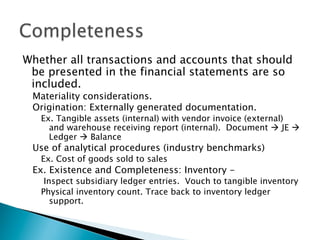

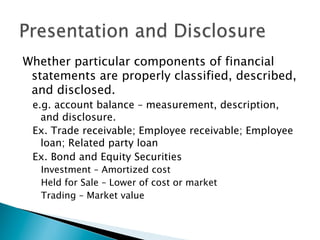

The document discusses evidential matter in auditing, which refers to the evidence that auditors obtain to determine whether financial statement assertions are fairly presented. It covers the concepts of existence, completeness, valuation, rights and obligations, and presentation and disclosure. Evidential matter comes from books and records, confirmations with third parties, analytical procedures, physical inspections, and other sources. The auditor's objective is to obtain sufficient, competent evidential matter to form an opinion on whether the financial statements are presented fairly.

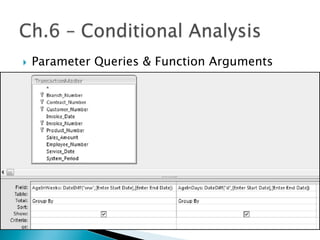

![} Parameter Queries

◦ Prompts for criteria

– Prompts versus hard coding

◦ Operational characteristics:

– Field name check

– Calculated field check

– Field reference

– User interaction

◦ Rules

– Brackets used

– Can’t use field name

– Special characters (e.g. !, ., &, or []](https://image.slidesharecdn.com/adamsgeorgiastatepresentationseries-151121134359-lva1-app6892/85/Adams-Georgia-State-Audit-Presentation-Series-43-320.jpg)

![} Parameter Queries & Wildcards

◦ Example:

– Like [Enter Lastname] & "*"

– Like "*" & [Enter Lastname] & "*“](https://image.slidesharecdn.com/adamsgeorgiastatepresentationseries-151121134359-lva1-app6892/85/Adams-Georgia-State-Audit-Presentation-Series-46-320.jpg)

![} IIF w/ Conditional Operators

◦ AND, OR, BETWEEN

– Ex. IIf([Home_Branch] = '920681' And [Hire_Date] >

#1/1/1985#,"True","False")

} Nested IIF: Multiple Conditions

◦ Complexity

– Ex. IIf([VALUE]>100,"A",IIf([VALUE]<100,"C","B"))](https://image.slidesharecdn.com/adamsgeorgiastatepresentationseries-151121134359-lva1-app6892/85/Adams-Georgia-State-Audit-Presentation-Series-58-320.jpg)

![} Switch Function

◦ Evaluate a list of expressions and return the value

associated with the expression determined to be

True

– Switch(Expression1, Value1, Expression2, Value2,

Expression3, Value3)

– Switch([Count] > 10, "Low", [Count] > 15, "High") may

return null

– Switch([Count] < 10, "Low", [Count] > 15, "High, True,

"Middle")

– “Middle” if nothing true](https://image.slidesharecdn.com/adamsgeorgiastatepresentationseries-151121134359-lva1-app6892/85/Adams-Georgia-State-Audit-Presentation-Series-64-320.jpg)

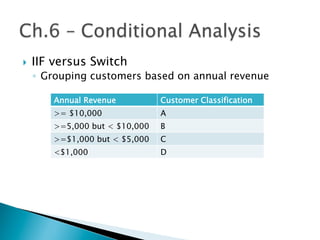

![} IIF versus Switch Cont’d

◦ Option 1: using Nested IIFs

– IIf([REV]>=10000,"A",IIf([REV]>=5000 And

[REV]<10000,"B", IIf([REV]>1000 And

[REV]<5000,"C","D")))

◦ Option 2: using Switch Function

– Switch([REV]>1000,"D",[REV]<5000,"C",

[REV]<10000,"B",True,"A")](https://image.slidesharecdn.com/adamsgeorgiastatepresentationseries-151121134359-lva1-app6892/85/Adams-Georgia-State-Audit-Presentation-Series-66-320.jpg)