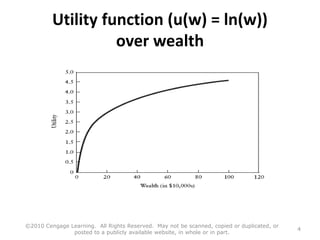

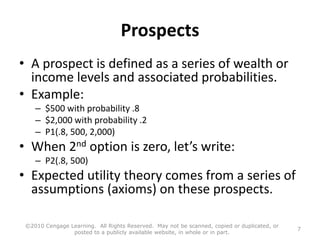

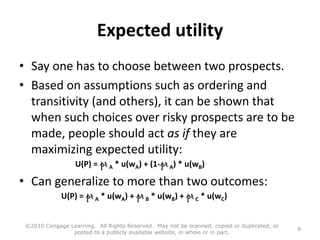

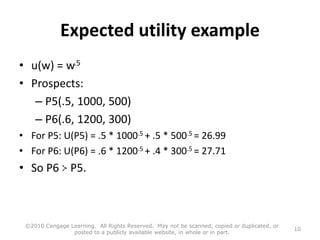

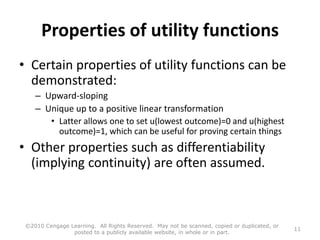

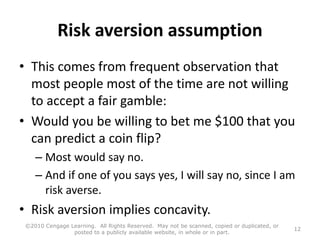

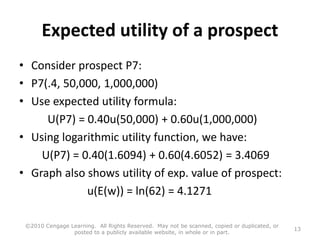

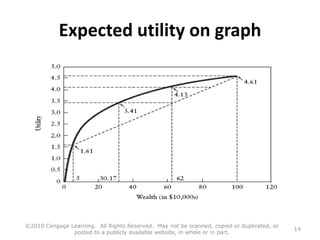

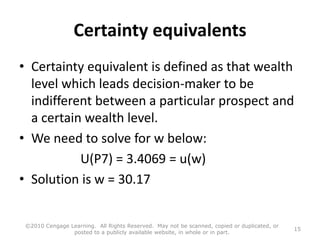

This document summarizes key concepts from expected utility theory. It outlines the theory's assumptions that people have rational preferences, maximize utility, and make independent decisions based on information. Preferences are defined as complete and transitive. Expected utility theory says individuals should act to maximize expected utility when making decisions under risk. It provides an example calculation and discusses properties like risk aversion. However, the document notes that expected utility theory has problems accounting for all observed behaviors.