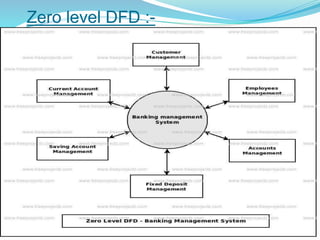

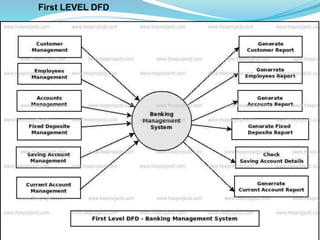

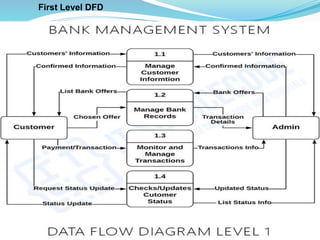

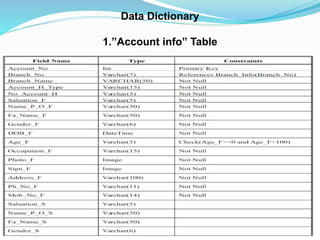

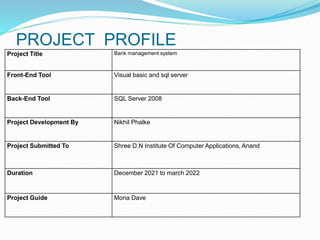

This document describes a bank management system project developed by Nikhil K Phalke. The project aims to automate manual bank processes using Visual Basic and SQL Server. It allows users to open new accounts, make deposits, withdrawals, check credit and apply for loans. The system improves efficiency over the existing manual system by reducing errors, storing customer records efficiently and providing faster retrieval of information. The system requirements, data flow diagram, entity relationship diagram, forms, and advantages are outlined. The project aims to provide a structured, secure and presentable way to manage all bank activities and documentation.

![Hardware requirements of the system

2.5GHz Dual processor that are each 3 GHz or

faster.

1 GB RAM

Disk NTFS file system-formatted partition with

of 3GB free space.

60 GB Hard-Disk.

4x Compact Disc drive or faster.

Monitor. [ 640 x 480 Display ]

Keyboard.

Mouse.](https://image.slidesharecdn.com/bankmanagementsystemppt-230810172318-9fae93ac/85/Bank-management-system-PPT-pptx-6-320.jpg)