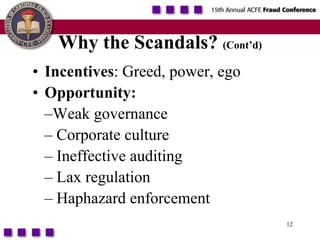

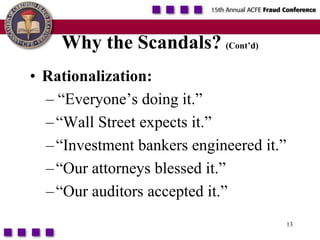

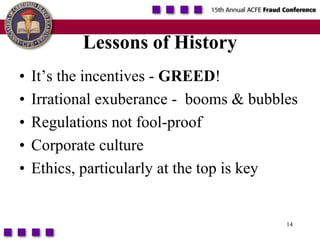

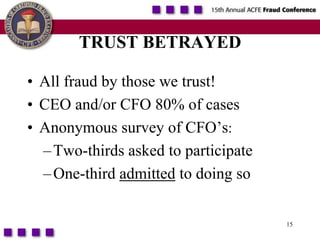

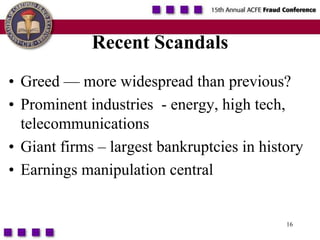

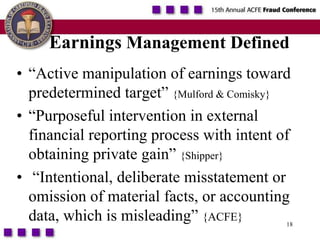

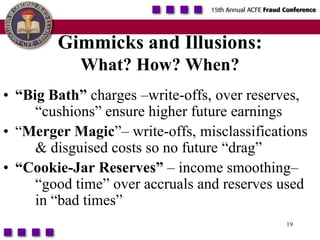

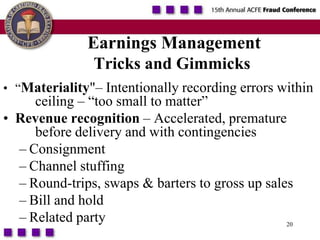

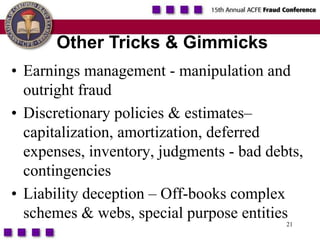

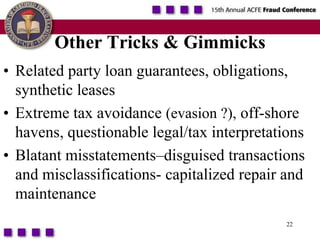

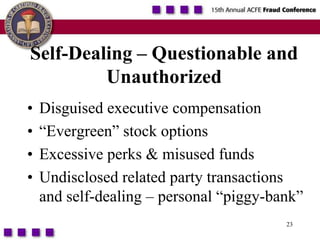

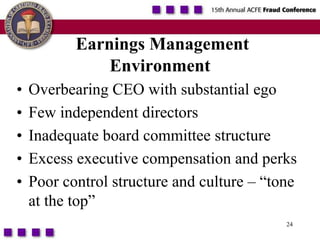

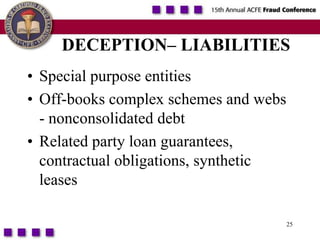

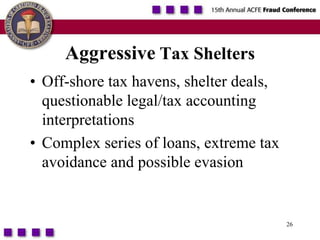

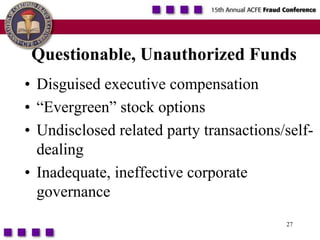

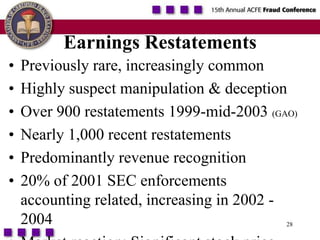

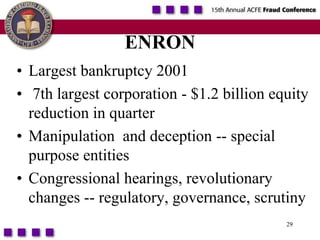

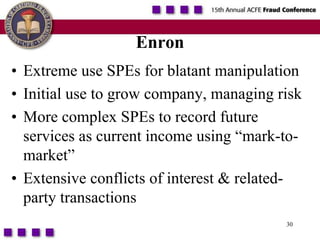

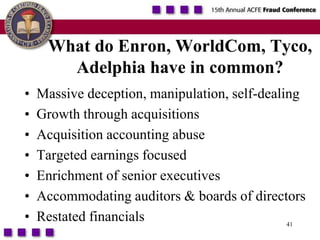

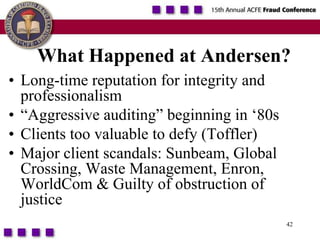

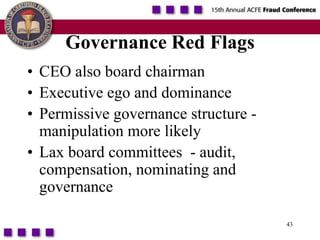

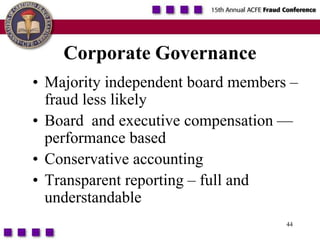

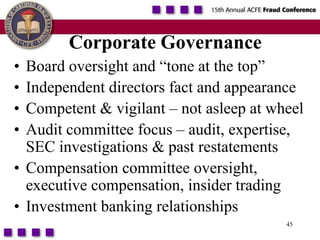

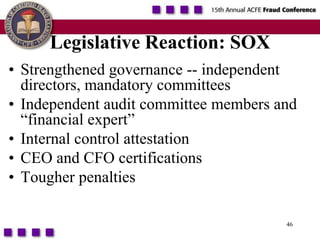

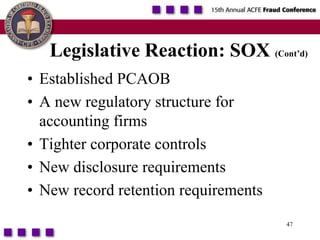

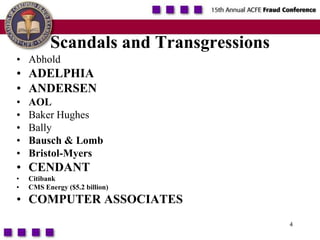

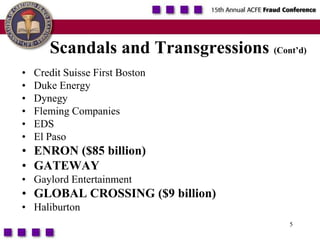

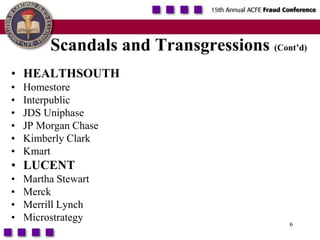

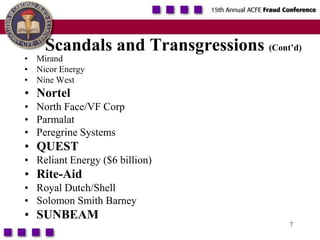

This document discusses numerous corporate scandals and instances of financial misconduct. It lists over 50 companies that have been involved in scandals related to deceptive financial practices, executive fraud, and earnings manipulation. These scandals have led to billions of dollars in losses and economic damage. The document examines common factors like aggressive accounting, weak corporate governance, inflated executive compensation, and permissive cultures that allowed misconduct to occur. Major scandals like Enron, WorldCom, Tyco, and Adelphia are discussed in depth to show how deception and self-dealing led to their falls. Lessons are discussed around improving governance, accounting practices, and prioritizing ethics to prevent future scandals.

![11Why the Scandals? (Cont’d)“Just a few”- rotten apple theorySpecific incentives – bonuses, excessive optionsInstitutional environment turns blind eye to unethical or illegal actsCulture allows egregious acts“It pays to do it, it’s easy to do, and it’s unlikely that you’ll be caught.” [Schilit]](https://image.slidesharecdn.com/presentation-100206075907-phpapp02/85/Presentation-11-320.jpg)