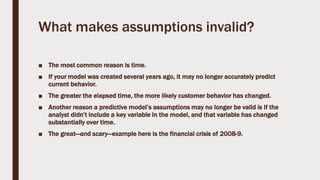

This document provides an overview of predictive analytics. It discusses how predictive analytics uses data from the past to predict the future, such as forecasting sales or determining what ad to display. It notes that predictive analytics relies on past data, statistical analysis, and assumptions. It outlines some common types of predictive analytics and discusses challenges such as lack of quality data, invalid statistical models, and assumptions becoming outdated over time, such as when key variables change.