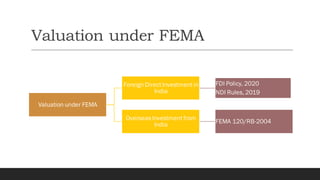

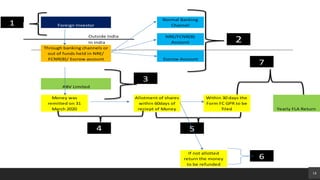

Valuation under FEMA focuses on two main rules:

1. All current account transactions are allowed unless prohibited.

2. All capital account transactions are prohibited unless allowed.

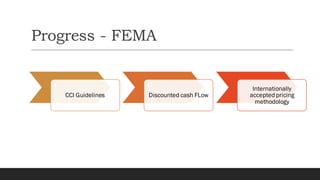

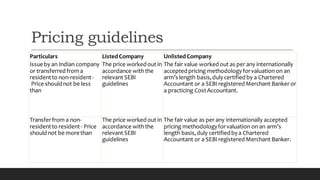

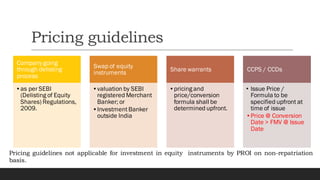

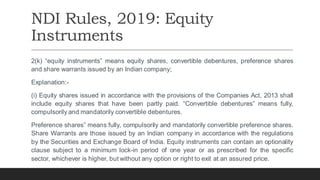

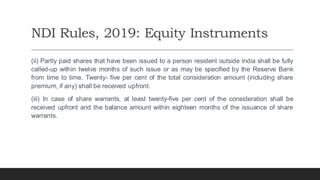

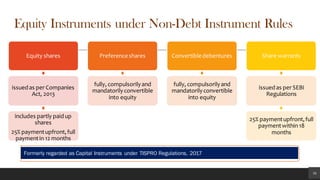

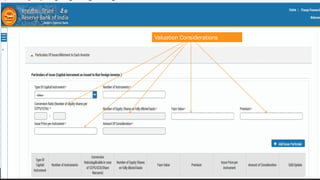

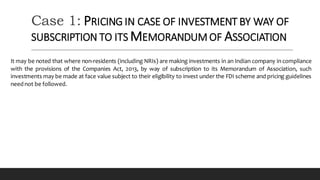

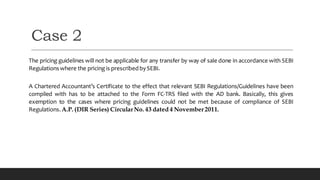

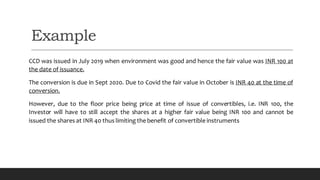

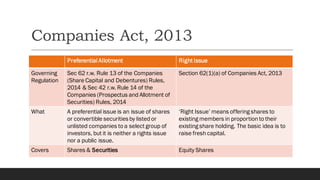

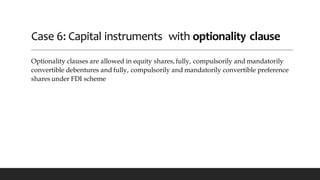

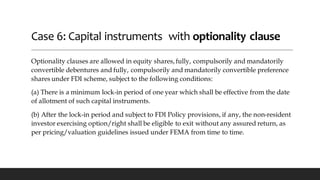

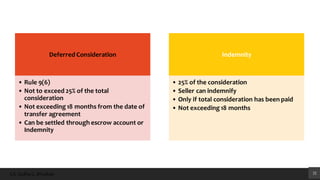

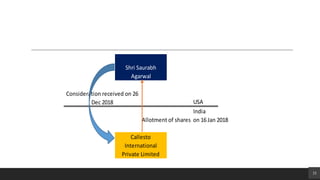

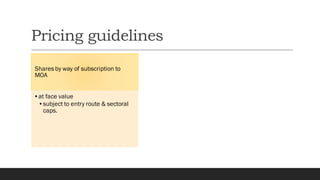

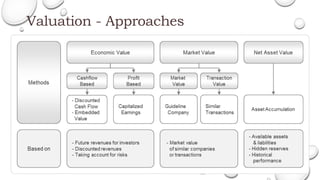

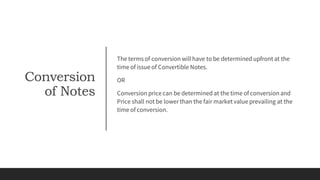

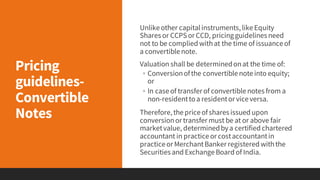

FEMA established guidelines for valuation of shares and securities for foreign direct investment. For listed companies, the price cannot be less than that determined by SEBI guidelines. For unlisted companies, valuation must use an internationally accepted methodology certified by authorized persons. Convertible instruments must specify the conversion price upfront, which cannot be lower than the fair value at issuance.