This document is the May 2016 issue of the Textile Value Chain magazine. It provides information on the textile industry in southern Indian states such as Tamil Nadu, Andhra Pradesh, Telangana and Karnataka. The spinning industry in these states has grown significantly, with capacity increasing from 34 million spindles in 2004-2005 to 46 million currently. Modern spinning machinery from companies like Lakshmi Machines have supported this growth. The magazine includes various articles, news briefs, market reports and advertisements related to the textile industry.

![3May 2016 www.textilevaluechain.com

All rights reserved Worldwide; Reproduction of

any of the content from this issue is prohibited

without explicit written permission of the

publisher. Every effort has been made to ensure

and present factual and accurate information.

The views expressed in the articles published in

this magazine are that of the respective authors

and not necessarily that of the publisher. Textile

Value chain is not responsible for any unlikely

errors that might occur or any steps taken

based in the information provided herewith.

Registered Office

Innovative Media and Information Co.

189/5263, Sanmati, Pantnagar,

Ghatkopar (East), Mumbai 400075.

Maharashtra, INDIA.

Tel : +91-22-21026386

Cell: +91-9769442239

Email: info@textilevaluechain.com

tvcmedia2012@gmail.com

Web: www.textilevaluechain.com

Owner, Publisher, Printer &

Editor

Ms. Jigna Shah

Printed & Processed by her at,

Impression Graphics,

Gala no.13, Shivai Industrial Estate,

Andheri Kurla Road,

Sakinaka, Andheri (East),

Mumbai 400072,

Maharashtra, India.

EDITORIAL

After many years in wilderness the Indian textile industry is once again in the reckoning, because of two seg-

ments, namely, spinning and home textiles. The entire capacity of spinning industry is totally in the organized sector.

At the same time, a large percentage of weaving, processing and garmenting capacities are in the micro, small and

medium segments.

About 1800 spinning mills are humming in the country day and night. Southern states namely, Tamilnadu, Andhra

Pradesh, Telengana and Karnataka account for bulk of Indian spinning capacity. Credit goes to the South Indian mil-

lowners who perceived the perceived the potential of the spinning sector. It must be recalled here that SIMA [South-

ern India Millowners’ Association] played a major role in getting industry-friendly policies.

No wonder, the spinning capacity has recorded a growth of 35 percent from 34 million spindles in 2004-2005 to

46 million spindles in 2015-2016.

What induced the millowners to augment the spinning capacity is the domestic availability of most modern spin-

ning machinery for which the entire credit goes to Late Mr. G.K. Devarajulu, the visionary industrialist of Tamilnadu.

It is said that, Rieters, the foreign collaborators of Lakshmi Machines were astonished to note the product develop-

ment achieved by their Indian partner.

The next source of help for the spinning sector was the flagship scheme of the Ministry of Textiles under which

fresh investment in eligible machines became entitled for interest subsidy.

Yarn spun by modern spinning mills excels the best spinners in quality. Thus, Indian yarn has carved a special

space for itself in the international market.

The spinning industry is also a beneficiary of the development of Indian cotton in terms of quantity and quality.

All this has helped spinners to earn annually foreign exchange worth US $ 4 to 5 billion per annum, which will

shoot up in the coming years.

Efforts are being made to diversify uses of cotton yarn by entering new fields

like Technical Textiles. In the Olympic of textile products, it is the spinning segment

holds the Indian flag high.

Spinning on a high pedestal

Shri V.Y. Tamhane

Editorial Advisor](https://image.slidesharecdn.com/may2016webissue-160528124726/85/May-2016-web-issue-3-320.jpg)

![We cordially invite you

Partner State

NON OlEN

liTER ITIII L

Exhibition

EJ

June 2016

Hall-5, Bombay Exhibition Center,

NSE complex, Goregaon East,

Mumbal, Maharashtra, India.

NON WOVEN TECH

ASIA 2016

INTERNATIONAL

PARTICIPATION

II

Japan•China

D

.......... [!].........•.. .. ..... .... .. 1 ..

... f~

........ .~-:.

Get Yourself

Registered

Now as VISITOR

For more details, Please contact :

Radeecal Communications

402, 4th Floor, "Optionz" Complex,

Opp. Nest Hotel, Off e.G. Road,

Navrangpura,Ahmedabad- 380009,

GUJARAT, INDIA.

Phone: +91 79 26401101/02/03,

Mobile: +919173440725,

+917718884496

Mail: sales@nonwoventechasia.com

Switzerland Belgium Italy

~CUSTAGE

Visitor KIt Show Daily Partner

VAU.DR'"

en~

_"-'r~"""''''-''

99 PRINT &PACK

~---.... 'f!~~t

Supported By

Media Partner

Co-organlser

Times International

•_~~ mt't~..........................liIIIIIIIIr

Organlser

.- .,Radeecalcommun Icatlons

f ... Like us on Facebook www.nonwoventechasia.com](https://image.slidesharecdn.com/may2016webissue-160528124726/85/May-2016-web-issue-6-320.jpg)

![15May 2016 www.textilevaluechain.com

y Freedom, P., 1994: “Boundaries of good taste”, Geographical.

y Gervais, D., 1998: The TRIPS Agreement: Drafting history and

analysis. London: Sweet & Maxwell.

y Harte-Bavendamm, H., 2000: Geographical Indications and

Trademarks: Harmony or conflict? In Anon., ed., Symposium on

the International protection of geographical indications, Som-

erset West, Cape Province, South Africa, September 1 & 2, 1999.

Publication No.764 (E). WIPO, Geneva.

y llbery, B. and M. Kneafsey, 2000a: “Producer constructions of

quality in regional speciality food production: A case study from

south-west England”, Journal of Rural Studies 16(2), pp. 217-30.

y llbery, B. and M. Kneafsey, 2000b: “Registering regional speci-

ality food and drink products in the United Kingdom: the case

of PDOs and PGIs.” Area 32(3): 317-325.

y Landes, William M. and Richard A. Posner, 1987: “Trademark

law: an economic perspective”. Journal of Law and Economics,

30(2): 265-309.

y McMichael, Philip: 1994: The Global Re-structuring of Agro-

Food Systems, Ithaca, USA: Cornell University Press.

y Press and Information Division of the European Court of Justice,

2003, Judgements of the Court of Justice in Cases C – 469/00

and C-108/01 – The Court Confirms the Extent of Protection Con-

ferred by Community Legislation on Grana Padano Cheese and

Parma Ham, Press Release No.42/03, available at http://europa.

eu.int/cj/en/actu/communiques/cp03/aff/cp0342en.htm.

y UNCTAD/ICTSD, 2003: Resource Books on TRIPS and Develop-

ment: Part Two – Substantive Obligations: 2.3 Geographical

Indications. Prepared for the UNCTAD/ICTSD Capacity Building

Project on Intellectual Property Rights and Sustainable Devel-

opment, Geneva. Available at

y http://www.iprsonline.org/unctadictsd/ResourceBookIndex.

htm.

y Saris of India by Markand Singh, RTA Kapur Chisti & Amba San-

yal published in the year 1989 by Wiley Eastern Ltd., & Amar

Vastra Kosh, New Delhi.

y Tie-dyed Textiles of India by Veronica Murphy & Rosemary Crill

published in the year 1991 by Victoria & Albert Museum & Mapin

Publishing P. Ltd., UK.

y Textile Arts of India by Kokyo Hatanaka,published in 1993 by

Kyoto Shoin Co.Ltd., Japan.

y Heritage of India authors fabric by Sukla Das in the year 1992

published by Shakti Malik Abhinav.

y Hand woven Fabrics of India edited Jasleen Dhamija & Jyotin-

dra Jain 1989 Mapin Publishing P. Ltd., Ahmedabad.

y Watal,J,2001: Intellectual Property Rights in the WTO and devel-

oping countries. Kluwer Law International, The Hague.

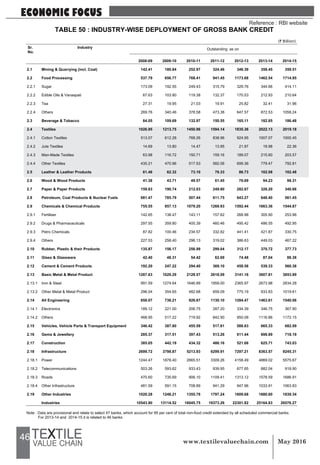

ECONOMIC FOCUS

Contract Workers

CITI has been vigorously pursuing to drop archaic provisions

in labour laws. One demand of the textile industry is that due to

the cyclical nature of demand for textiles, the industry should have

flexibility in the matter of labour employment.

Central Govt. has proposed that the Contract Labour Act be

amended as under:-

i. “the rates of wages payable to workmen by the contractor

shall not be less than:-

a. the rates prescribed under the Minimum Wages Act, 1948 (11 of

1948)

for such employment where applicable; or

b. the rates, if any, fixed by agreement, settlement or award, or

c. ten thousand rupees,

CITI has vehemently opposed to the above amendment on be-

half of textile industry as the proposed wages of contract workers

are higher than the existing wages and will make the textile manu-

facturing in the country uneconomical.

An excellent comparative table on minimum wages vis-a-vis

per capita income of different countries has been prepared by CITI

which is reproduced below

If minimum wages are compared in relation to per capita in-

come, it is clear that the Indian textile industry is the highest pay-

master; with minimum wages being 113% of per capita income,

against 83% in the case of China and 84% in case of Bangladesh.

Per capita income and minimum wage [US $]

It appears that Government is likely to fix contract workers’

wages at Rs.10,000/- per month .CITI has requested for reconsid-

eration of the same . However, it needs to be noted that no notifi-

cation has been raised so far on the subject.

Praiseworthy development in Arvind M ills

Textiles has become part of the fashion industry. Following this

development, Arvind Mills is in talks to acquire the online Fashion

and Lifestyle startup.

Certainly, this will give a big boost to their sales.

We wish Arvind Mills all success in their new project.

TUFS

The picture about continuance or otherwise of this hag shop

scheme of the Ministry of Textiles is still hazy. In the meantime,

funds allocated for TUFS in 2016-2017 are only Rs.1356 crore;

Shri V.Y. Tamhane](https://image.slidesharecdn.com/may2016webissue-160528124726/85/May-2016-web-issue-15-320.jpg)

![20 May 2016www.textilevaluechain.com

the reflectance of the adjacent yarns in the knit structure. Mecha-

nism responsible for the reflectance of the yarn was responsible

for Barre.

Consistency in all phases of the textile can prevent the occur-

rence of the barre. Material should be properly labelled to avoid

mix up. Fugitive tinting o t he cones can help to segregate the

material. FIFO must be followed for inventory control. Equipment

must be periodically checked for maintenance. In spinning and knit-

ting before going for full scale production, sample dyeing can be

done it will be helpful to check the Barre appearance. Training of

the knitter will also help if he can identify the barre occurrence at

the knitting stage. [4]

Literature review

Barre is the problem that results from the inconsistencies and

poor management of the fiber, yarn and/or related knitting pro-

cesses. The spinner, knitter and processor must communicate and

work together as a team to overcome the Barre [8].

Barré problem arises in fabric due to fluctuation of number

of fibres in yarn cross section. And the Micronaire value of cotton

determines the no. of fibre in yarn cross section. By performing

the author suggested method for any cotton lot, it is possible to

maintain the average Micronaire value with a limited CV% and also

possible to distribute the color grades uniformly against it’s Micro-

naire value. Author defined procedure of bale selection for each

lay down can confirm the uniform distribution of fibre in yarn cross

section which will lead to minimizing Barré problem [2].

The fabric analysis in the case of fabric made from different

yarn counts (16s, 20s and 30s) show that yarn counts do not create

the fabric barre, however if there is a mixing of yarn of different

counts then knitted fabric may produce fabric barre or streaks. [6]

The results obtained in case of different twist multipliers show

that if T.M. is higher from a certain limit, the fabric barre are visually

shown in the knitted fabric samples.[6]

In the case of yarn count deviation, fabric barre are produced

if there is an excessive yarn count fluctuation. Those yarns which

fluctuate ±1 from nominal value of the yarn count, cause the fabric

barre or streaks in knitted fabric.[6]

Of the fibre parameters, the degree of yellowness of cotton

seems to have a relatively more significant effect on the Barre in-

tensity in fabrics than the micronaire. Difference more than 1.5 of

+b value leads to barre appearance. However even deviation of

micronaire value to the extent of +0.15 results in a visible barre de-

fect. Deviations in yarn count also shows up significantly as Barre

defects [7].

Definition

The noun “barré” is defined by ASTM as an unintentional, re-

petitive visual pattern of continuous bars and stripes usually paral-

lel to the filling of woven fabric or to the courses of circular knit fab-

ric. In a warp knit fabric, barré normally runs in the length direction,

following the direction of yarn flow. Barré can be caused by physi-

cal or optical or dye differences in the yarn, geometric difference

in the fabric structure or by any combination of these difference.

Barre defined by AATCC Monograph M10 barre, n.—an unin-

tentional, usually repetitive, pattern of continuous bars or stripes,

parallel to the courses of circular knit fabric, or, the filling of woven

fabric. NOTE: The term “barré” is sometimes used as a synonym for

“filling bands” in woven fabrics.

Terminology AATCC Monograph M10

There are different terminologies used worldwide for dealing

with Barre, Below mentioned are terminologies given in the AATCC.

Darker appearing — A barré that appears darker than the nor-

mal portion of the fabric. This barré can appear as darker in dyed

shade when the fabric is viewed with reflected light, or darker in

appearance when the fabric is viewed with transmitted light.

Lighter appearing —A barré that appears lighter than the nor-

mal portion of the fabric. This barré can appear as lighter in dyed

shade when the fabric is viewed with reflected light, or lighter in

appearance when the fabric is viewed with transmitted light.

Multiple End type —A regularly repeating barré wherein more

than one course from the knitting machine creel repeat exhibits a

barré appearance, unlike the band type barré. However, a multiple

End type barré appearance does not involve consecutive ends

(from the knitting machine creel).

Random — A barré that does not repeat periodically along the

length of the fabric. (Syn: short term.)

Regularly repeating — A barré that repeats periodically along

the length of the fabric.

Single end type— A regularly repeating barré wherein only one

course from the knitting machine creel repeat exhibits a barré ap-

pearance.

Figure 01 Figure 02 Figure 03

Figure 01 Light appearing & Multiple end type

Figure 02 Regularly repeating

Figure 03 Darker Appearing & Random Barre

Identification of Barre

The First Step in Barre analysis is identification of the Barre. As

per ASTM & AATCC Bars or bands must come in the repetitive fash-

ion to declare it a Barre, It must follow a pattern. Dyeing or pro-

cessing related problem can create repetitive pattern but it’s very

difficult to produce sharp boundary line of the Barre which follows

single course. Many articles are saying that fabric must analysed

on the inclined inspection Table for Barre identification, But not

all type of Barre are visible on inclined Table. Barre are very tricky

sometimes we can see on horizontal table, sometimes on inclined,

sometimes inclined but in course direction. It is better to hold the

both side edges with hands and try all possible position by chang-

ing the hand positions. Few barre can be visible only in particular

position and in peculiar angle.

Dos and Don’ts of Barre

It is better to prevent rather cure & barre are difficult to rectify.

Some guidelines to prevent the Barre appearance.

Fibre Stage:

1. Fiber of different whiteness level should not be mixed up.

COVER STORY](https://image.slidesharecdn.com/may2016webissue-160528124726/85/May-2016-web-issue-20-320.jpg)

![27May 2016 www.textilevaluechain.com

found to have higher tensile strength than others in warp direction

as it has higher ends/dm while plain weave fabric is having higher

tensile strength than other in weft direction as it has higher picks/

dm. The tensile strength of the Mock leno weave fabric is found

to be in between the other two fabrics. The tear strength of the

Mock Leno fabric was found to be higher than others as shown in

the Table 2. Air permeability and water permeability properties of

the Mock Leno weave were also found to be better than other as

shown in the Table 2.

3.3 FR Finishing treatment and analysis of properties:

All the three fabric samples were treated with FR finish in four

concentrations and analysed for the following FR properties.

3.3.1 Limiting Oxygen Index (ISO 4589-2):

Limiting Oxygen Index (LOI) is the preliminary test to ascertain

that fibre is flame retardant or not. The Oxygen index (OI) is the

minimum concentration of oxygen by percentage volume in a mix-

ture of oxygen and nitrogen that will support combustion of a ma-

terial under specified test conditions. Following equation is used to

determine Oxygen Index value of a material.

LOI = [O2

]X100

-------------

[O2

] + [N2

]

where

[O2]= the volumetric flow of oxygen in cm3/s; and

[N2]= the corresponding volumetric flow rate of nitrogen in

cm3/s

It is clear from the figure 7 all the FR finished fabric samples

are having LOI more than 23. However the FR finished Mock Leno

weave fabric samples show higher LOI value compare to the cor-

responding FR finished other woven samples.

Figure-7: Limiting Oxygen Index of FR Finished fabric samples

3.3.2 Limited flame spread (ISO 15025):

There are two types-surface and edge ignition tests are given

under ISO 15025 test standard. The results of both the tests are

given in the Tables-3 to 8. Tables 3 to 5 show the test results of lim-

ited flame spread (Surface ignition) when tested in accordance to

ISO 15025 (Procedure A). From these tables it is clear that P34, P38,

G34, G 38, M30, M34 and M38 samples pass the criteria as men-

tioned in the ISO 11612 specification. Table 6 to 8 indicate the test

results of samples when tested as per ISO 15025 (Procedure B) i.e

Edge ignition. From these tables it is clear that P34, P38, G34, G 38,

M30, M34 and M38 samples pass the performance criteria. From

both the tests it is clear that Mock Leno weave fabric after finish-

ing with 300gpl FR finish pass the criteria of performance. While

other woven fabric require higher amount of flame retardant finish

to qualify the passing requirements.

*As per ISO 6330 procedure 5A, followed by Tumble dry

Table 3: Surface Ignition as per ISO 15025 Procedure A of P26, P30, P34 and

P38

Table 4: Surface Ignition as per ISO 15025 Procedure A of G26, G30, G34 and

G38

Test Parameter

ISO 15025 Procedure A

Flame spread- (Single layer)

Test Results

G26 G30 G34 G38

Warp Weft Warp Weft Warp Weft Warp Weft

Whether any aming reaches the top edge

or either side edge

-Before wash

-After 5 wash*

Yes

Yes

Yes

Yes

No

No

Yes

Yes

No

No

No

No

No

No

No

No

Whether a hole develops

-Before wash

-After 5 wash*

Yes

Yes

Yes

Yes

No

Yes

Yes

Yes

No

No

No

No

No

No

No

No

Occurrence of aming melting debris

-Before wash

-After 5 wash*

No

No

No

No

No

No

No

No

No

No

No

No

No

No

No

No

After ame time, Seconds

-Before wash

-After 5 wash*

7

8

8

8

5

5

5

6

0

0

0

0

0

0

0

0

After glow time, Seconds

-Before wash

-After 5 wash*

4

4

6

8

2

2

3

3

0

0

0

0

0

0

0

0

Table 5: Surface Ignition as per ISO 15025 Procedure A of M26, M30, M34

and M38

Test Parameter

ISO 15025 Procedure A

Flame spread- (Single layer)

Test Results

M26 M30 M34 M38

Warp Weft Warp Weft Warp Weft Warp Weft

Whether any aming reaches the top edge

or either side edge

-Before wash

-After 5 wash*

No

Yes

Yes

Yes

No

No

No

No

No

No

No

No

No

No

No

No

Whether a hole develops

-Before wash

-After 5 wash*

Yes

Yes

Yes

Yes

No

No

No

No

No

No

No

No

No

No

No

No

Occurrence of aming melting debris

-Before wash

-After 5 wash*

No

No

No

No

No

No

No

No

No

No

No

No

No

No

No

No

After ame time, Seconds

-Before wash

-After 5 wash*

7

8

8

8

0

0

0

0

0

0

0

0

0

0

0

0

After glow time, Seconds

-Before wash

-After 5 wash*

2

3

3

3

0

0

0

1

0

0

0

0

0

0

0

0

Table 6: Surface Ignition as per ISO 15025 Procedure B of P26, P30, P34 and

P38

Test Parameter

ISO 15025 Procedure B

Flame spread- (Single layer)

Test Results

P26 P30 P34 P38

Warp Weft Warp Weft Warp Weft Warp Weft

Whether any aming reaches the top edge

or either side edge

-Before wash

-After 5 wash*

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

No

No

No

No

No

No

No

No

Occurrence of aming melting debris

-Before wash

-After 5 wash*

No

No

No

No

No

No

No

No

No

No

No

No

No

No

No

No

After ame time, Seconds

-Before wash

-After 5 wash*

9

11

10

11

8

9

10

12

0

0

0

0

0

0

0

0

After glow time, Seconds

-Before wash

-After 5 wash*

4

5

7

8

5

5

4

5

0

0

0

0

0

0

0

0

Test Parameter

ISO 15025 Procedure A

Flame spread- (Single layer)

Test Results

P26 P30 P34 P38

Warp Weft Warp Weft Warp Weft Warp Weft

Whether any aming reaches the top edge

or either side edge

-Before wash

-After 5 wash*

Yes

Yes

Yes

Yes

No

No

Yes

Yes

No

No

No

No

No

No

No

No

Whether a hole develops

-Before wash

-After 5 wash*

Yes

Yes

Yes

Yes

Yes

Yes

Yes

Yes

No

No

No

No

No

No

No

No

Occurrence of aming melting debris

-Before wash

-After 5 wash*

No

No

No

No

No

No

No

No

No

No

No

No

No

No

No

No

After ame time, Seconds

-Before wash

-After 5 wash*

10

11

12

13

7

9

8

11

0

0

0

0

0

0

0

0

After glow time, Seconds

-Before wash

-After 5 wash*

5

6

6

8

4

5

5

5

0

0

0

0

0

0

0

0

TECHNICAL TEXTILE](https://image.slidesharecdn.com/may2016webissue-160528124726/85/May-2016-web-issue-27-320.jpg)

![Raymon~

-LINEN-

Visit: www.raymond.in I] facebook.comlRaymondLimited C twitter.comltheraymondltd To find aRaymond Store near you, visit www.storelocamr.raymond.in](https://image.slidesharecdn.com/may2016webissue-160528124726/85/May-2016-web-issue-52-320.jpg)