This document discusses various investment incentives available in Malaysia, including:

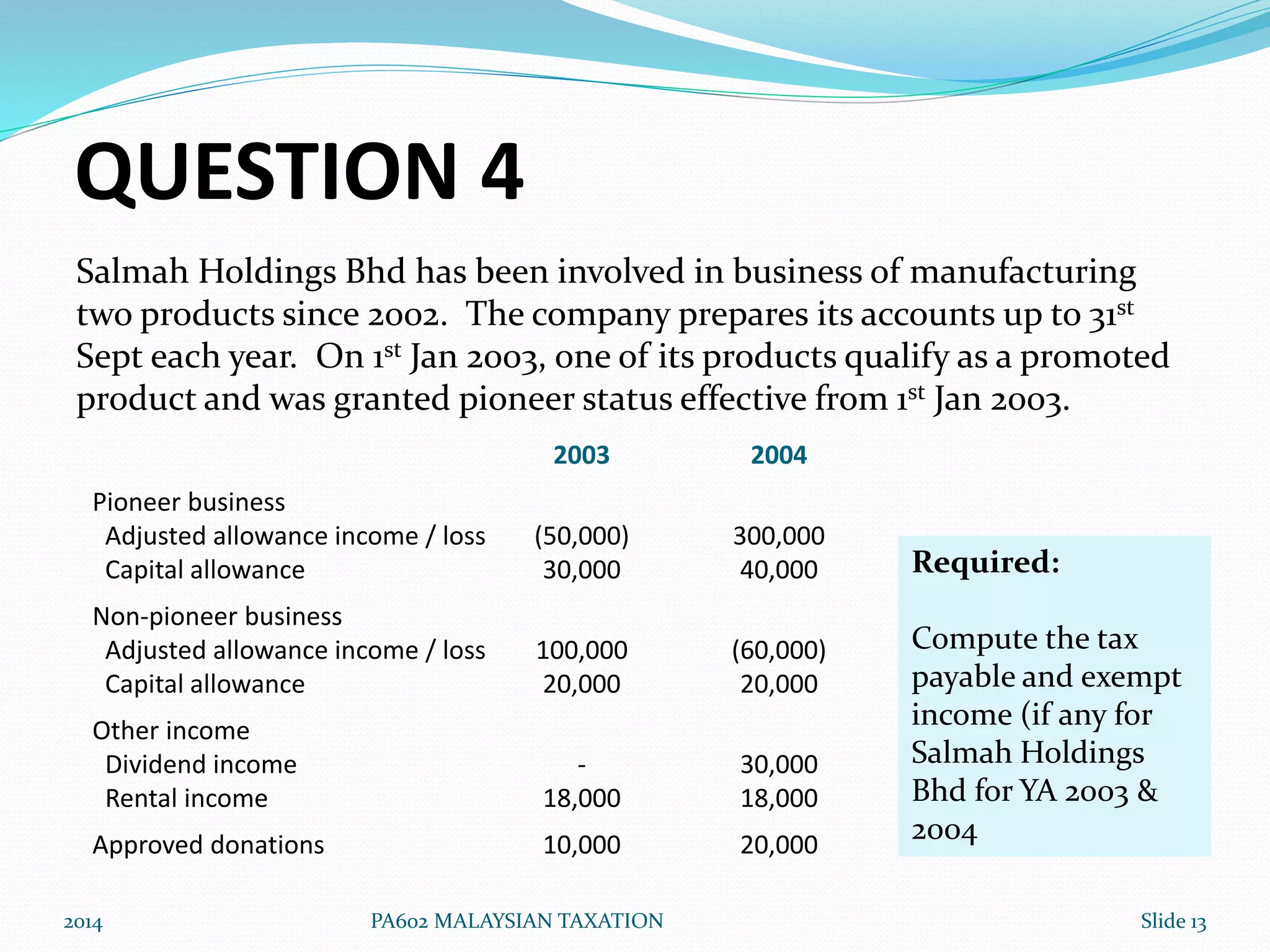

1. Pioneer status provides full or partial income tax exemption for promoted industries like manufacturing. Profits exempted are transferred to an exempt account to frank tax-exempt dividends.

2. Investment tax allowance and reinvestment allowance provide tax deductions or allowances based on qualifying capital expenditures for manufacturing assets.

3. Industries eligible for these incentives include manufacturing, agriculture, and tourism. Incentives aim to promote investment and industrialization in Malaysia.