This document provides an overview of key concepts related to auditing, including:

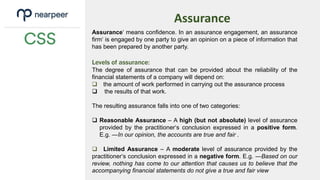

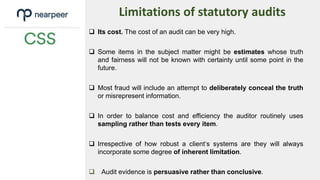

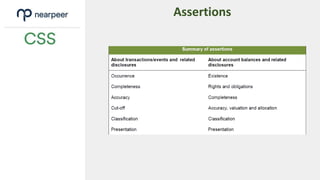

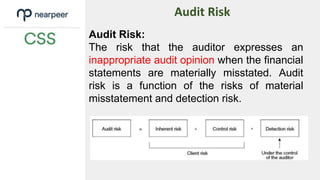

- The objectives of an audit are to obtain reasonable assurance about whether financial statements are free from material misstatement and to report on the financial statements.

- An auditor must be independent, consider materiality, and determine if financial statements present a true and fair view.

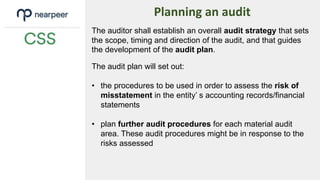

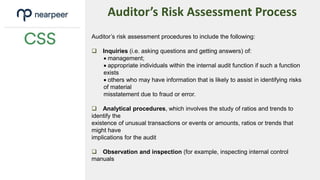

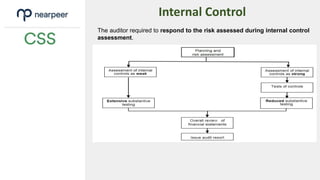

- Planning an audit involves assessing risks, developing an audit strategy and plan, and determining appropriate audit procedures.

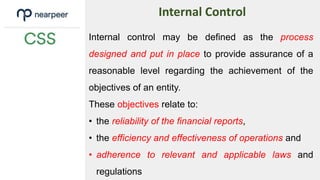

- Internal controls are evaluated to determine if they are properly designed and operating effectively.