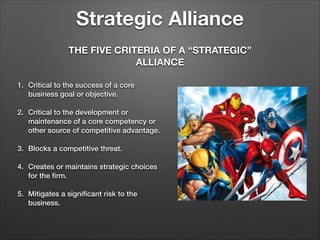

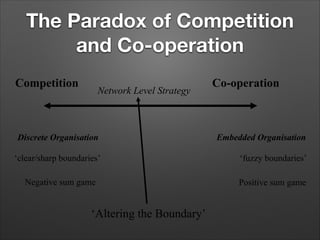

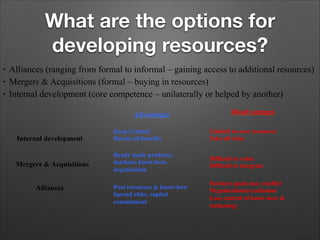

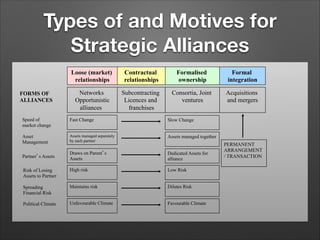

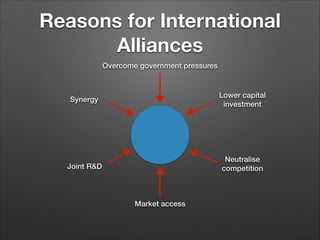

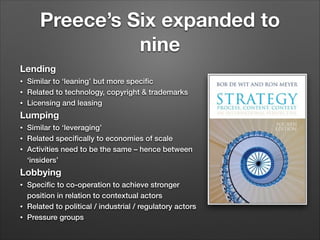

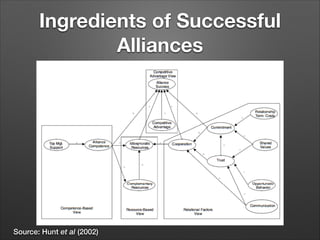

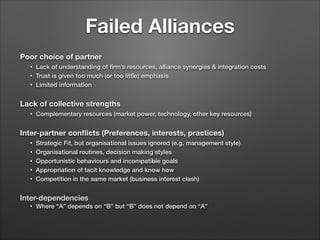

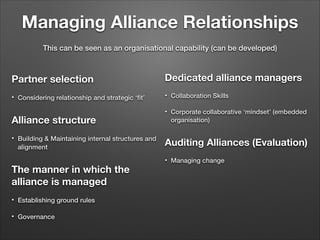

This document discusses private sector alliances and partnerships. It begins by explaining why companies collaborate and providing examples of partnerships. It then distinguishes between different types of partnerships like strategic partnerships, joint ventures, and strategic alliances. Joint ventures involve establishing a new jointly-owned entity, while strategic alliances involve a legal agreement to share resources without creating a new company. The document also notes that alliances have increased significantly in recent decades. Successful alliances require compatible goals, complementary resources, and effective relationship management, while failed alliances can result from issues like incompatible cultures or power imbalances between partners.