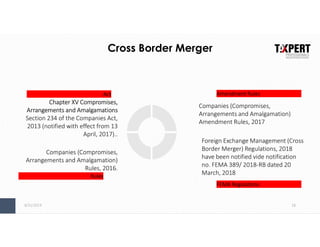

The document discusses the due diligence requirements for cross border transactions and mergers. It covers:

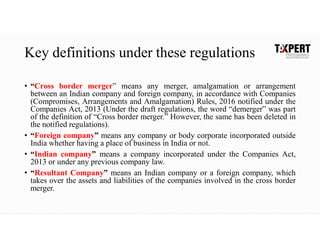

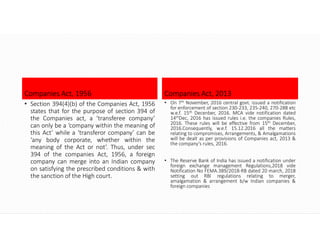

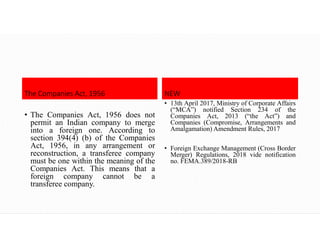

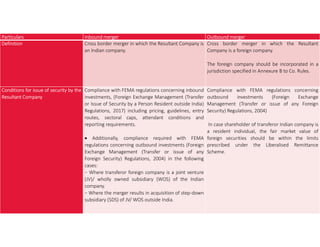

- The key definitions under regulations for cross border mergers between an Indian company and foreign company.

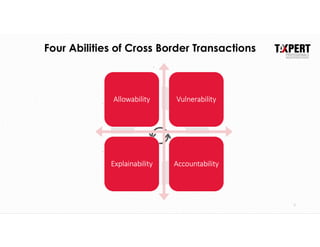

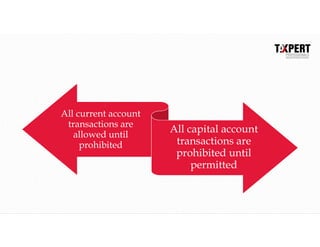

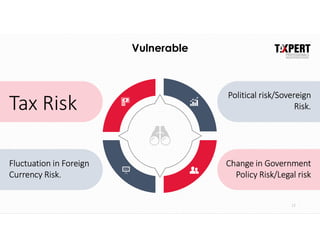

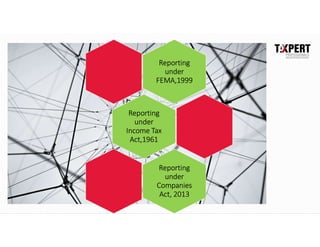

- The allowability, vulnerability, accountability, and explainability aspects that must be considered for cross border transactions.

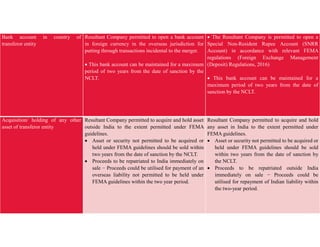

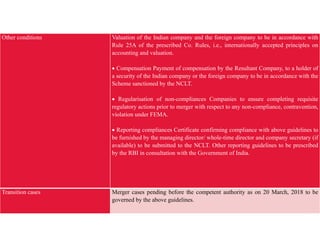

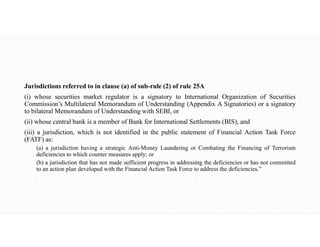

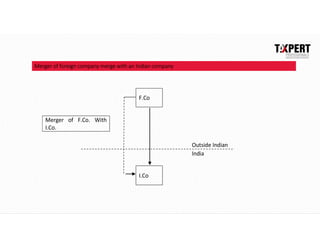

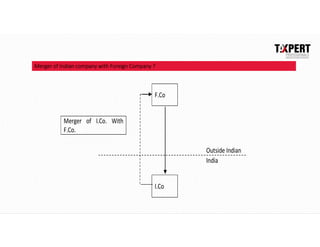

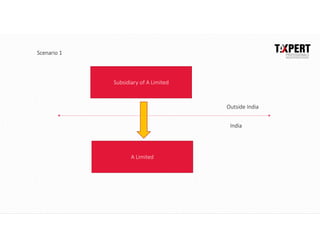

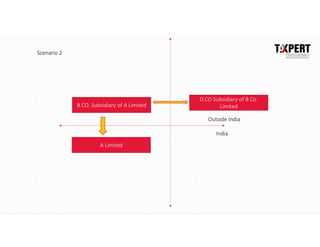

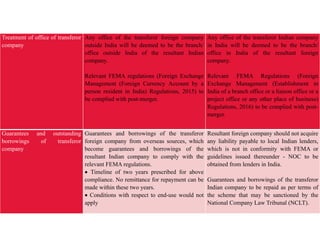

- The conditions under which an Indian company can merge with a foreign company or vice versa, including compliance with FEMA regulations, treatment of offices and assets/liabilities, valuation requirements, and other regulatory conditions.

- Specific provisions for inbound and outbound mergers depending on whether the resultant company is Indian or foreign. This includes timelines for compliance on guarantees, borrowings, and non-compliant assets.

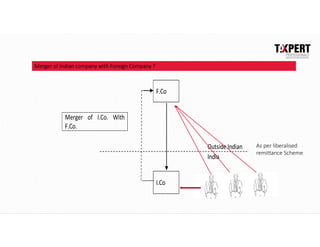

![Merger of Indian company with Foreign Company ?

F.Co

Merger of I.Co. With

F.Co.

Outside Indian

India

I.Co

Indian Company becomes the Branch

office of Foreign Co. ??????

Compliance with Chapter XXII of the

Companies Act, 2013 read with The

Companies (Registration of Foreign

Companies) Rules, 2014 ]](https://image.slidesharecdn.com/presentationcrossbordermerger-200820082237/85/Presentation-on-Cross-Border-Mergers-30-320.jpg)