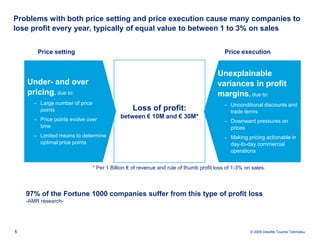

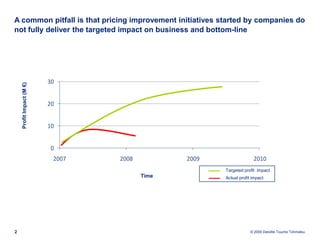

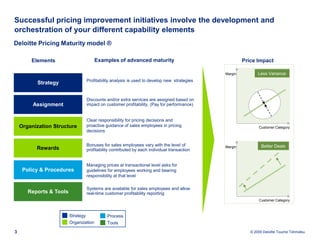

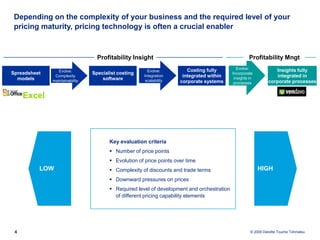

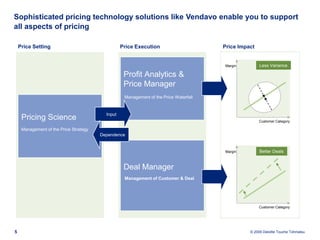

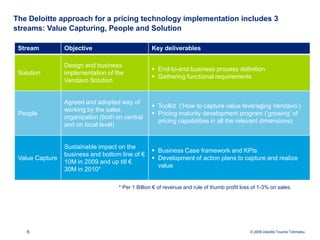

The document discusses the challenges companies face in pricing strategy, noting that issues with price setting and execution can lead to significant profit losses, typically between 1-3% of sales. It emphasizes the importance of sophisticated pricing technology and maturity models for effective pricing that aligns with business goals, and outlines key principles for implementing these solutions. The document also proposes assessment strategies to identify pricing improvement opportunities and measure pricing maturity compared to best practices.