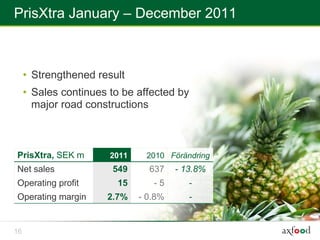

Axfood reported stable sales growth of 1.6% in 2011 with operating profits increasing 3.4% to SEK 1,250 million. Key accomplishments included modernizing stores, increasing the private label product share, and acquiring a 50% stake in a care products supplier. For 2012, Axfood aims to maintain the previous year's operating profit through sales growth, cost controls, further store investments and a new business system despite uncertain market conditions.