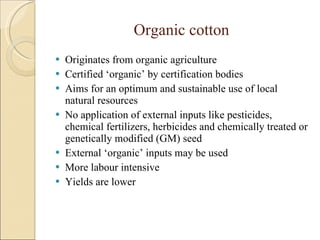

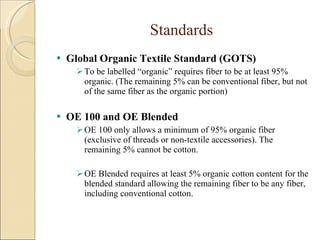

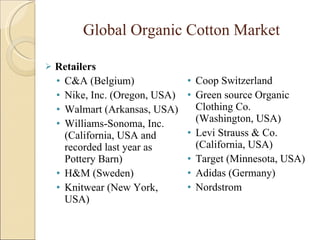

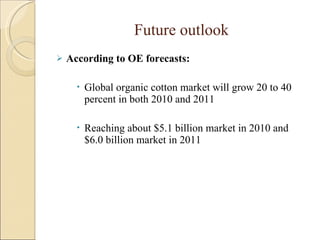

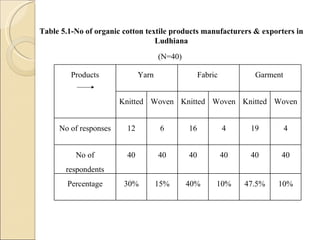

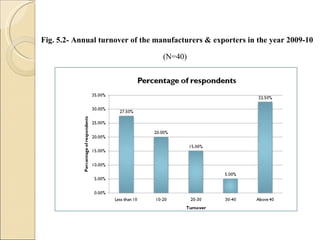

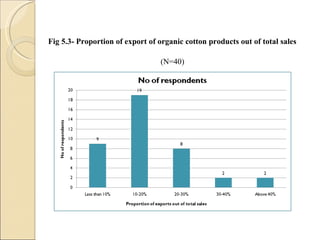

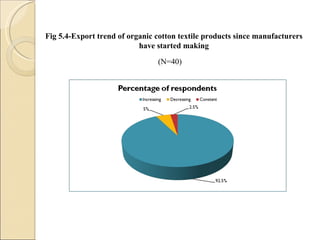

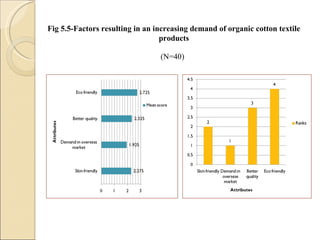

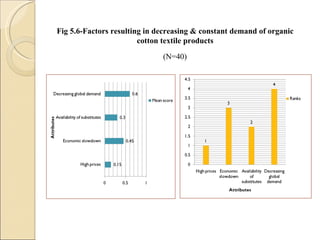

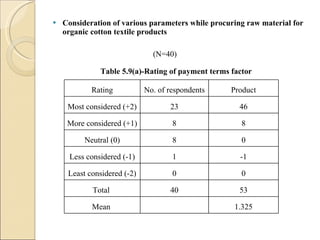

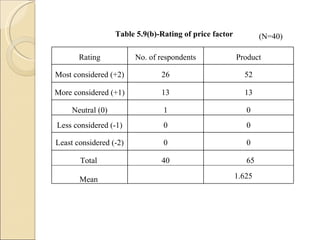

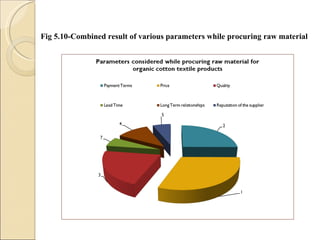

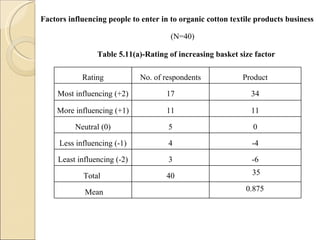

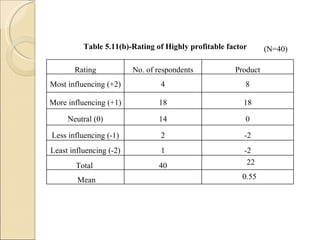

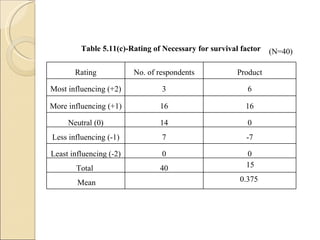

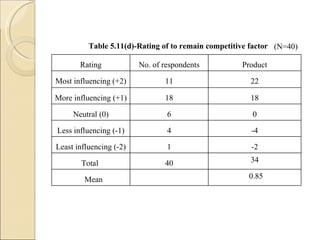

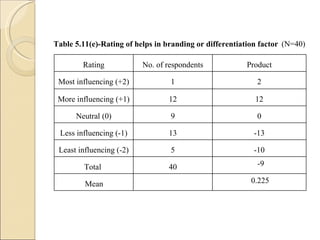

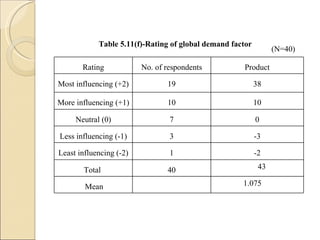

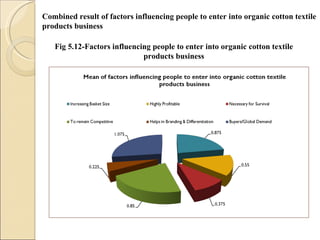

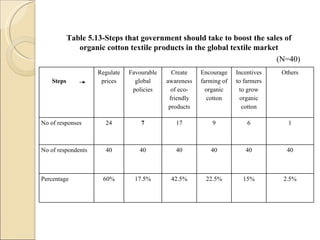

The document summarizes a summer training project on organic cotton undertaken at Aarti International Limited. It provides an overview of the Indian textile industry and company Aarti International Limited. It then discusses the objectives, methodology and findings of the research conducted on organic cotton and the opportunity it presents for the Ludhiana textile industry to trade in the global market. Key findings include garments being the largest organic cotton product, over 50% of manufacturers exporting organic cotton products, and increasing basket size and profitable nature influencing entry into organic business.