Tim Participações S.A. announced its results for the third quarter of 2008. Some key highlights include:

- Total subscriber base reached 35.2 million users, a 20.7% growth over the prior year. TIM maintained a 25% market share.

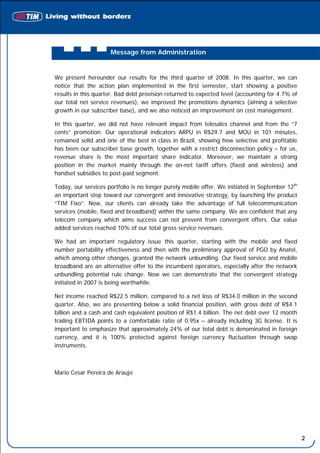

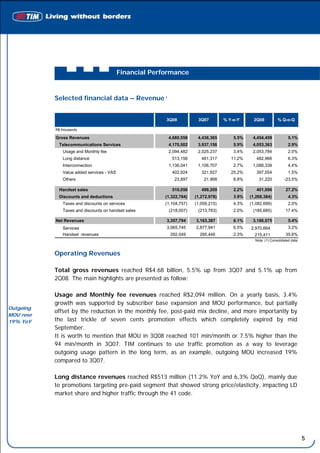

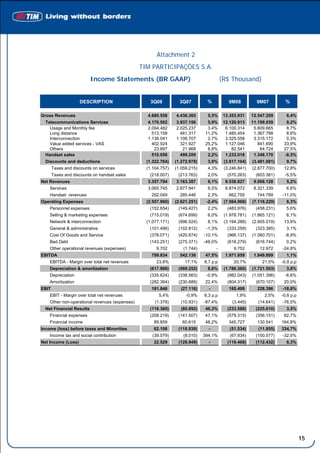

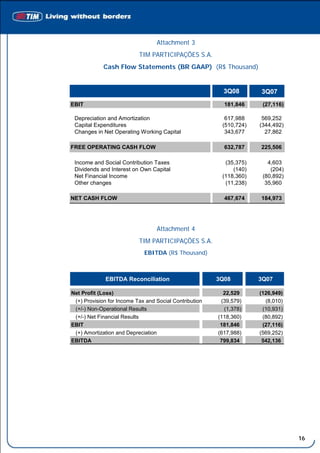

- Service revenue grew 6.5% year-over-year to R$3,066 million. EBITDA was R$800 million, a margin of 23.8%.

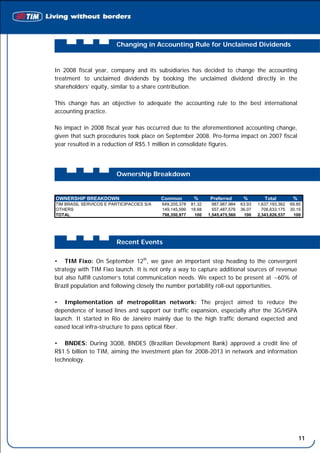

- In September, TIM launched its fixed service brand TIM Fixo, an important step in its convergent strategy.

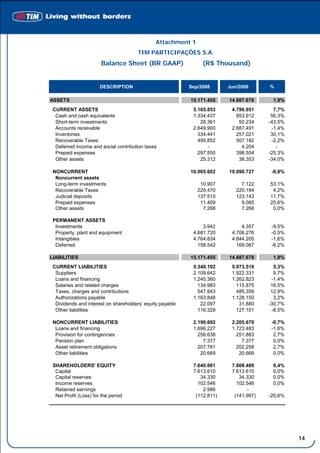

- The total debt was R$4.1 billion and cash position was R$1.4 billion,