The Economic Times News from 18-22 October reported on several major business deals and developments:

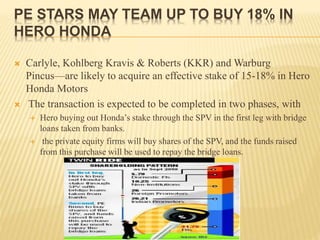

1) Private equity firms Carlyle, KKR, and Warburg Pincus are likely to acquire a 15-18% stake in Hero Honda Motors through a transaction completed in two phases.

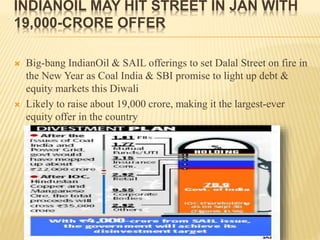

2) IndianOil is planning to raise about 19,000 crore rupees through an IPO in January, which would be the largest equity offering in India.

3) The Future Group and Everonn Education have formed a joint venture to provide retail industry training programs to 3,000 students initially and 25,000 students next year.