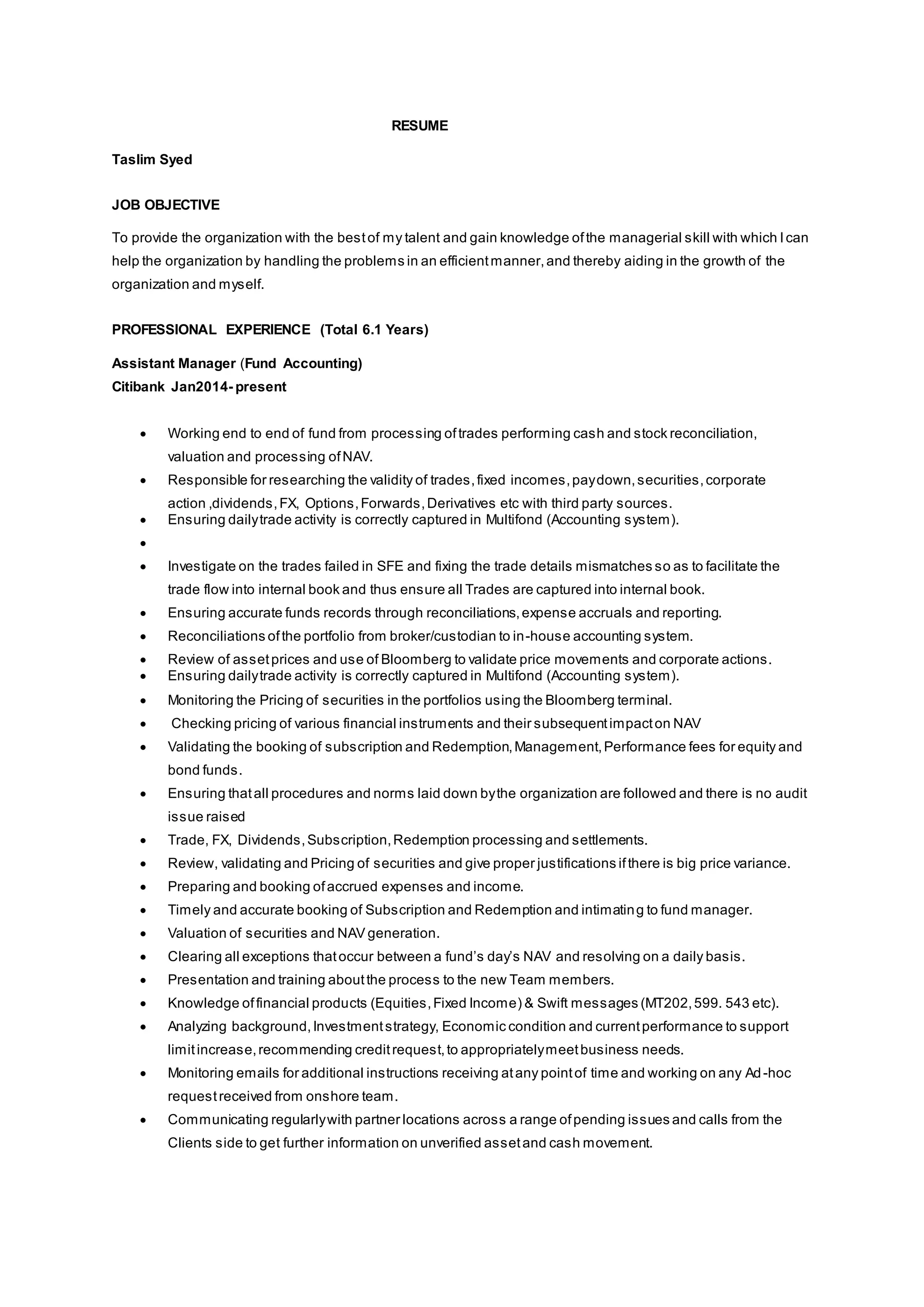

Taslim Syed has over 6 years of experience in fund accounting and reconciliation roles at Citibank, HSBC, and JP Morgan Chase. He currently works as an Assistant Manager at Citibank, where he is responsible for end-to-end fund processing including trades, valuations, NAV calculations, and ensuring procedures are followed. Previously he analyzed credit limits and performed fund onboarding at HSBC and reconciled fund assets between custodian and accounting systems at JP Morgan Chase. He has skills in portfolio accounting, reconciliations, and market/product expertise.