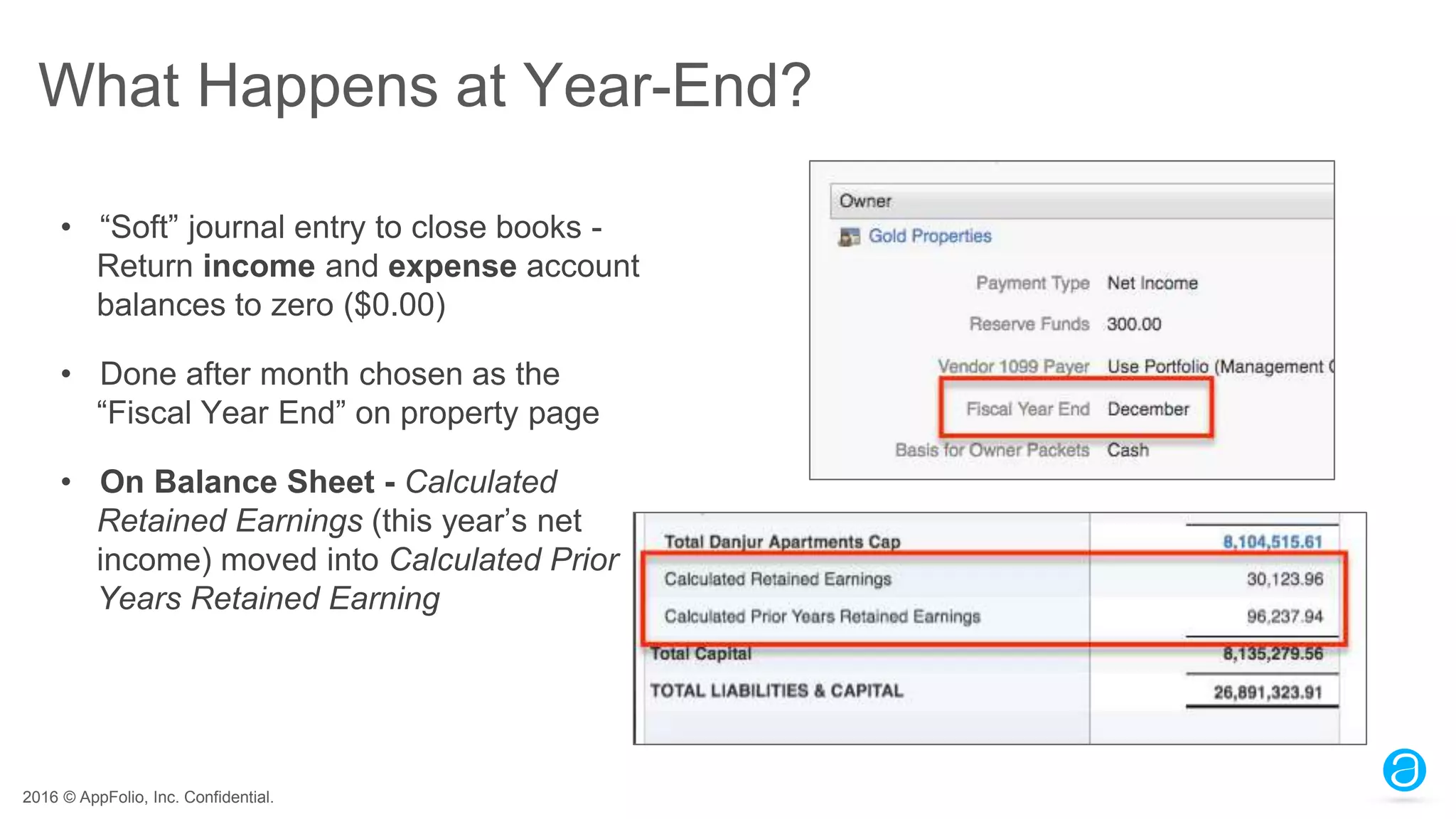

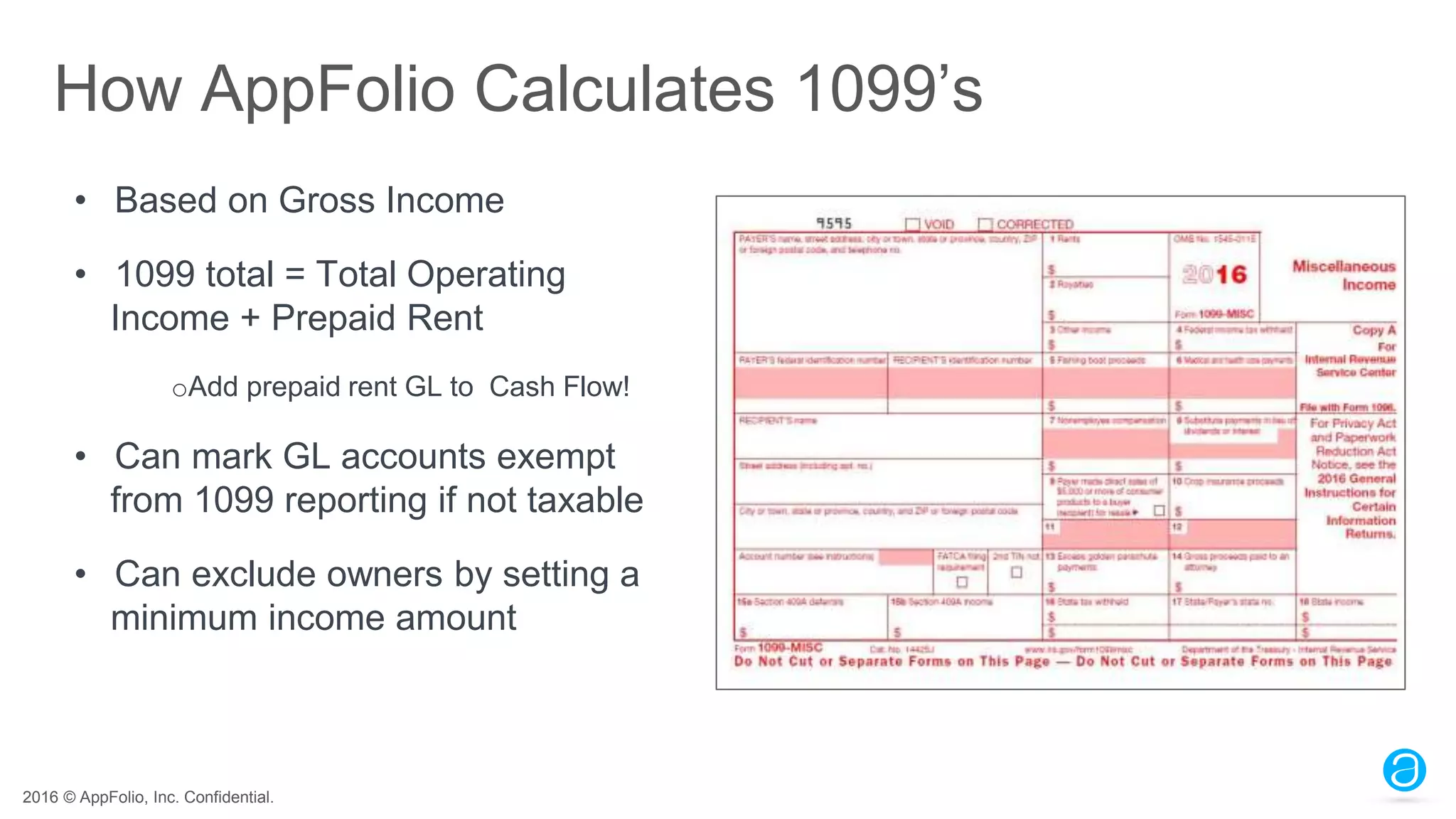

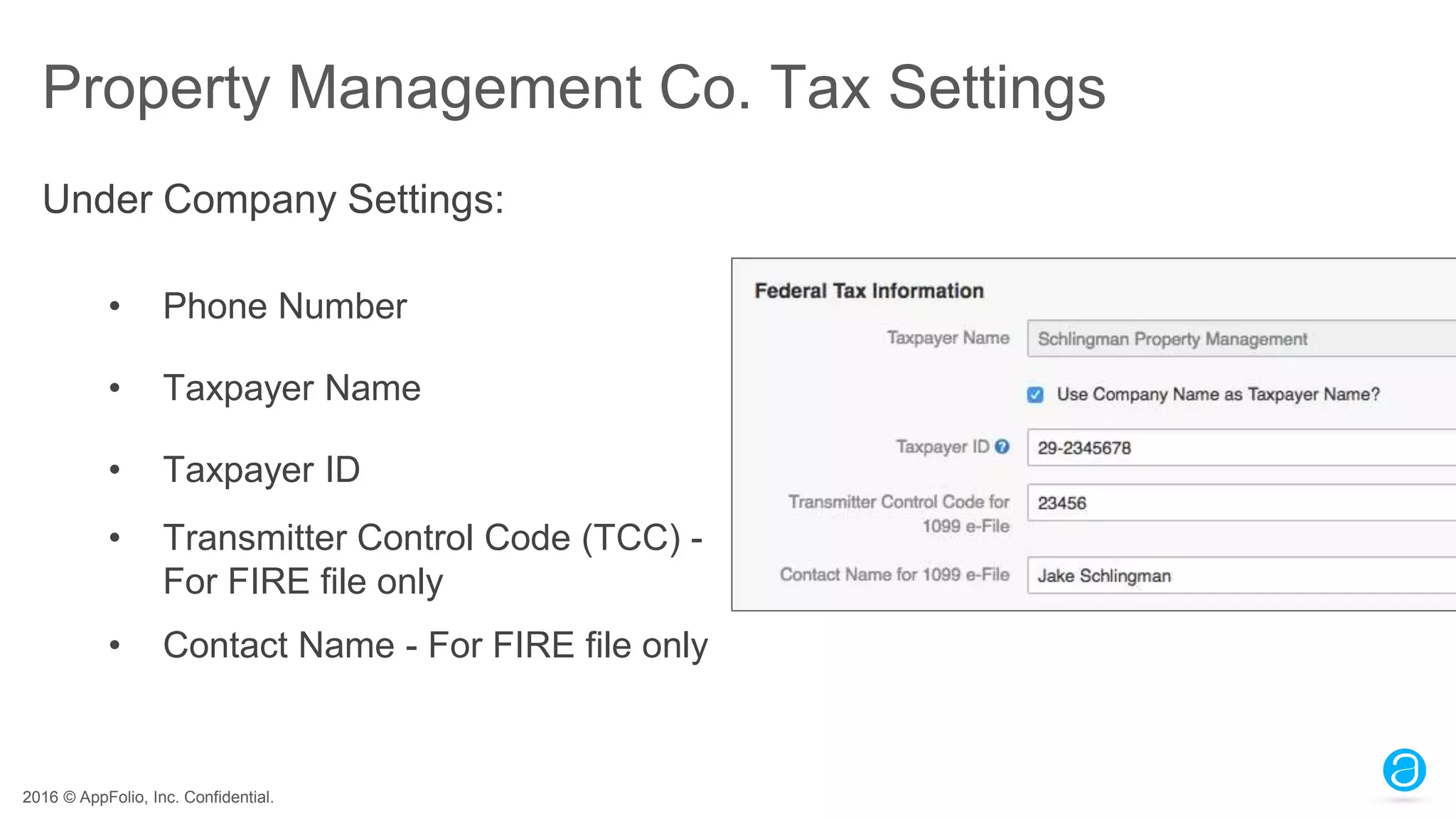

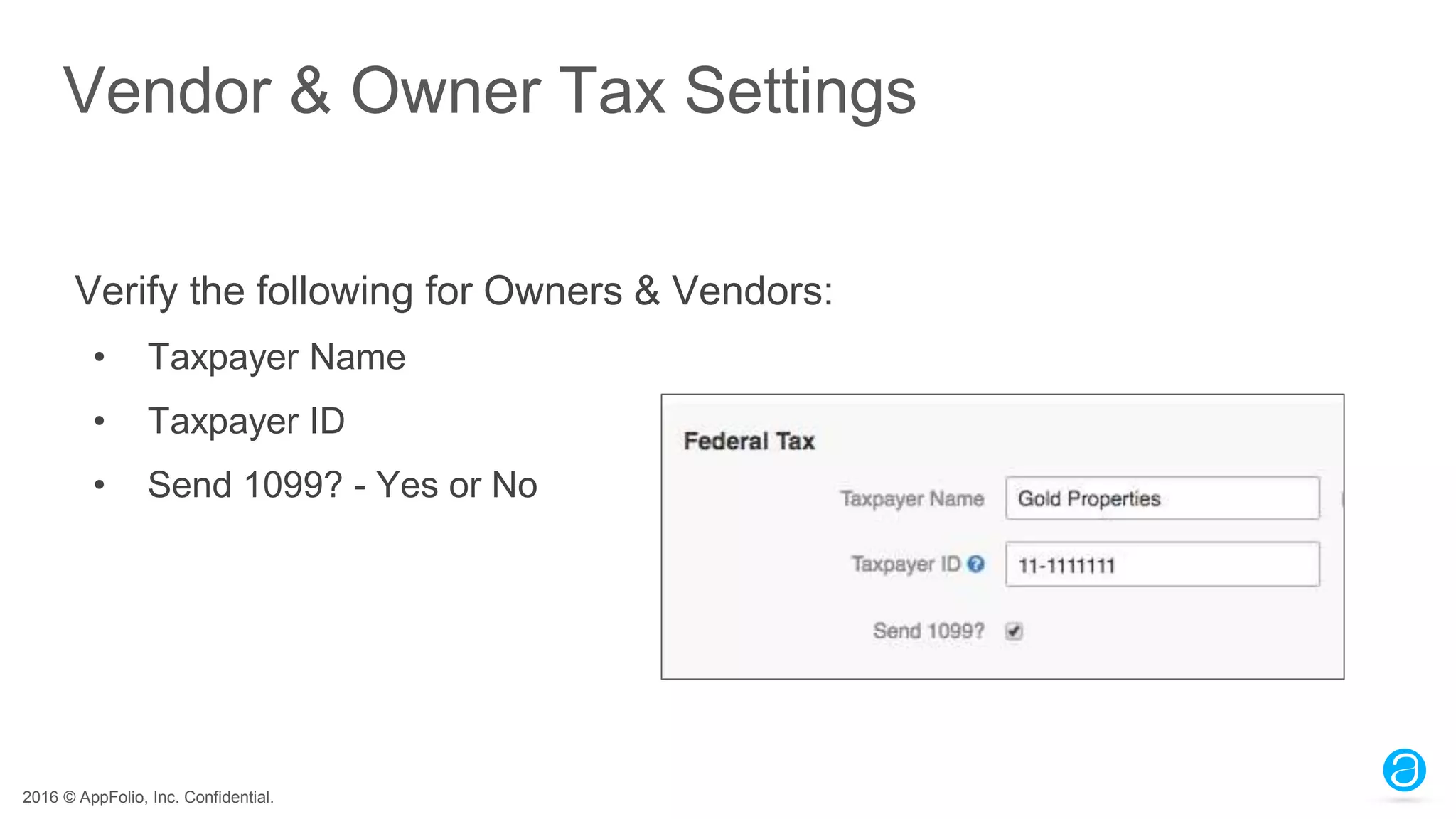

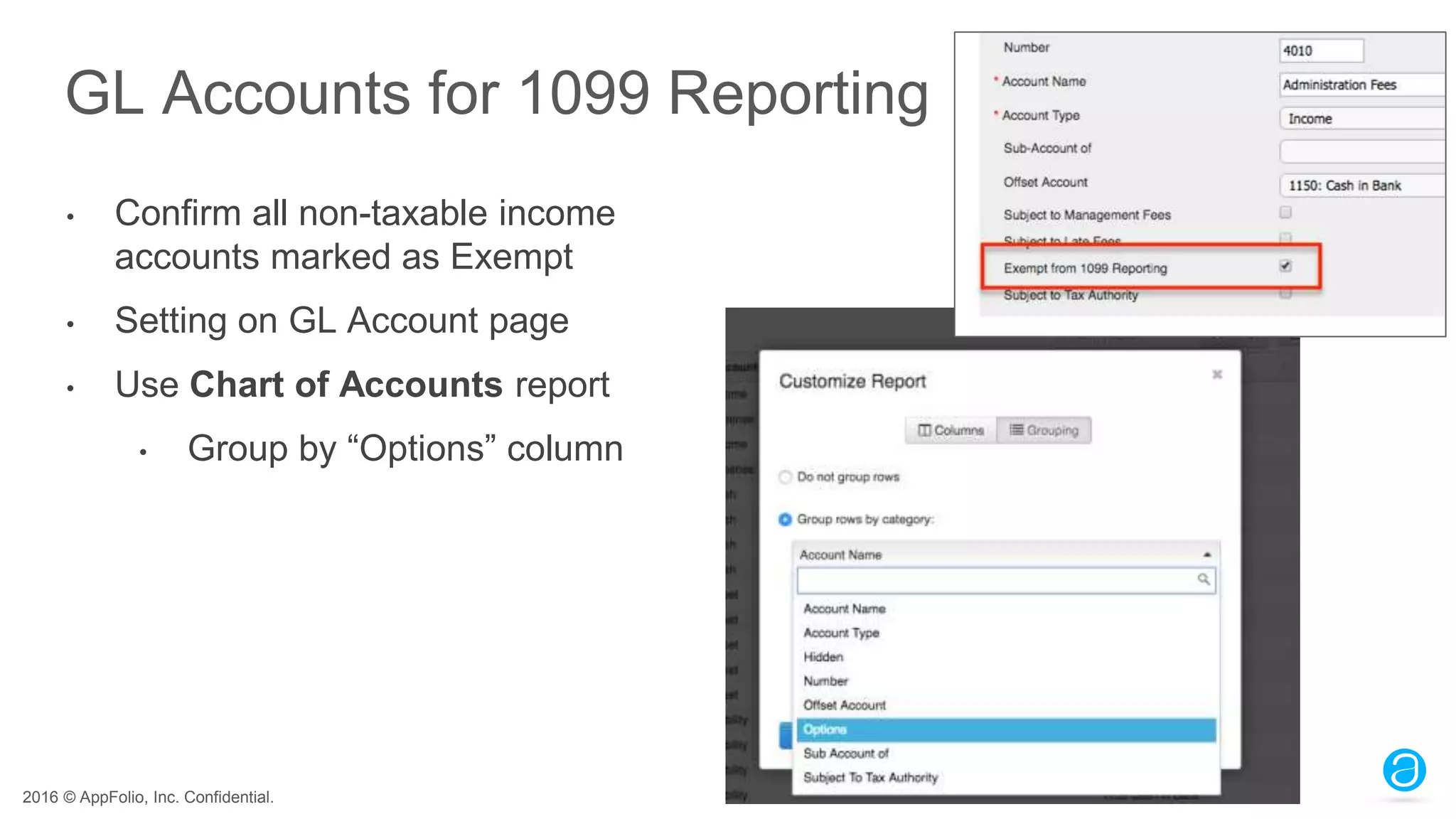

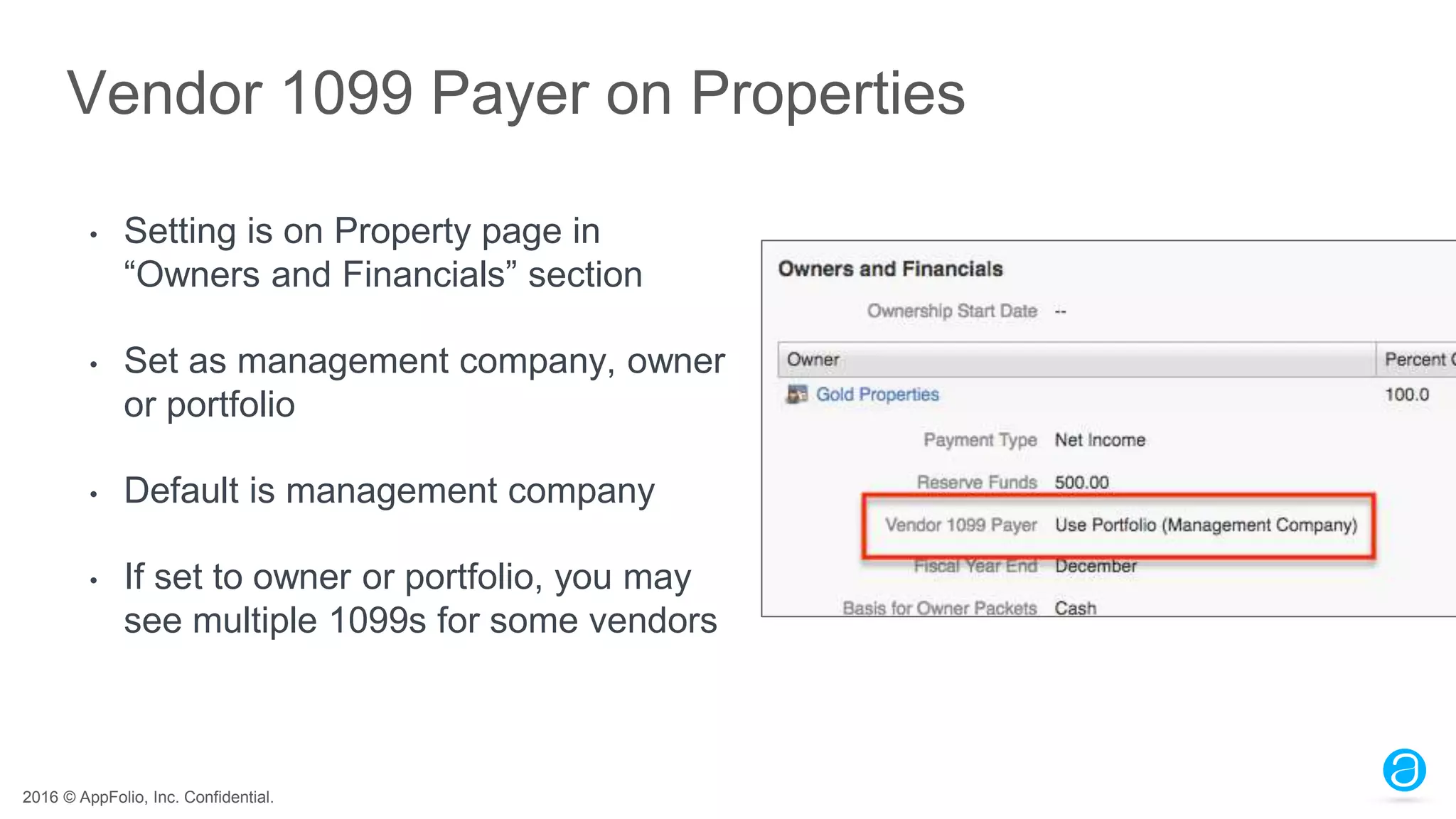

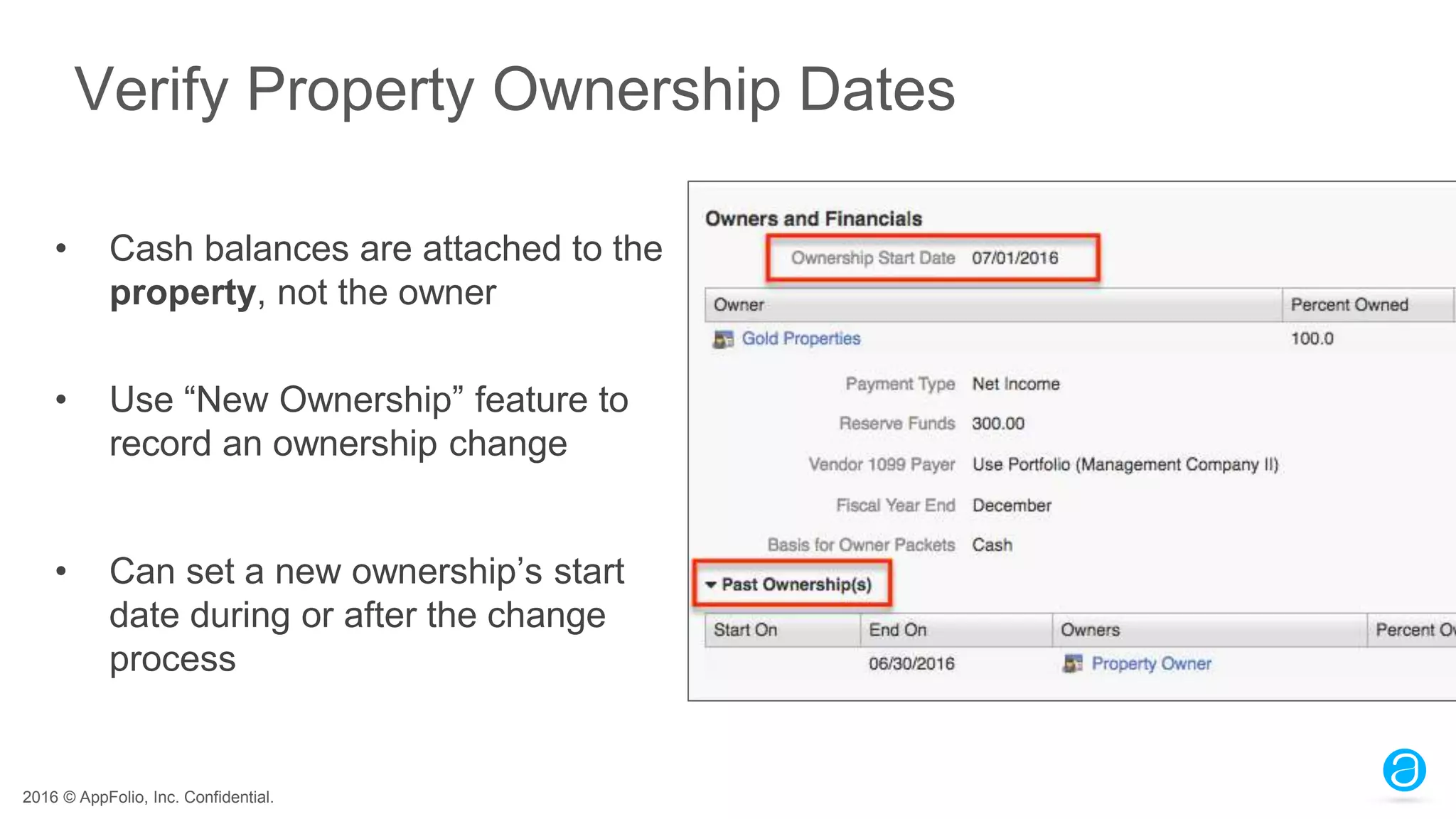

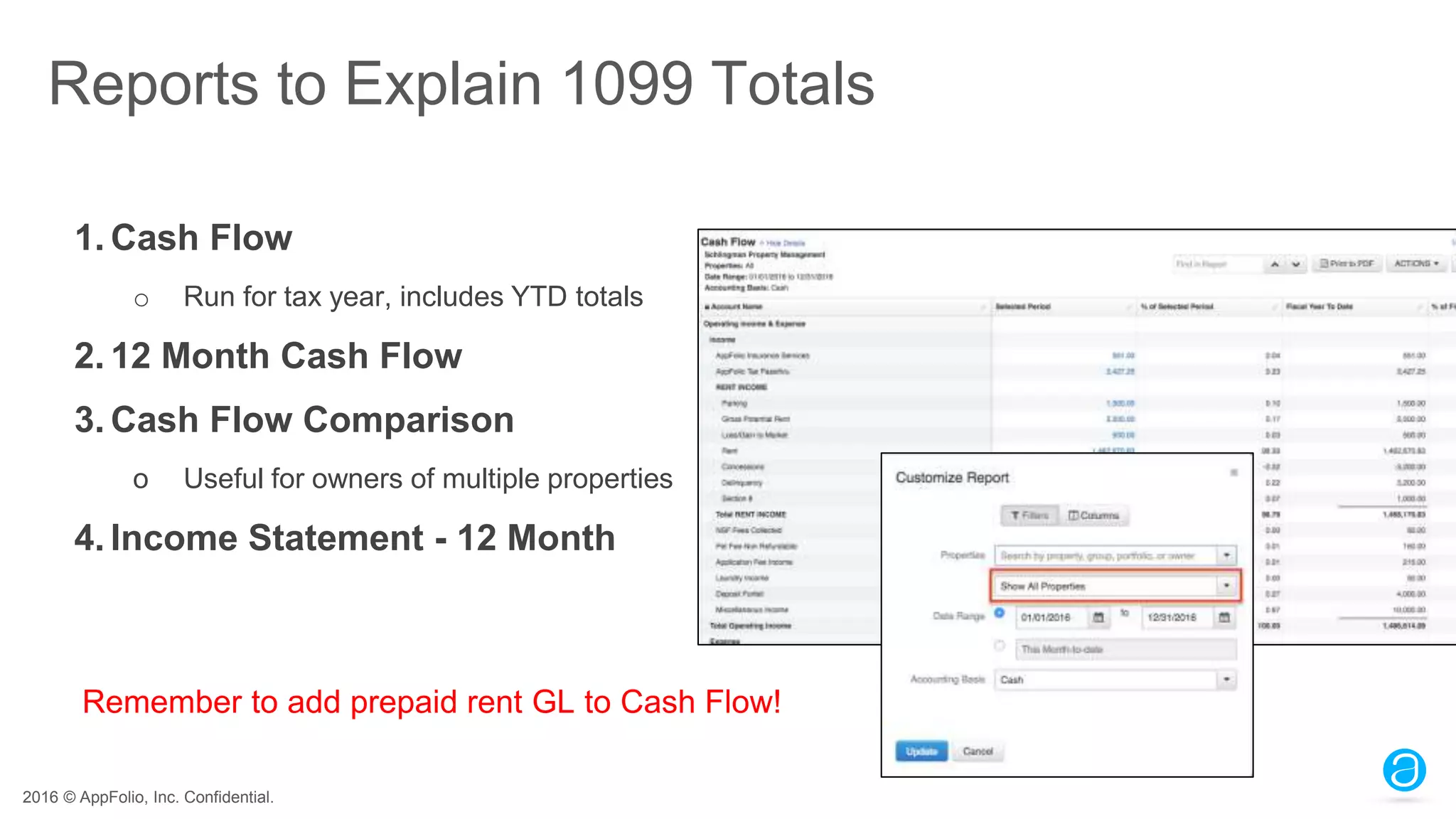

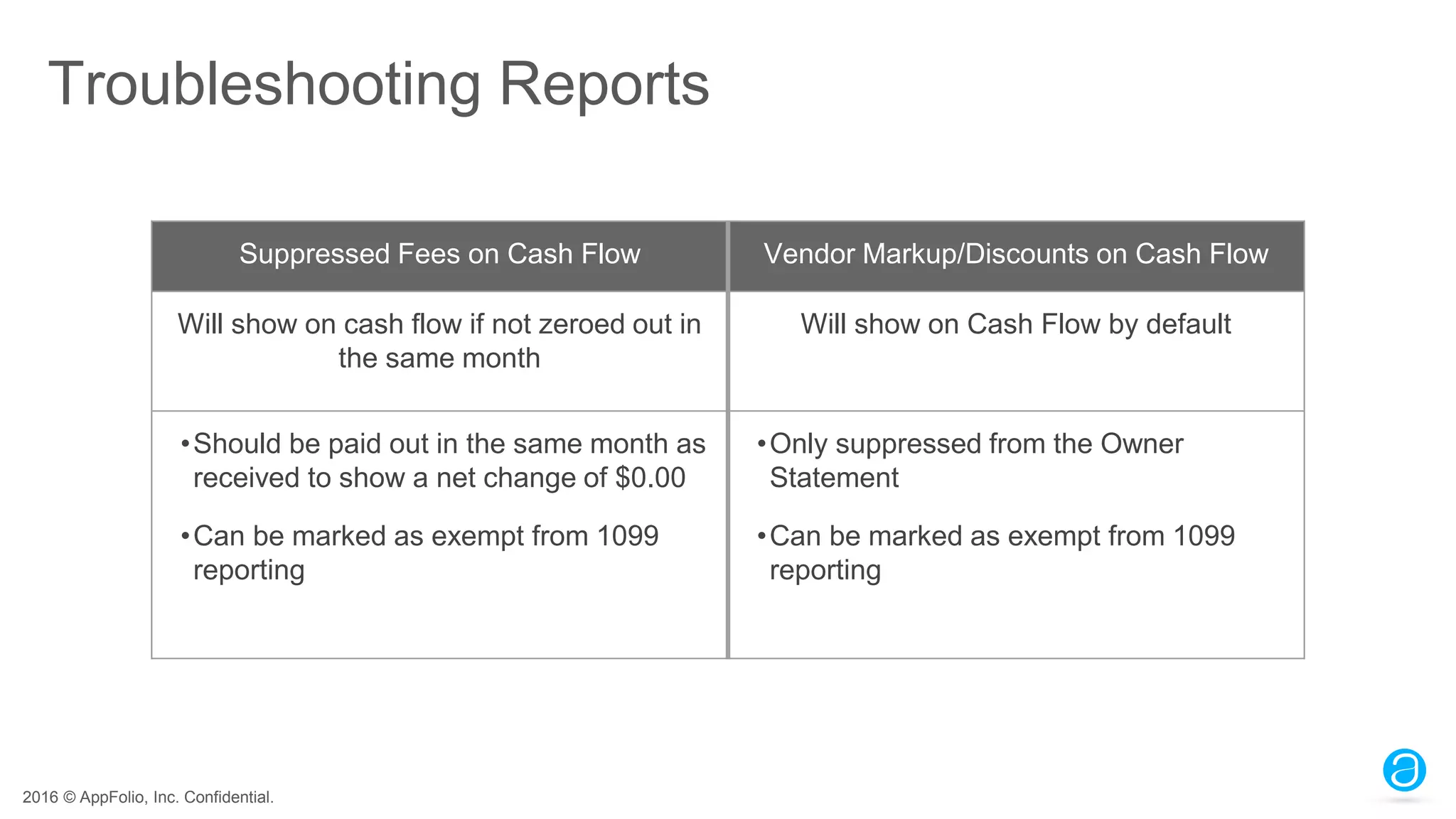

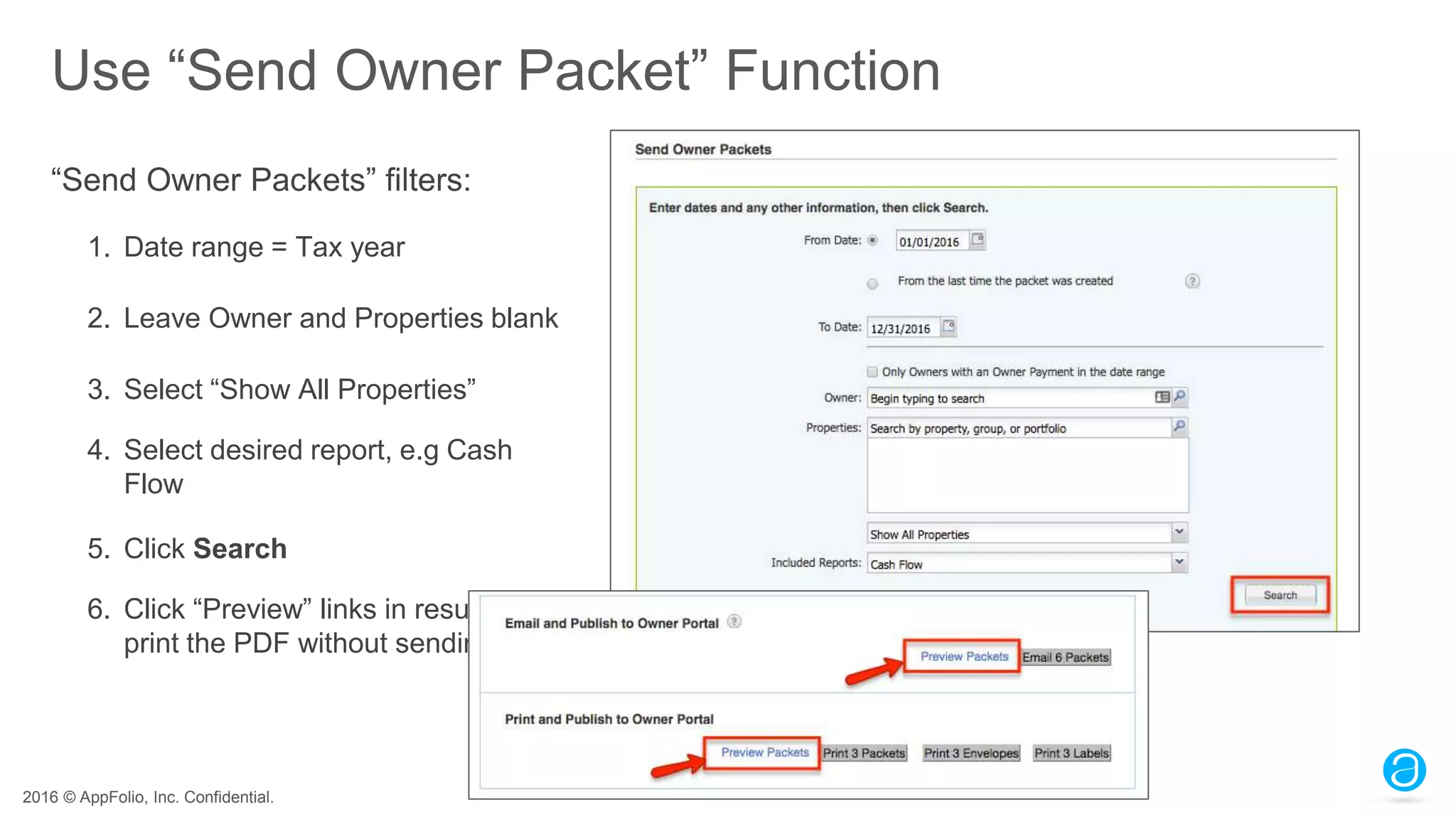

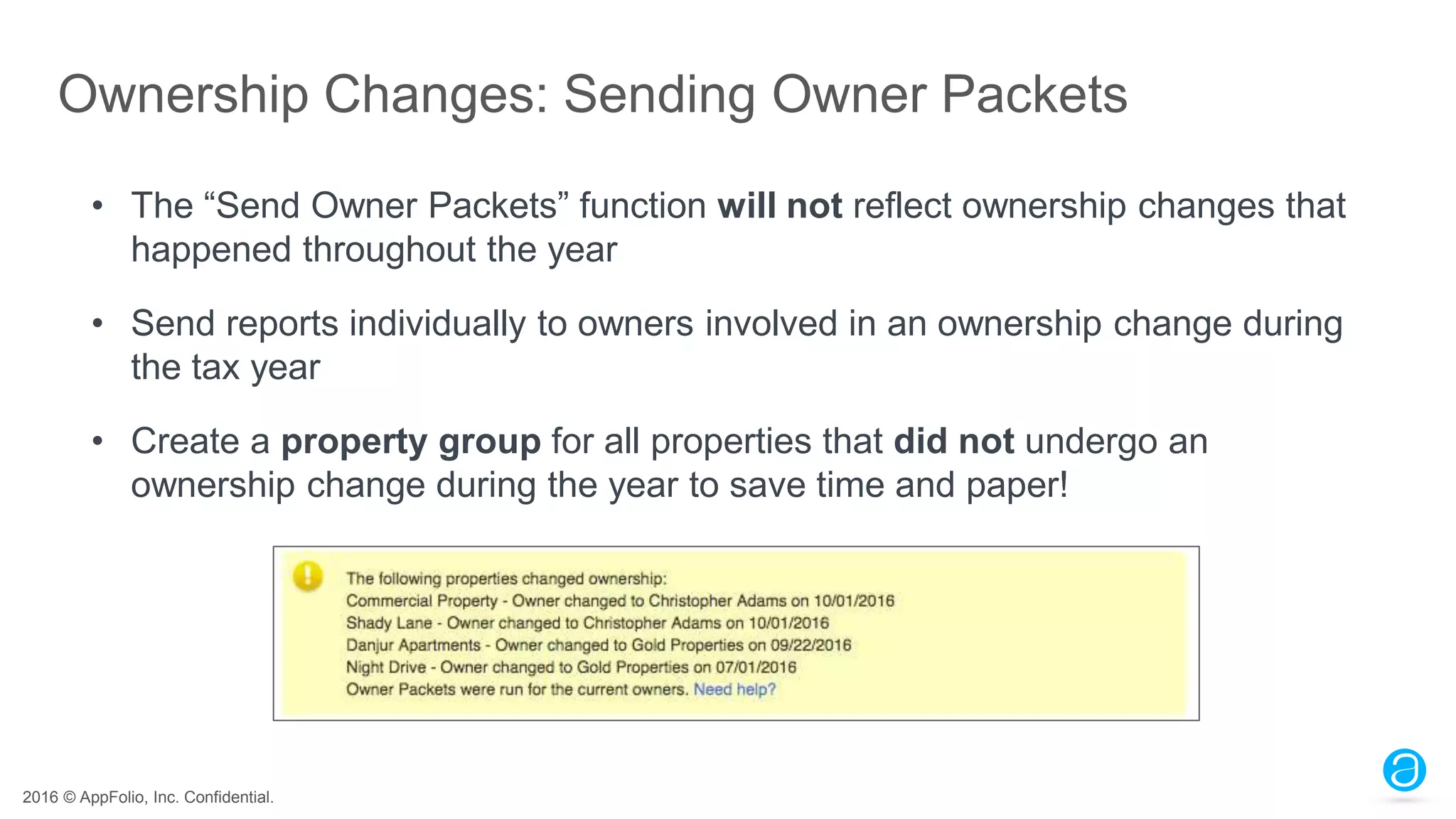

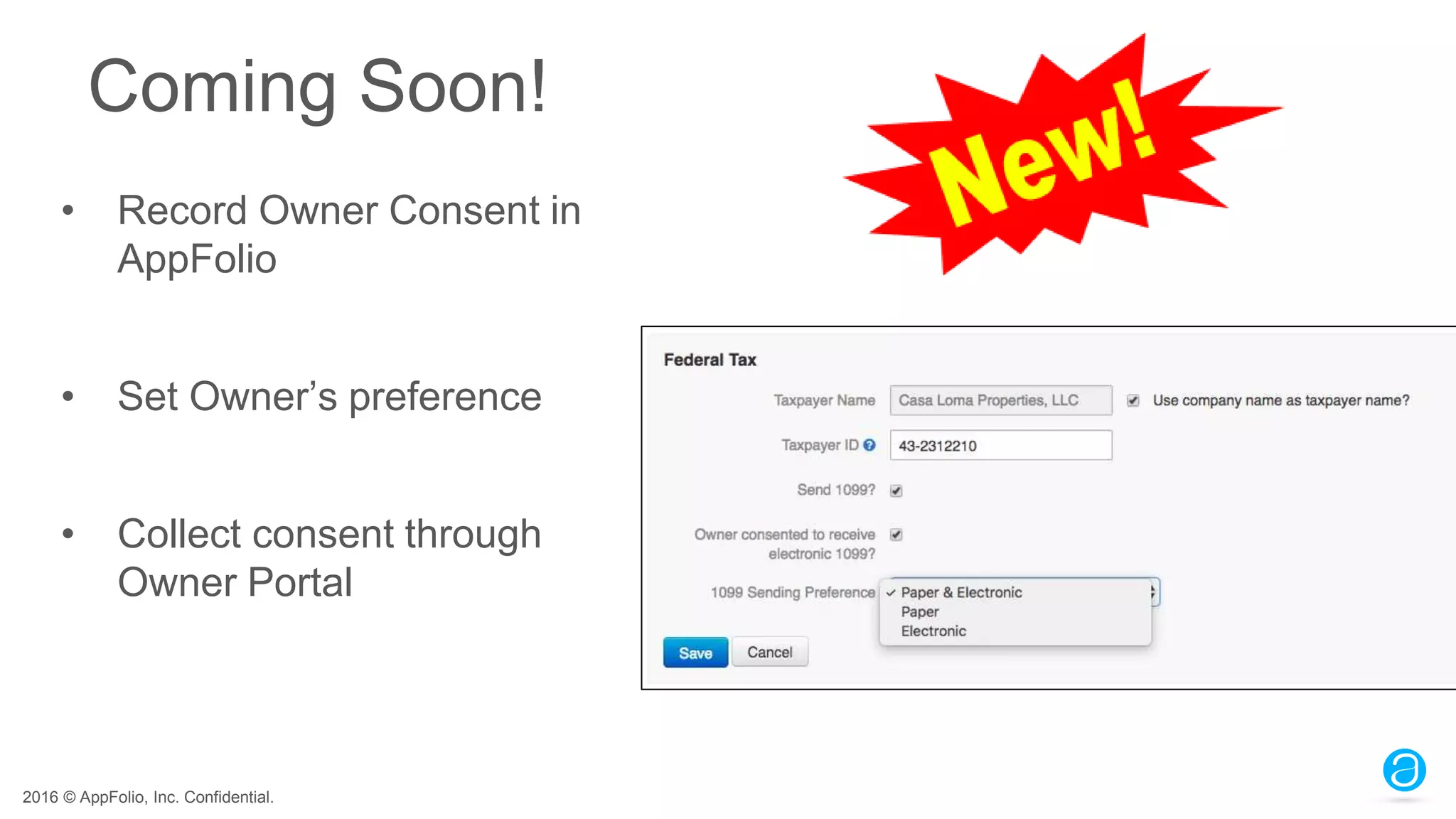

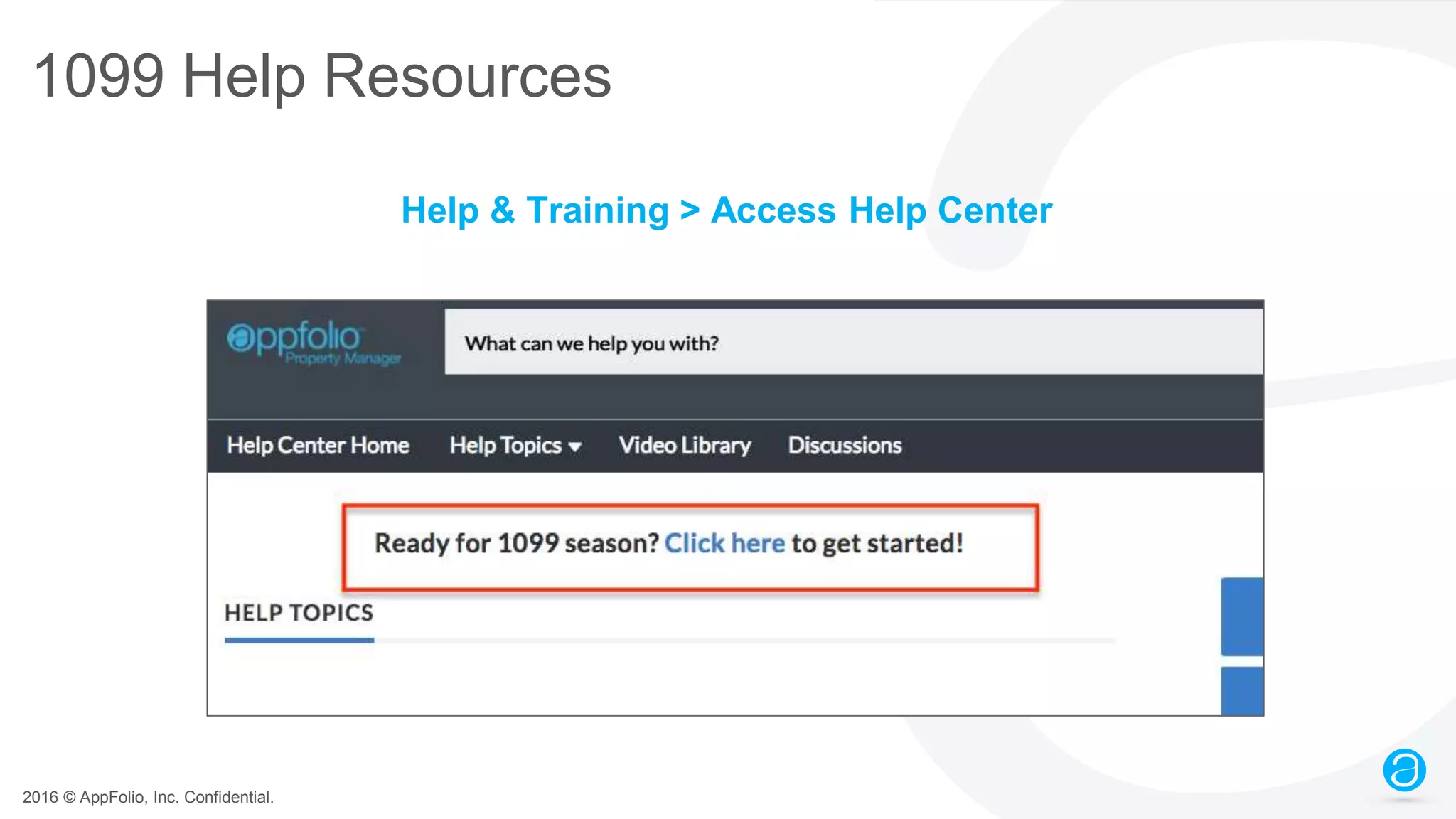

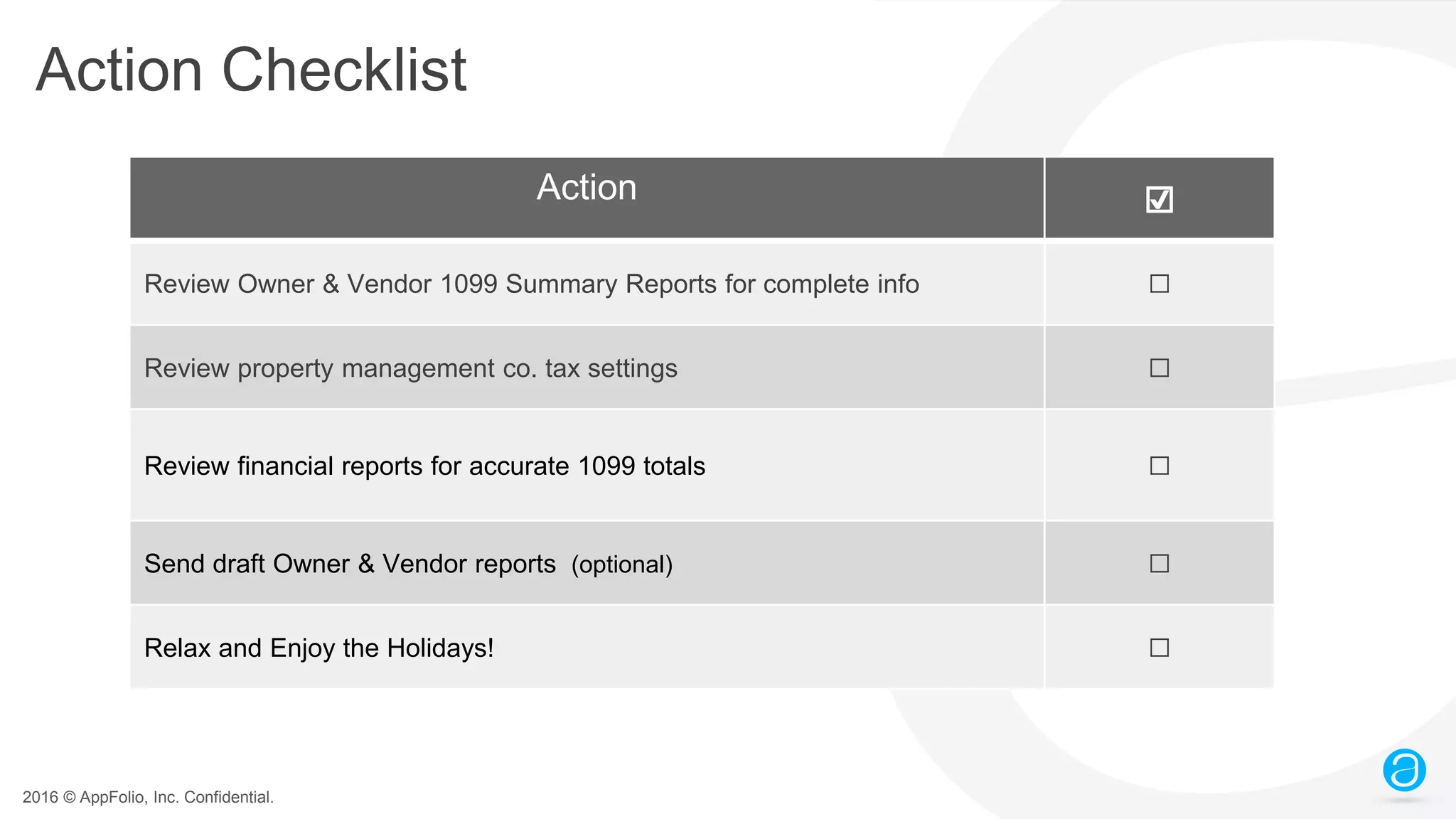

The document outlines the end-of-year preparation process for AppFolio users, detailing steps to review settings, generate reports, and manage 1099s for owners and vendors. It emphasizes the importance of checking tax settings, understanding how 1099 totals are calculated, and utilizing reporting functions effectively. Additionally, it includes FAQs and action checklists to assist users in ensuring compliance and accuracy before year-end deadlines.