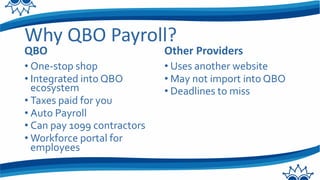

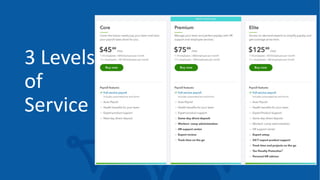

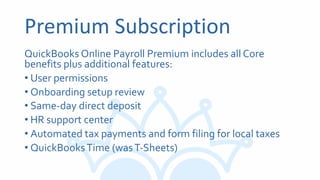

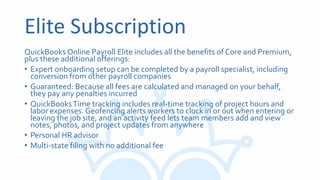

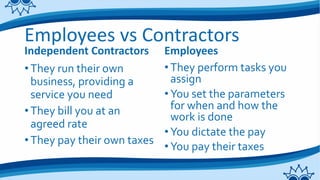

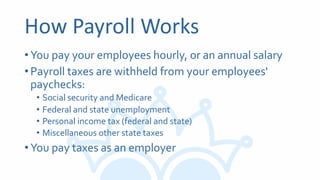

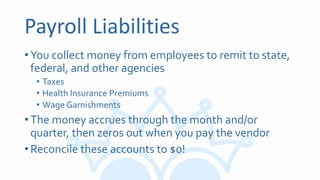

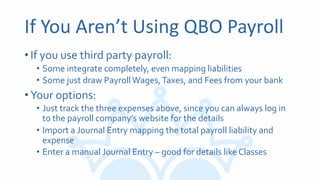

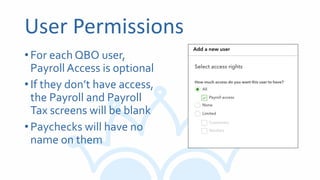

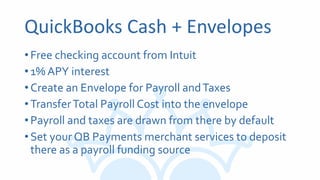

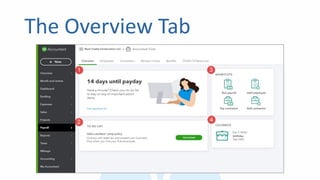

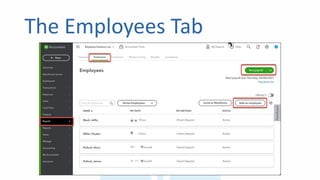

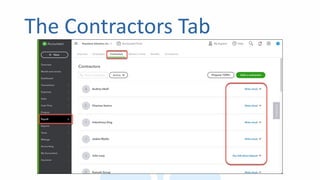

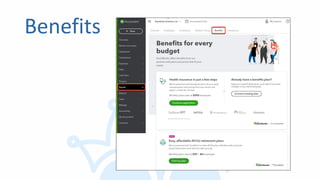

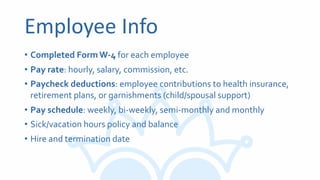

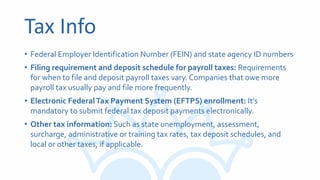

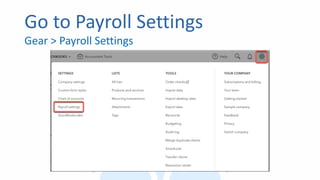

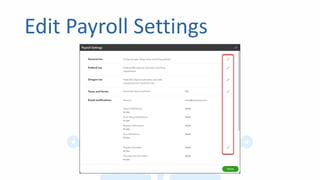

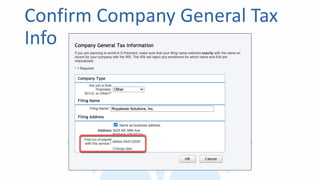

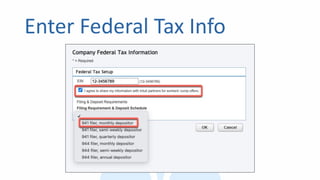

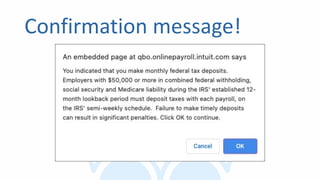

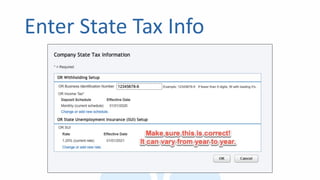

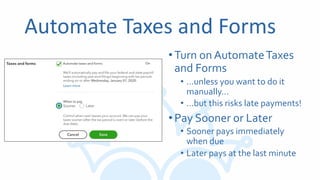

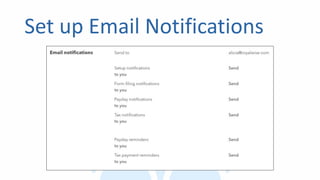

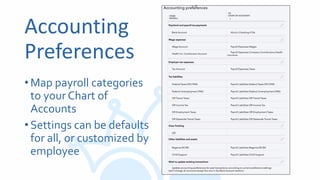

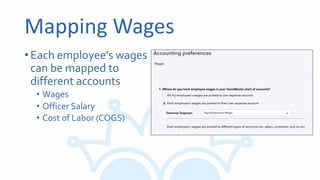

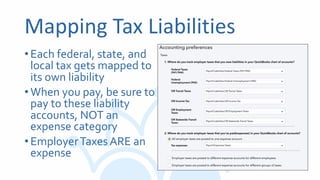

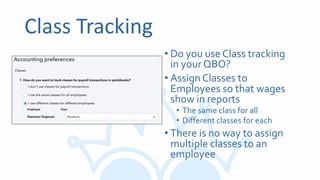

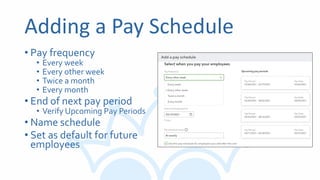

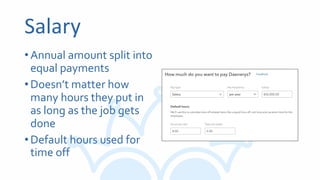

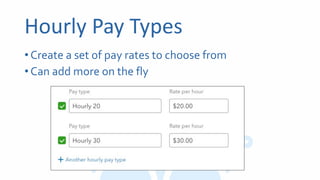

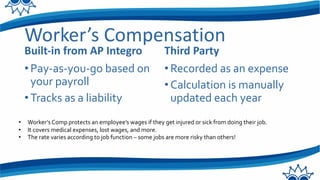

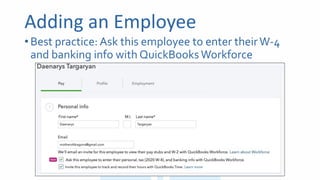

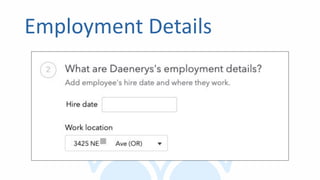

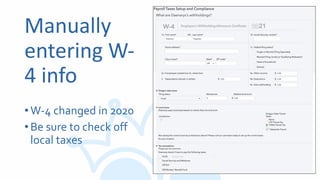

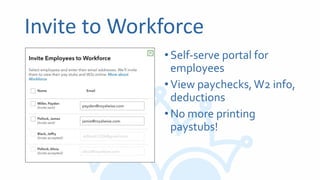

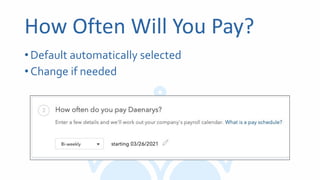

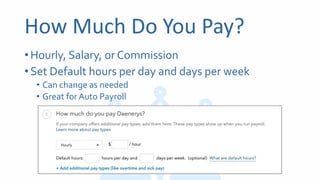

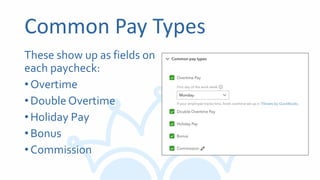

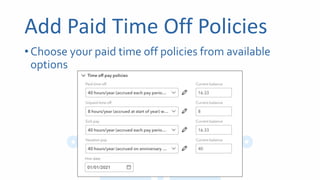

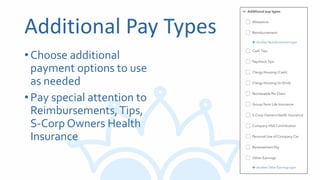

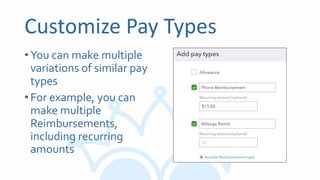

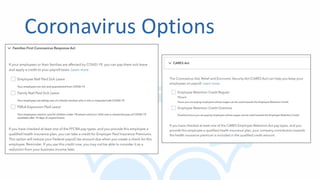

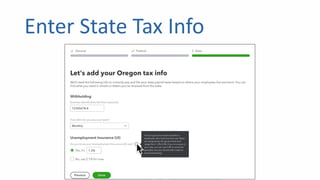

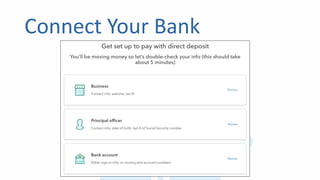

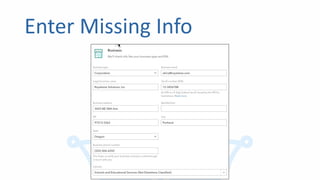

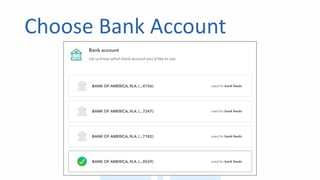

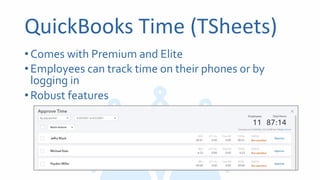

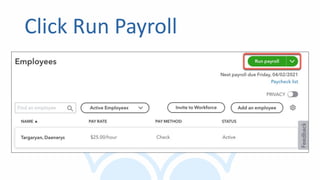

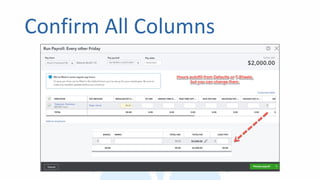

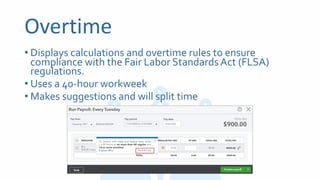

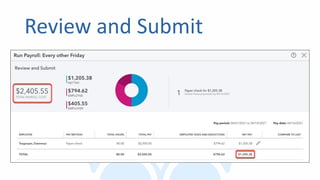

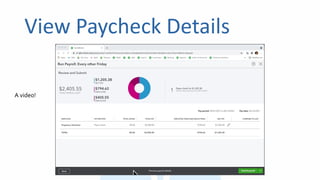

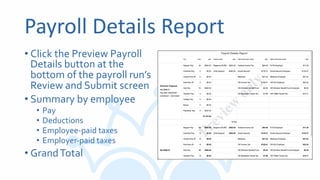

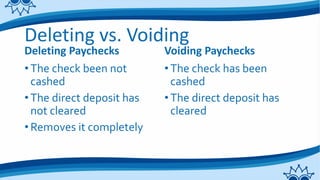

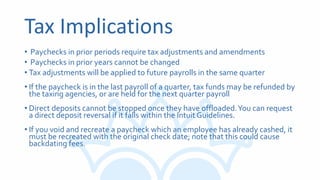

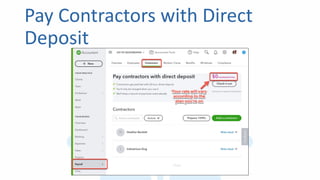

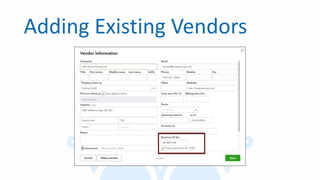

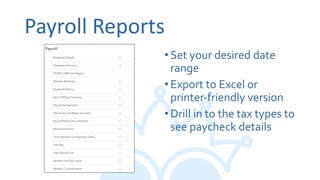

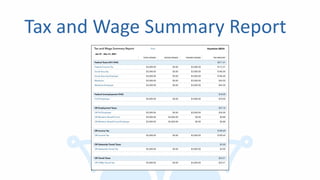

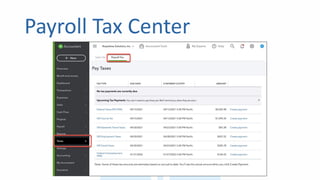

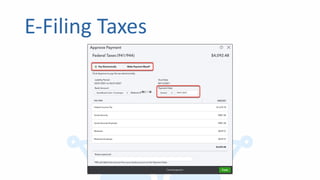

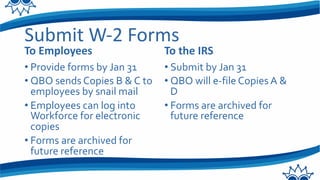

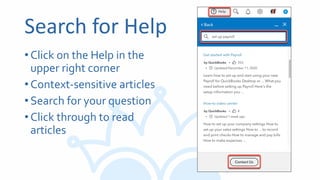

The document provides a comprehensive guide on QuickBooks Online Full Service Payroll, including its benefits, service levels, and setup procedures. It covers topics such as understanding employee versus contractor classification, payroll processes, managing taxes, setting up employee information, and running payroll. The document also includes recommended practices for payroll management and highlights features available within the different service tiers of QuickBooks Payroll.