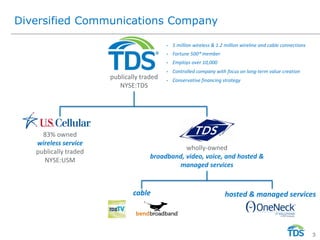

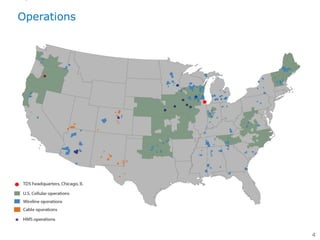

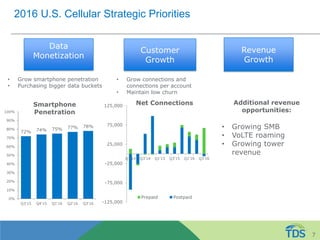

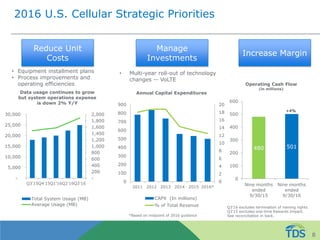

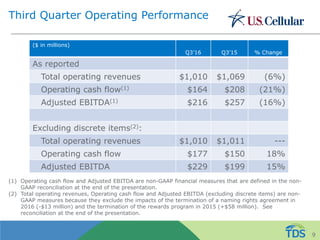

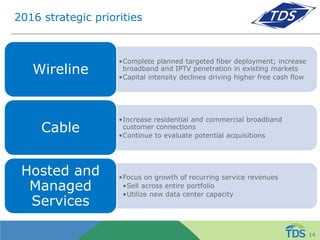

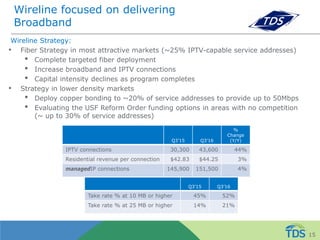

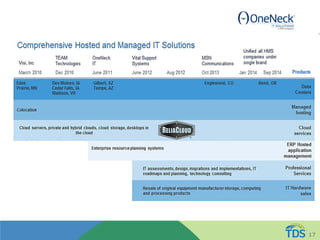

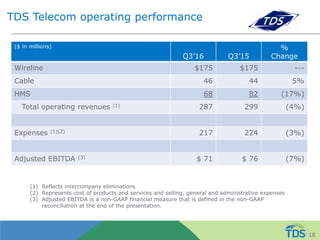

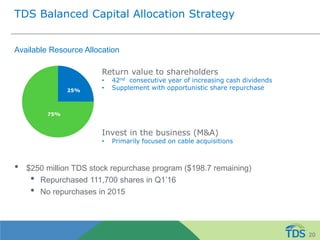

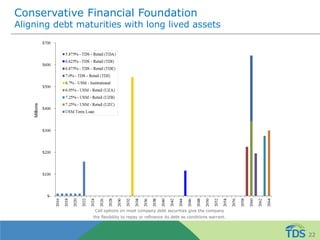

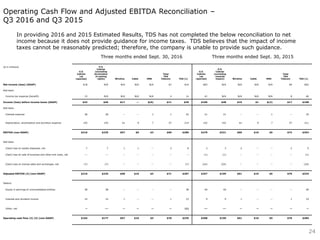

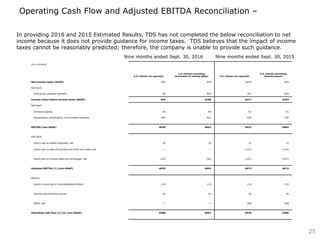

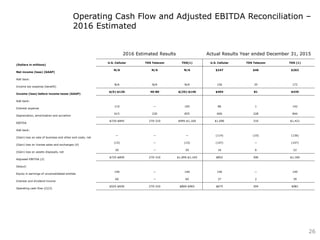

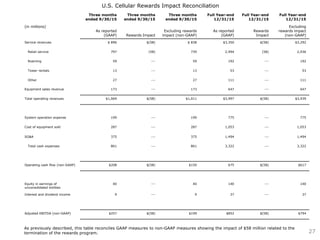

This document provides a summary of a 2016 Southwest IDEAS Investor Conference presentation by TDS Telecom and U.S. Cellular. It begins with a safe harbor statement noting that forward-looking statements in the presentation involve risks and uncertainties that could cause actual results to differ. The presentation then provides an overview of TDS Telecom and U.S. Cellular, their operations, strategic priorities, and financial performance. It discusses their focus on customer growth, revenue growth, data monetization, reducing costs and increasing margins. The presentation concludes with discussions of TDS' balanced capital allocation strategy and conservative financial position.