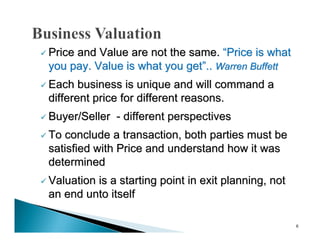

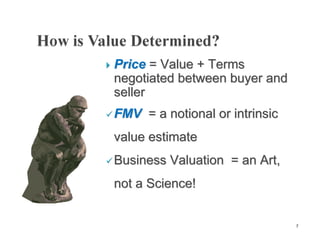

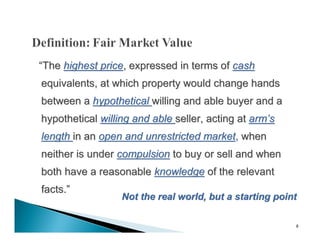

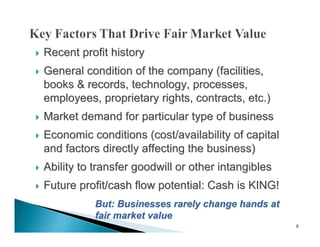

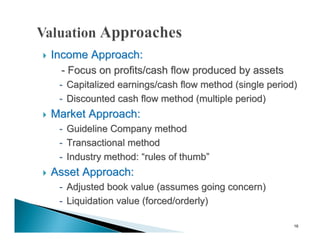

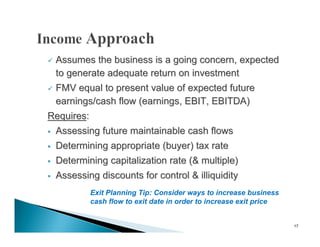

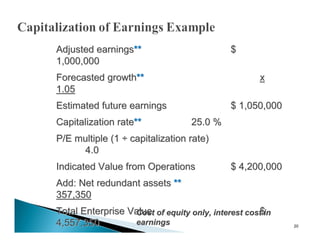

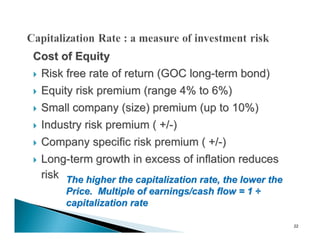

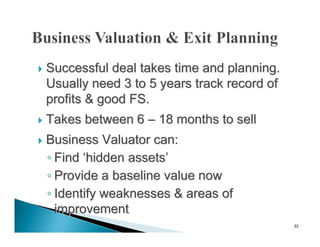

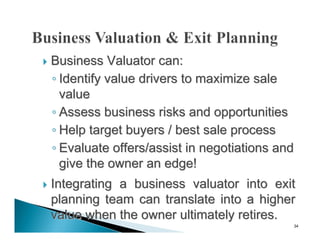

Vine Valuations Inc. provides business valuation services with offices in Hamilton, Burlington, and Kitchener. The document discusses business valuation methods and exit planning strategies. It notes that business valuation is critical for exit planning and maximizing wealth from a business sale. The valuation approach depends on the unique characteristics of each business and involves considering factors like profit history, market conditions, and future potential.