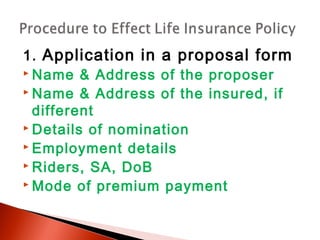

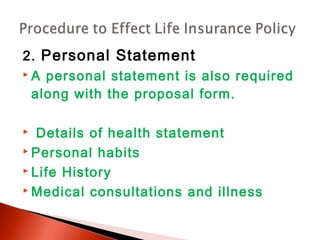

The document outlines the application process for a life insurance proposal, which includes submitting a proposal form with personal details, a personal statement of health history and habits, proof of age, medical and agent reports. The insurance company will decide within 15 days to accept or reject the proposal based on underwriting. If accepted, a first premium receipt is issued upon payment and the policy document is then issued, containing the terms and conditions of the insurance contract. Other documents include cover notes, endorsements, and prospectuses.