility associated with the known

level of expected wealth (although there is

uncertainty around what the level of wealth will

be, there is no such uncertainty about its expected

value)

• E[U(W)] is the expected utility of wealth is utility

associated with level of wealth that may obtain

• The relationship between U[E(W)] and E[U(W)] is

very important](https://image.slidesharecdn.com/2005fc49note02-141028004827-conversion-gate01/85/2005-f-c49_note02-20-320.jpg)

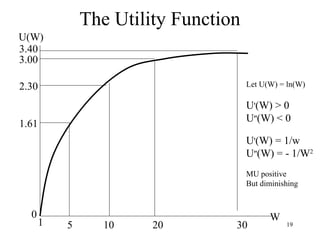

![21

Expected Utility

• Assume that the utility function is natural logs: U(W) = ln(W)

• Then MU(W) is decreasing

• U(W) = ln(W)

• U'(W)=1/W

• MU>0

• MU''(W) < 0 => MU diminishing

Consider the following example:

80% change of winning $5

20% chance of winning $30

E(W) = (.80)*(5) + (0.2)*(30) = $10

U[E(W)] = U(10) = 2.30

E[U(W)] = (0.8)*[U(5)] + (0.2)*[U(30)]

= (0.8)*(1.61) + (0.2)*(3.40)

= 1.97

Therefore, U[(E(W)] > E[U(W)] -- uncertainty reduces utility](https://image.slidesharecdn.com/2005fc49note02-141028004827-conversion-gate01/85/2005-f-c49_note02-21-320.jpg)

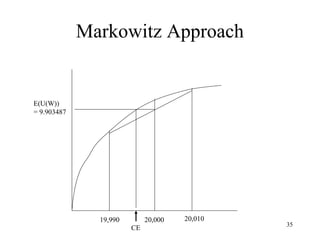

![22

The Markowitz Premium

U(W)

3.40

1.61

1 W 5 10 30

U[E(W)] = 2.30

0

U[E(W)] = U(10) = 2.30

E[U(W)]

= 0.8*U(5) + 0.2*U(30)

= 0.8*1.61 + 0.2*3.40

= 1.97

Therefore, U[E(W)] > E[U(W)]

Uncertainty reduces utility

Certainty equivalent: 7.17

That is, this individual will take

7.17 with certainty rather than

the uncertainty around the gamble

CE

= 7.17

E[U(W)] = 1.97

2.83

U(W) = ln(W)](https://image.slidesharecdn.com/2005fc49note02-141028004827-conversion-gate01/85/2005-f-c49_note02-22-320.jpg)

![23

The Certainty Equivalent

• The Expected wealth is 10

• The E[U(W)] = 1.97

• How much would this individual take with

certainty and be indifferent the gamble

• Ln(CE) = 1.97

• Exp(Ln(CE)) = CE = 7.17

• This individual would take 7.17 with certainty

rather than the gamble with expected payoff of 10

• The difference, (10 – 7.17 ) = 2.83, can be viewed

as a risk premium – an amount that would be paid

to avoid risk](https://image.slidesharecdn.com/2005fc49note02-141028004827-conversion-gate01/85/2005-f-c49_note02-23-320.jpg)

![24

The Risk Premium

• Risk Premium:

– the amount that the individual is willing to give up in order to avoid the

gamble

• Recall the gamble

80% change of winning $5

20% chance of winning $30

E(W) = (.80)*(5) + (0.2)*(30) = $10

Suppose the individual has the choice now between the gamble and the

expected value of the gamble

E[U[W)] = 1.97

Certainty equivalent = $7.17

Investor would be willing to pay a maximum of $2.83 to avoid the gamble

($10 - $7.17) ie will pay an insurance premium of $2.83.

THIS IS CALLED THE MARKOWITZ PREMIUM

Ln(CE)=1.97, i.e U(CE)=E[U(W)],, CE=7.17 RP=10-7.17=$2.83](https://image.slidesharecdn.com/2005fc49note02-141028004827-conversion-gate01/85/2005-f-c49_note02-24-320.jpg)

![25

The Risk Premium

Risk

Premium

=

an individual's

expected

wealth,given he

plays the gamble

-

level of wealth the

individual would accept

with certainty if the

gamble were removed (ie

the certainty equivalent)

In general,

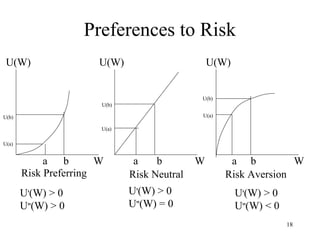

if U[E(W)] > E[U(W)] then risk averse individual (RP > 0)

if U[E(W)] = E[U(W)] then risk neutral individual (RP = 0)

if U[E(W)] < E[U(W)] then risk loving individual (RP < 0)

risk aversion occurs when the utility function is strictly concave

risk neutrality occurs when the utility function is linear

risk loving occurs when the utility function is convex](https://image.slidesharecdn.com/2005fc49note02-141028004827-conversion-gate01/85/2005-f-c49_note02-25-320.jpg)

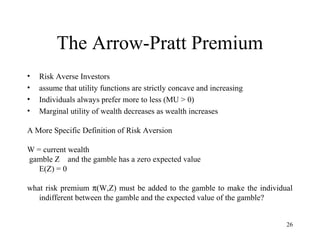

![27

The Arrow-Pratt Premium

The risk premium p can be defined as the value that satisfies the

following equation:

E[U(W + Z)] = U[ W + E(Z) - p( W , Z)] (*)

LHS: RHS:

expected utility of utility of the current level of wealth

the current level plus

of wealth, given the the expected value of

gamble the gamble

less

the risk premium

We want to use a Taylor series expansion to (*) to derive an expression

for the risk premium p(W,Z)](https://image.slidesharecdn.com/2005fc49note02-141028004827-conversion-gate01/85/2005-f-c49_note02-27-320.jpg)

![37

Mean & Variance as choice

variables

• With 5 axioms, prefer more to less, we

have Expected utility theorem

• With risk-aversion assumption, we

solve St. Petersburg’s paradox

• With returns of risky assets being

jointly normally distributed, we can

draw indifference curves on the plane

of return (E(r)) and risk (var(r) or

standard deviation of r) as the right

diagram

• Essentially, mean and variance are the

choice variables investors concern

about in order to max their E[U(w)]

Return

Risk](https://image.slidesharecdn.com/2005fc49note02-141028004827-conversion-gate01/85/2005-f-c49_note02-37-320.jpg)