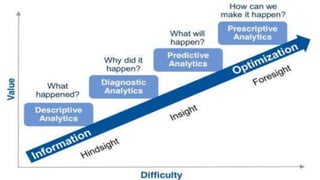

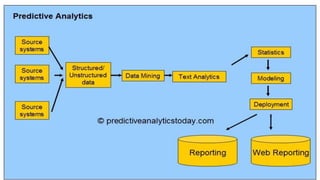

Predictive analytics leverages historical data to identify risks and opportunities, guiding decision-making in businesses. It is commonly used for fraud detection, marketing optimization, operational improvements, and risk reduction, employing methods like decision trees, regression, and neural networks for modeling. By predicting outcomes based on input variables, predictive analytics helps organizations anticipate future scenarios beyond just historical insights.