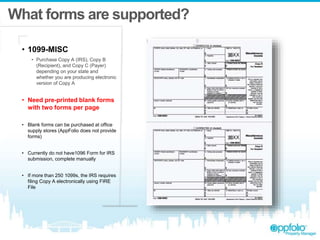

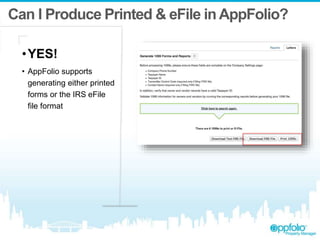

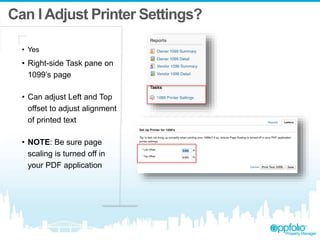

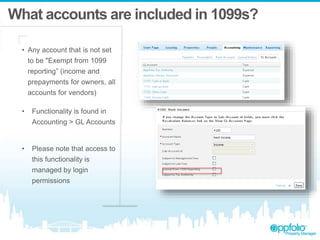

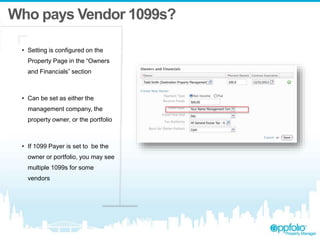

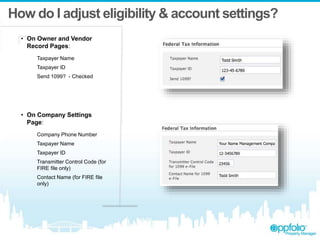

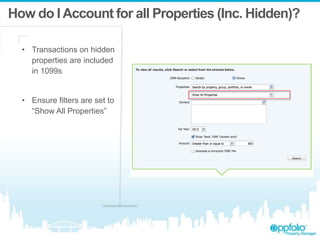

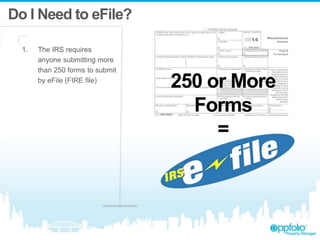

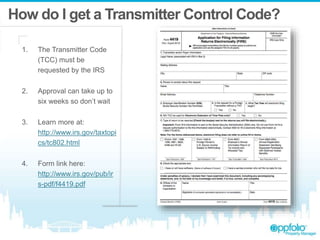

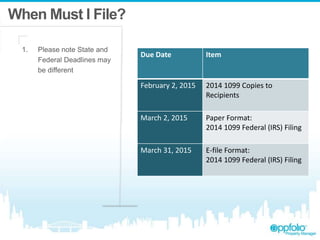

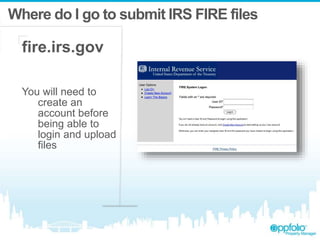

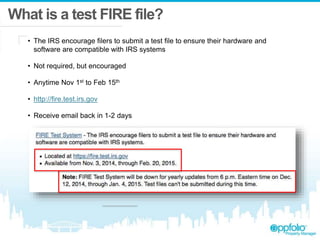

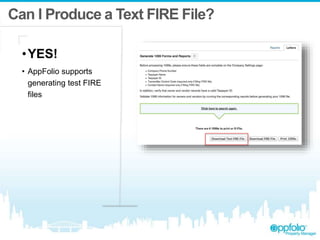

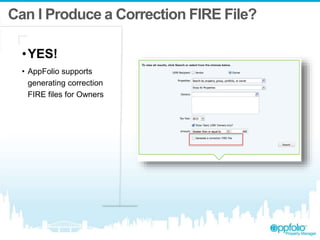

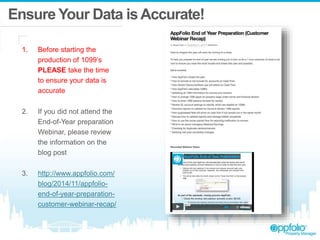

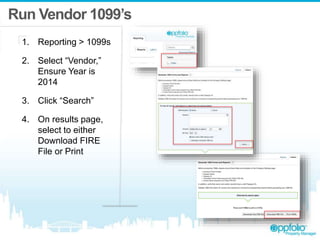

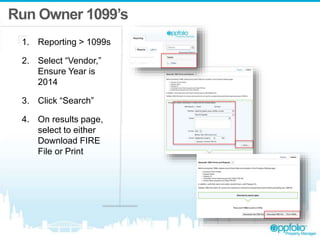

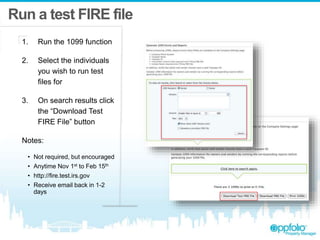

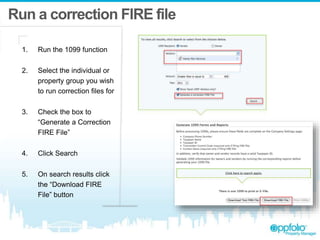

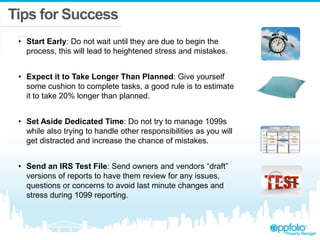

This webinar provided an overview of completing 1099 forms in AppFolio. It discussed common questions, the steps to generate 1099 forms, and demonstrated how to run 1099s for vendors and owners. Attendees were encouraged to start the process early, verify their data is accurate, and allow extra time as the process often takes longer than expected. The webinar also covered 1099 requirements, form types, account settings, submission deadlines and where to find additional help resources.