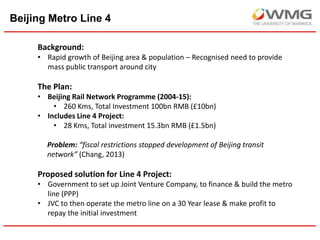

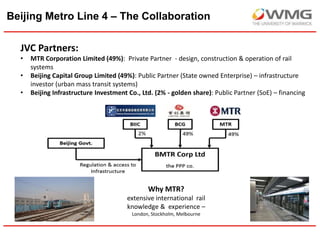

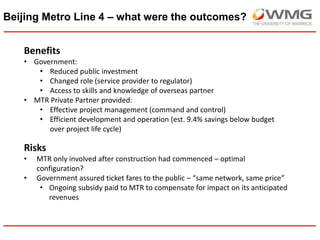

The Beijing Metro Line 4 project was a public-private partnership between the Beijing municipal government and MTR Corporation Limited, a private rail operator, to build and operate a new metro line. Through the joint venture company established for the project, MTR provided its rail expertise and management skills to construct the 28km line on time and under budget, while the government transferred construction risk to the private partner and gained access to MTR's international experience. However, MTR's involvement after construction began limited design optimization, and government-mandated fare subsidies impacted MTR's expected revenues, requiring ongoing public compensation. The project demonstrated how PPPs can efficiently develop infrastructure through risk sharing and leveraging private sector skills, but also highlighted challenges in