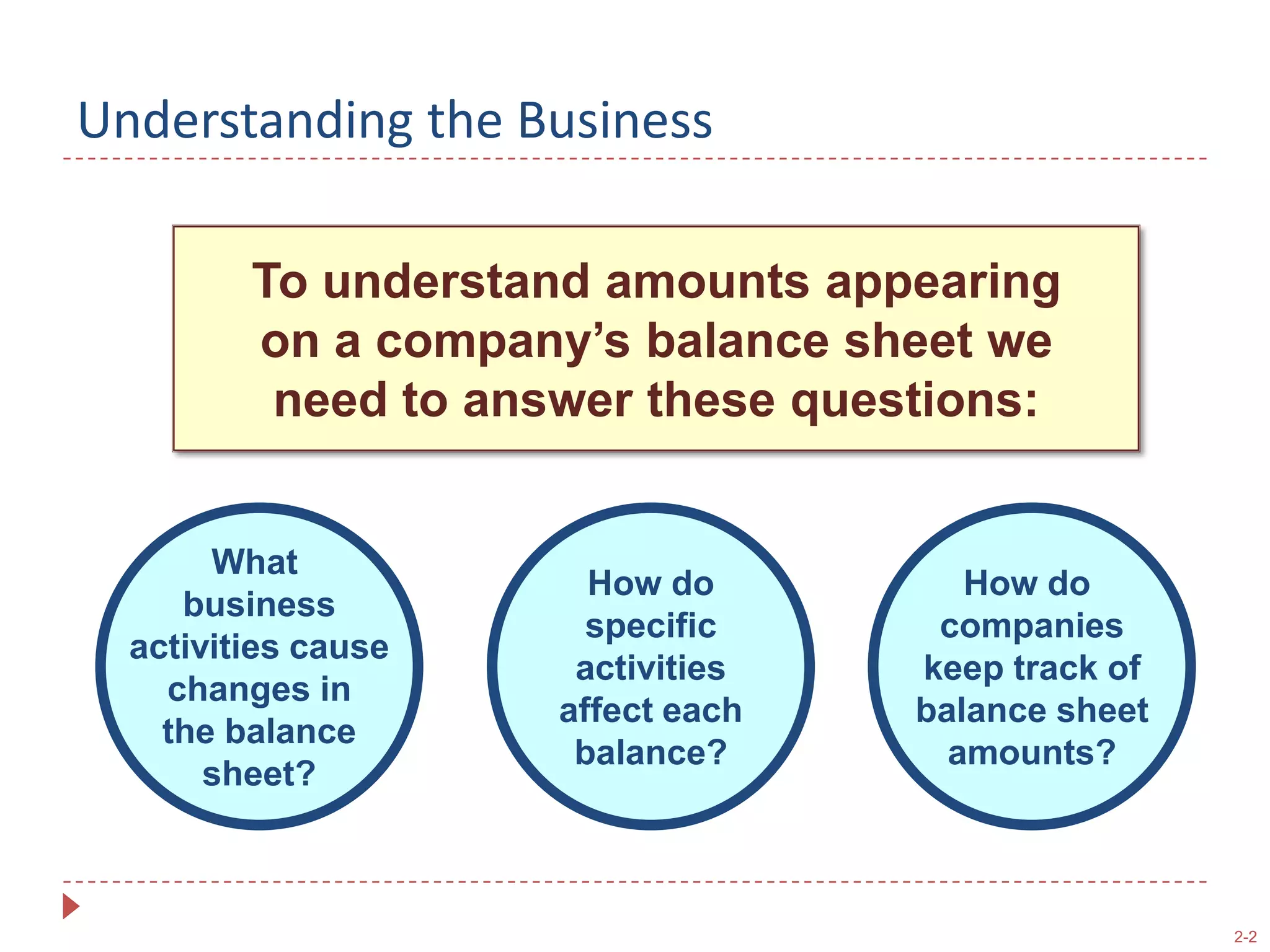

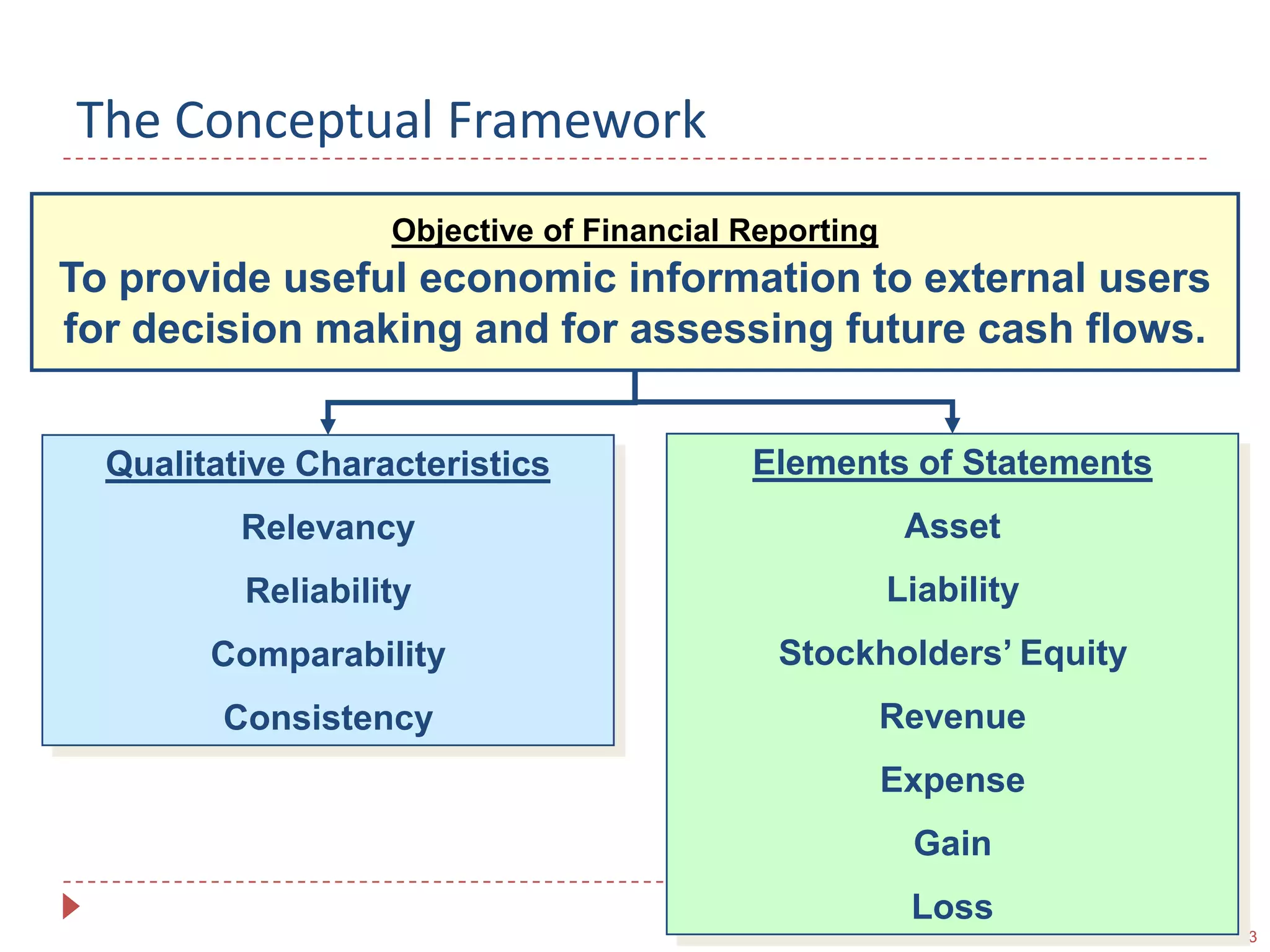

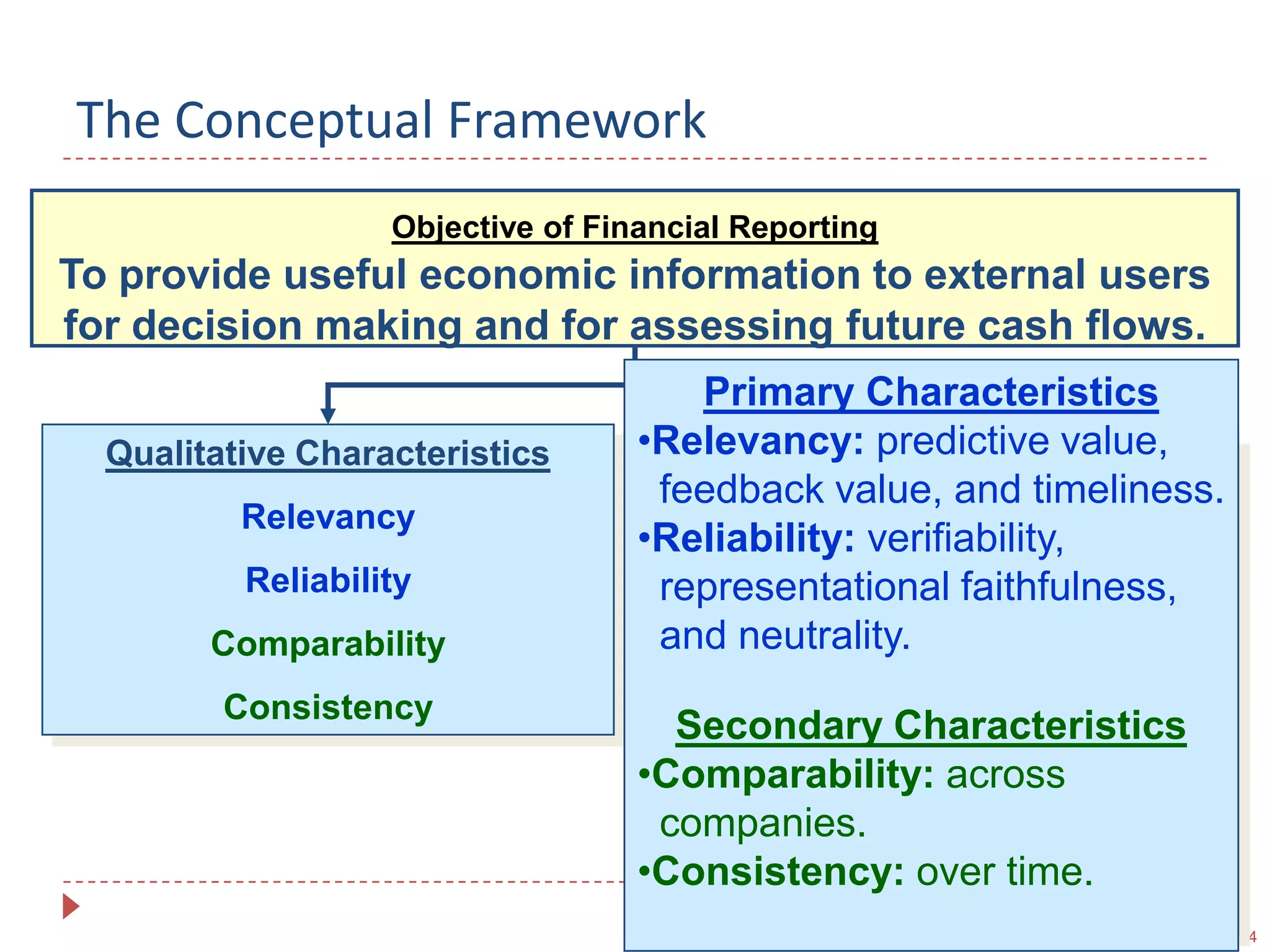

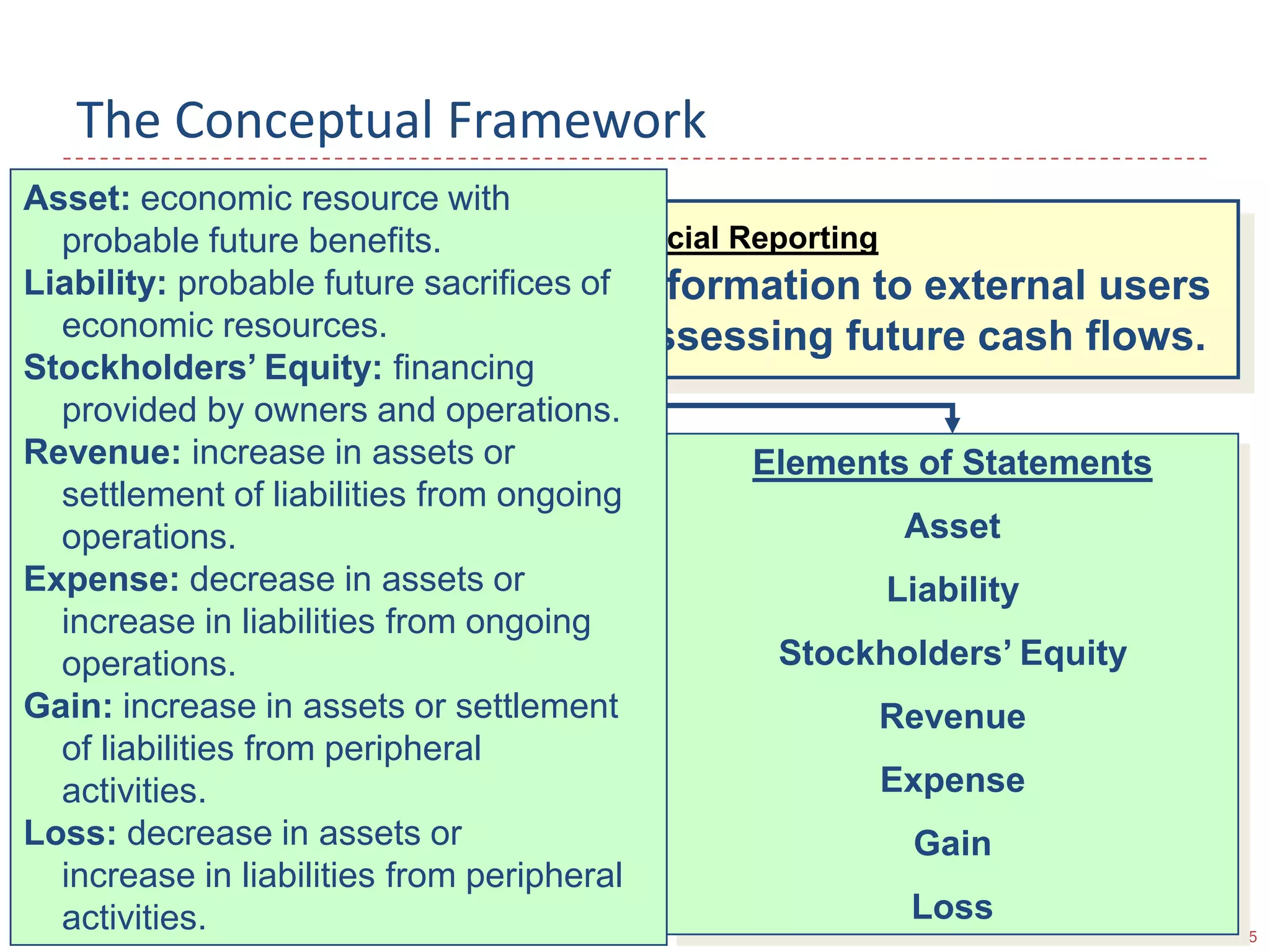

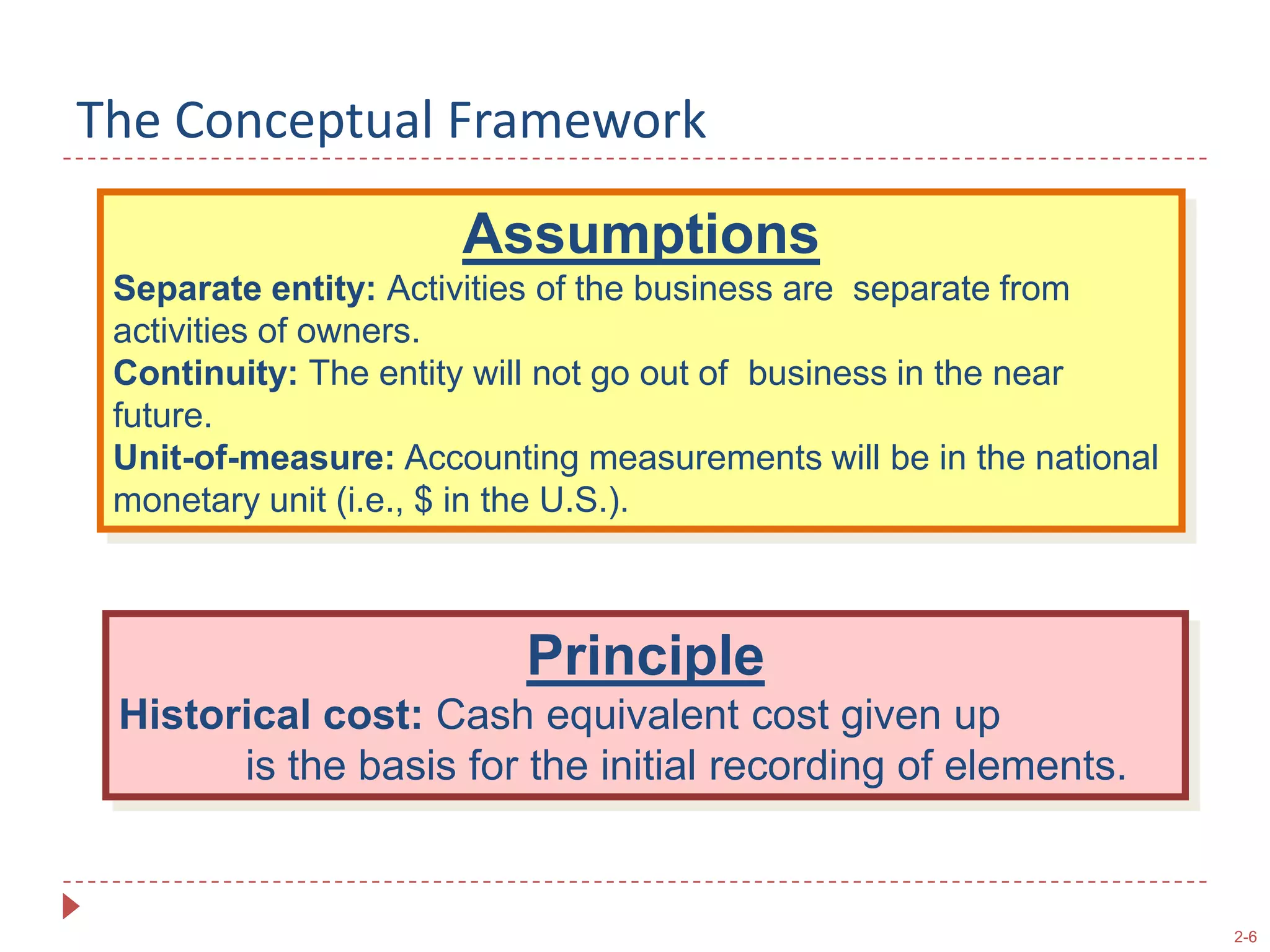

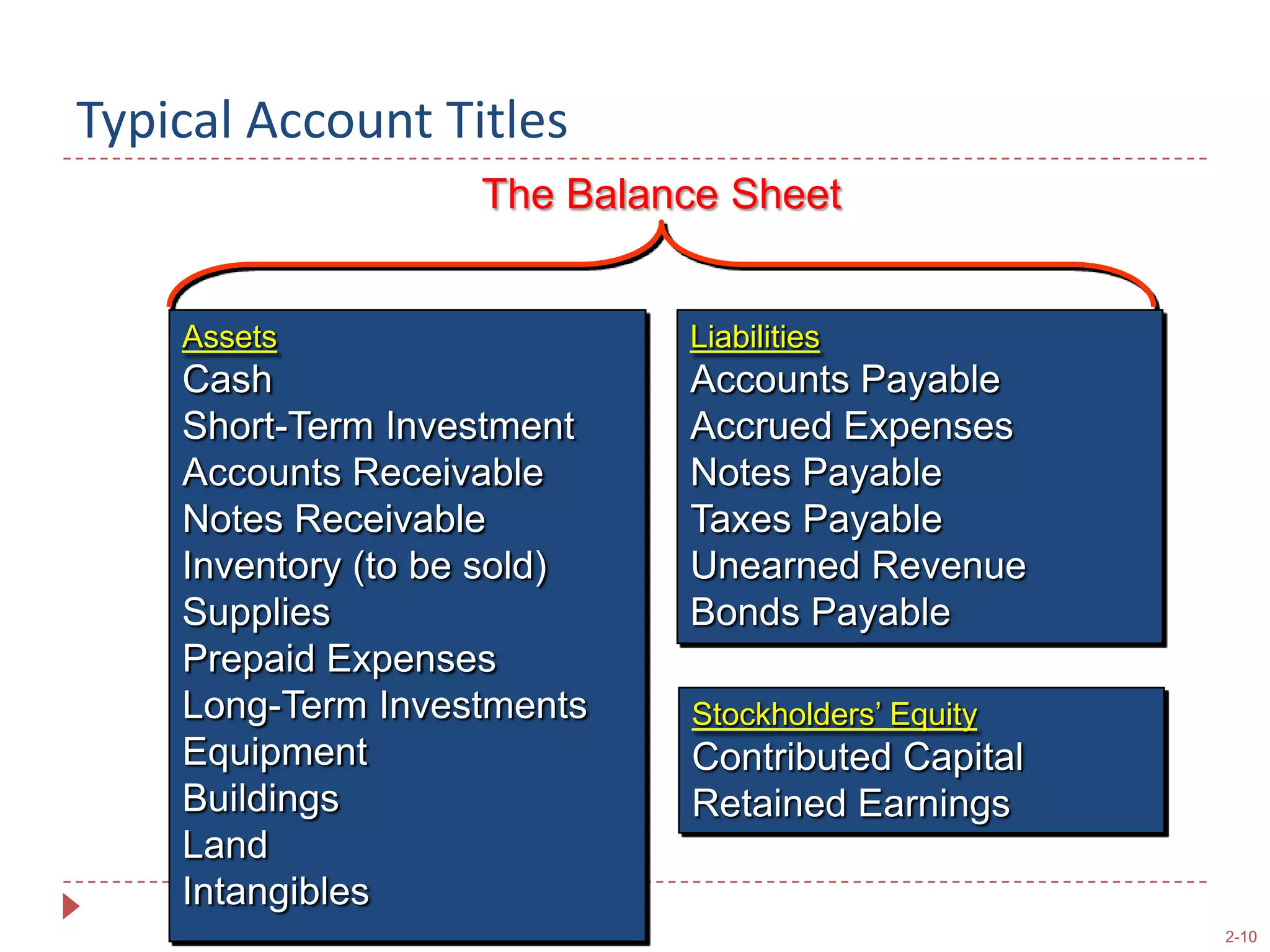

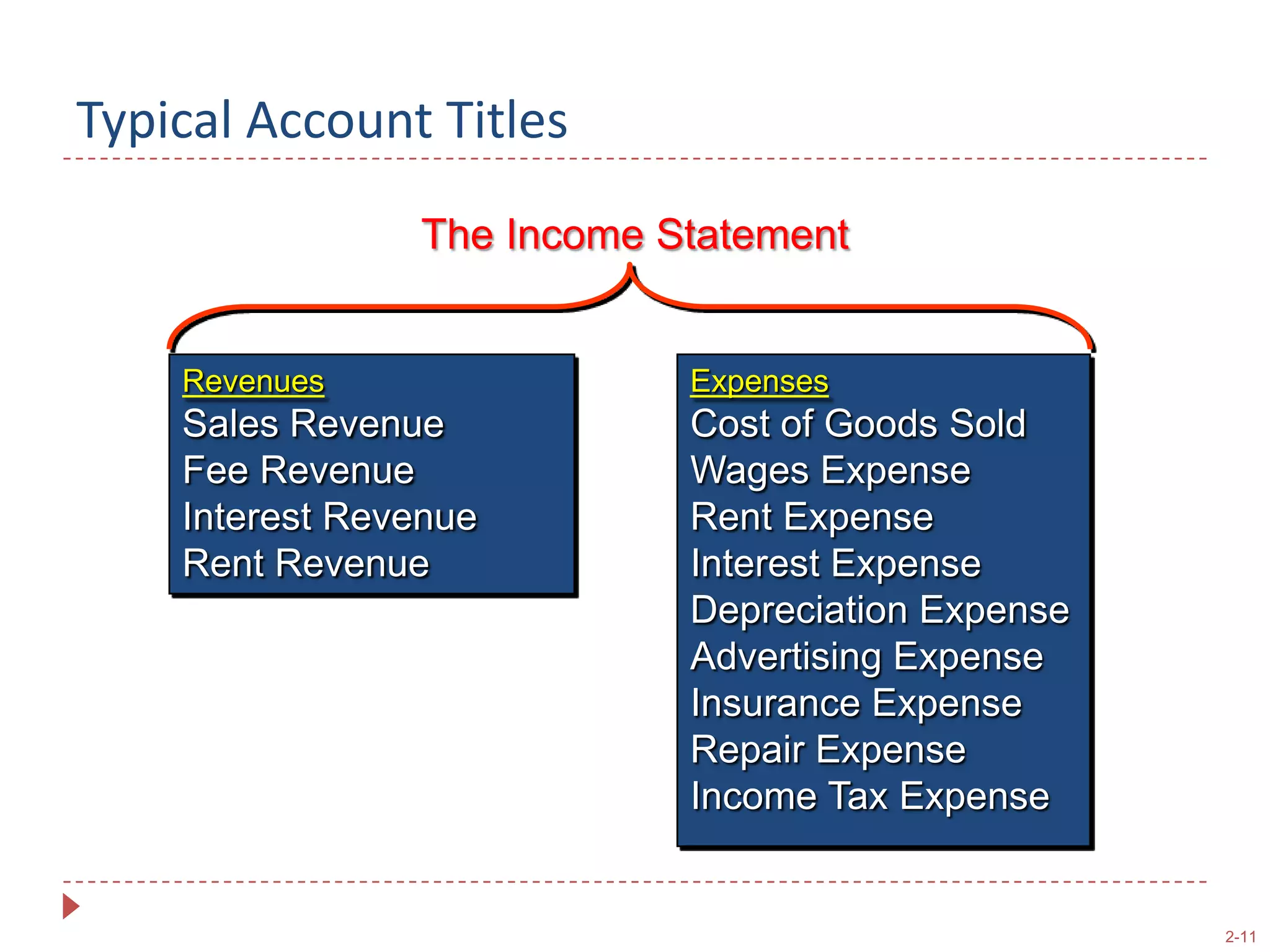

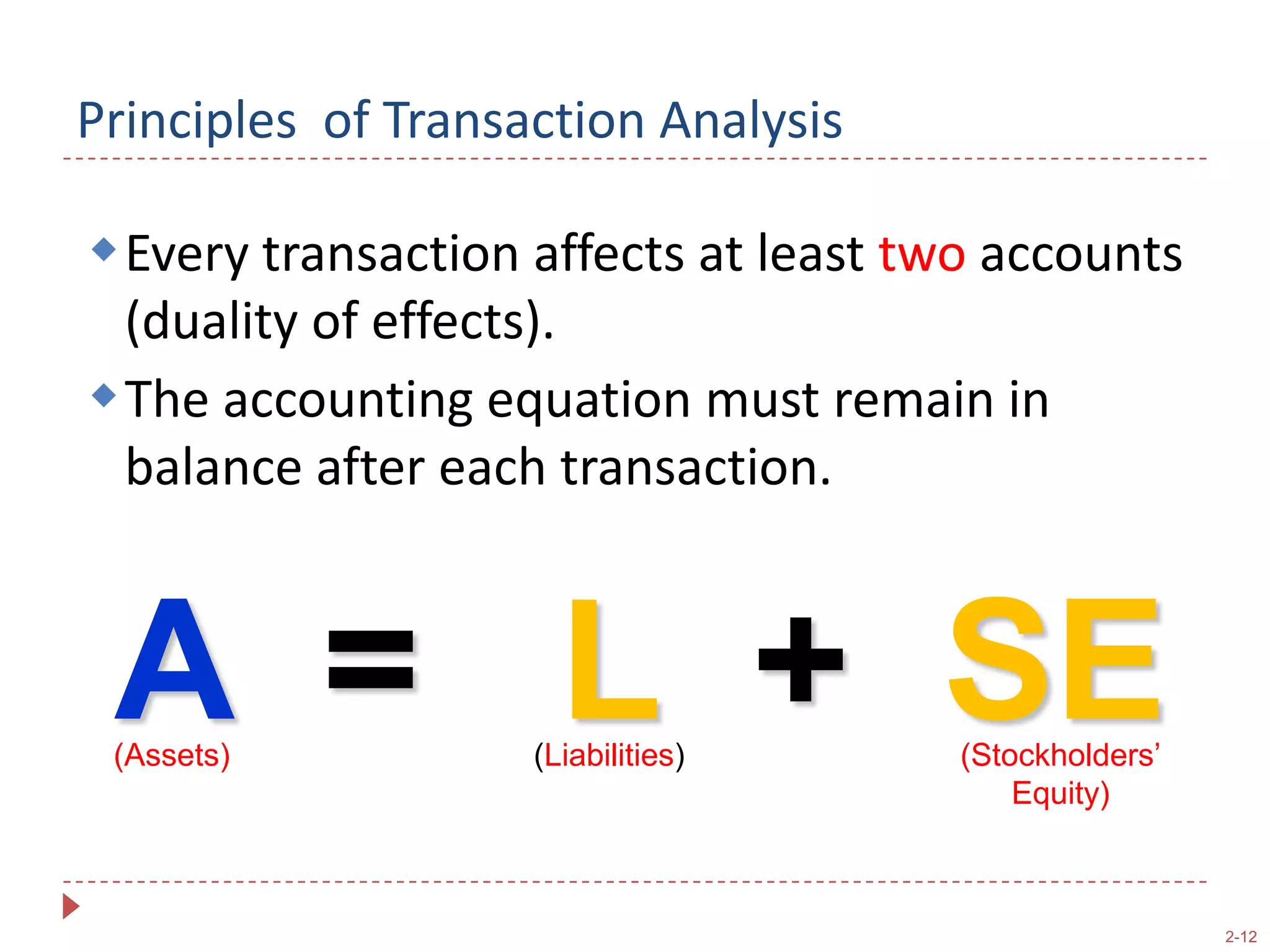

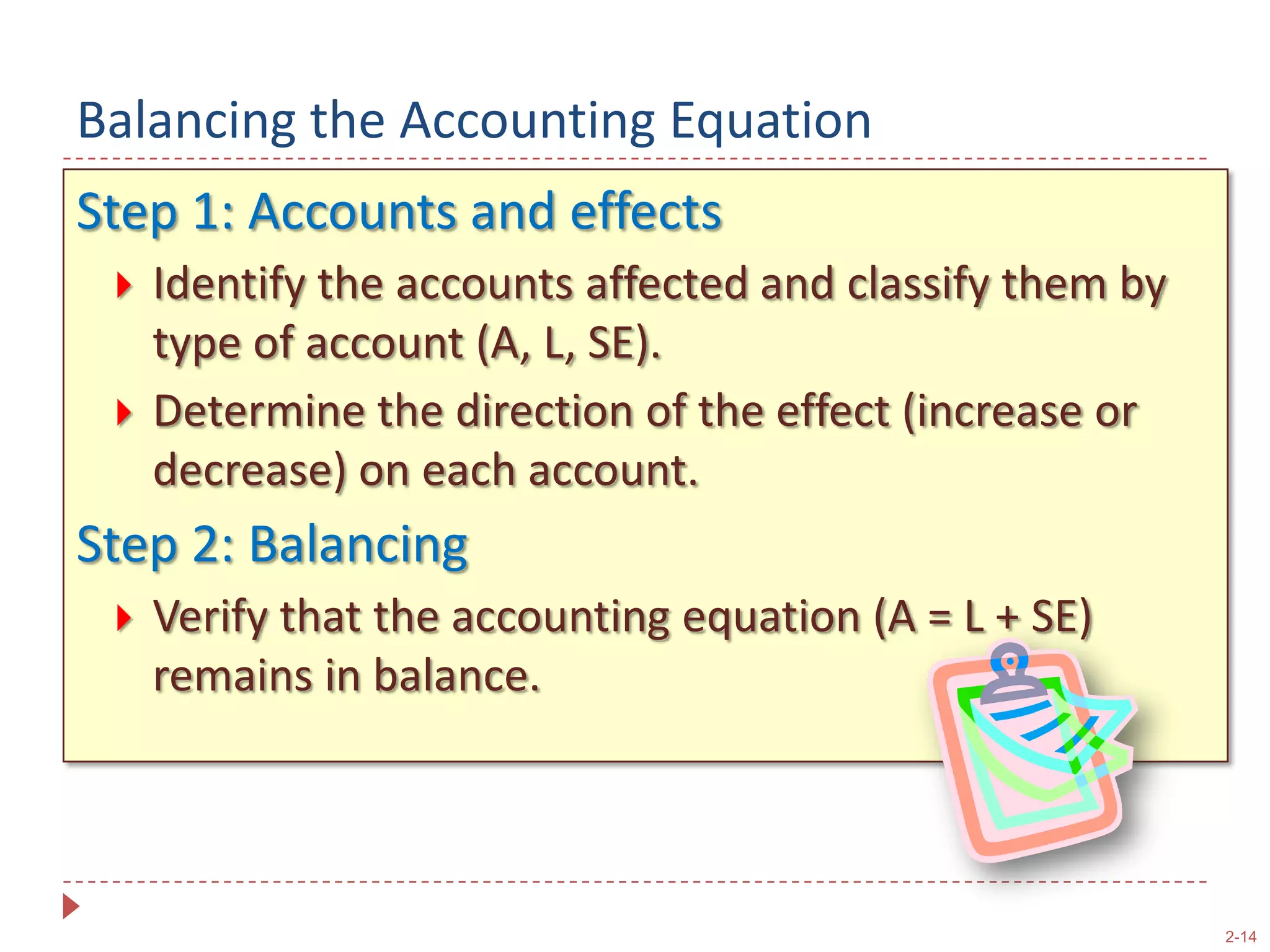

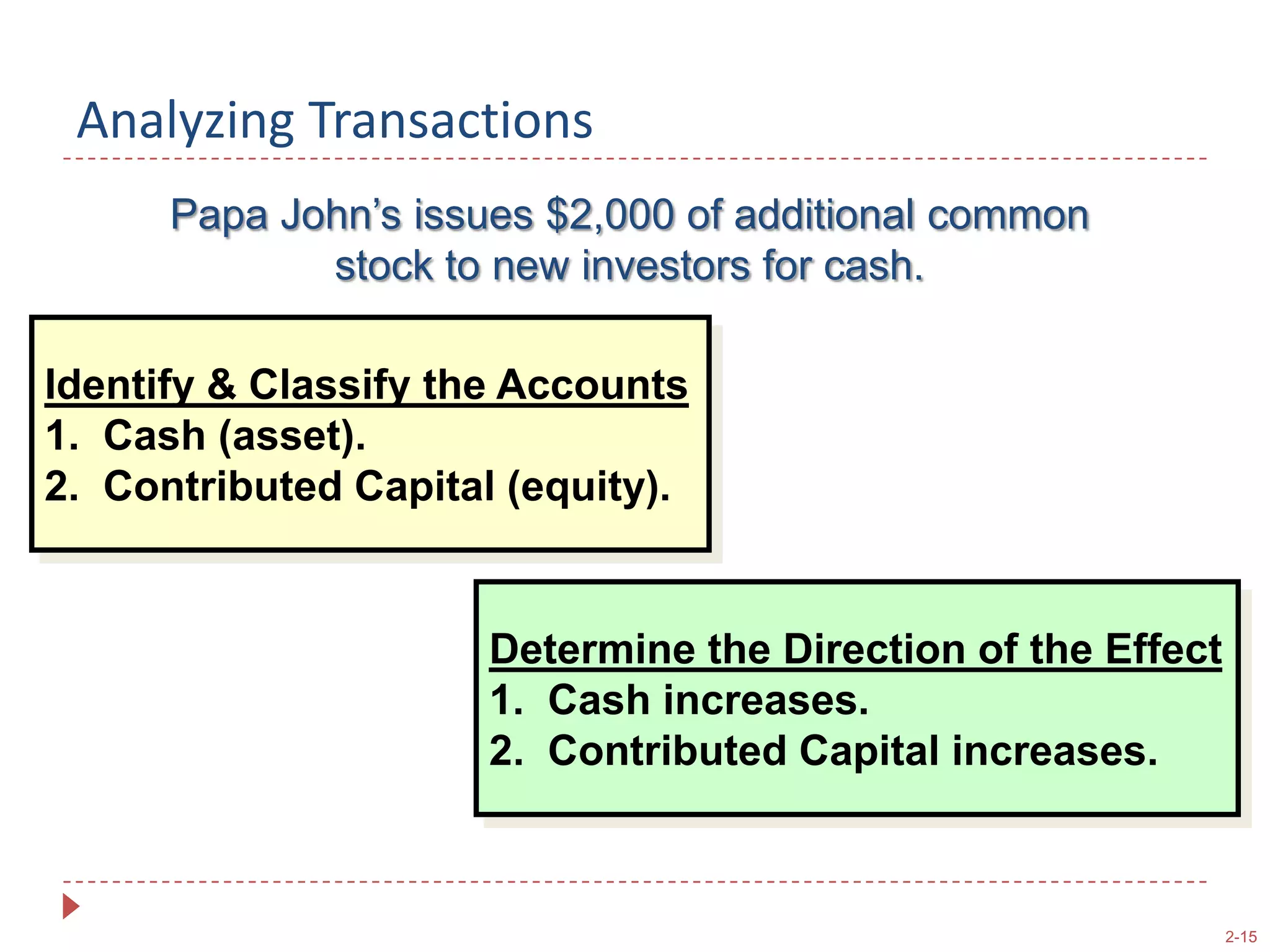

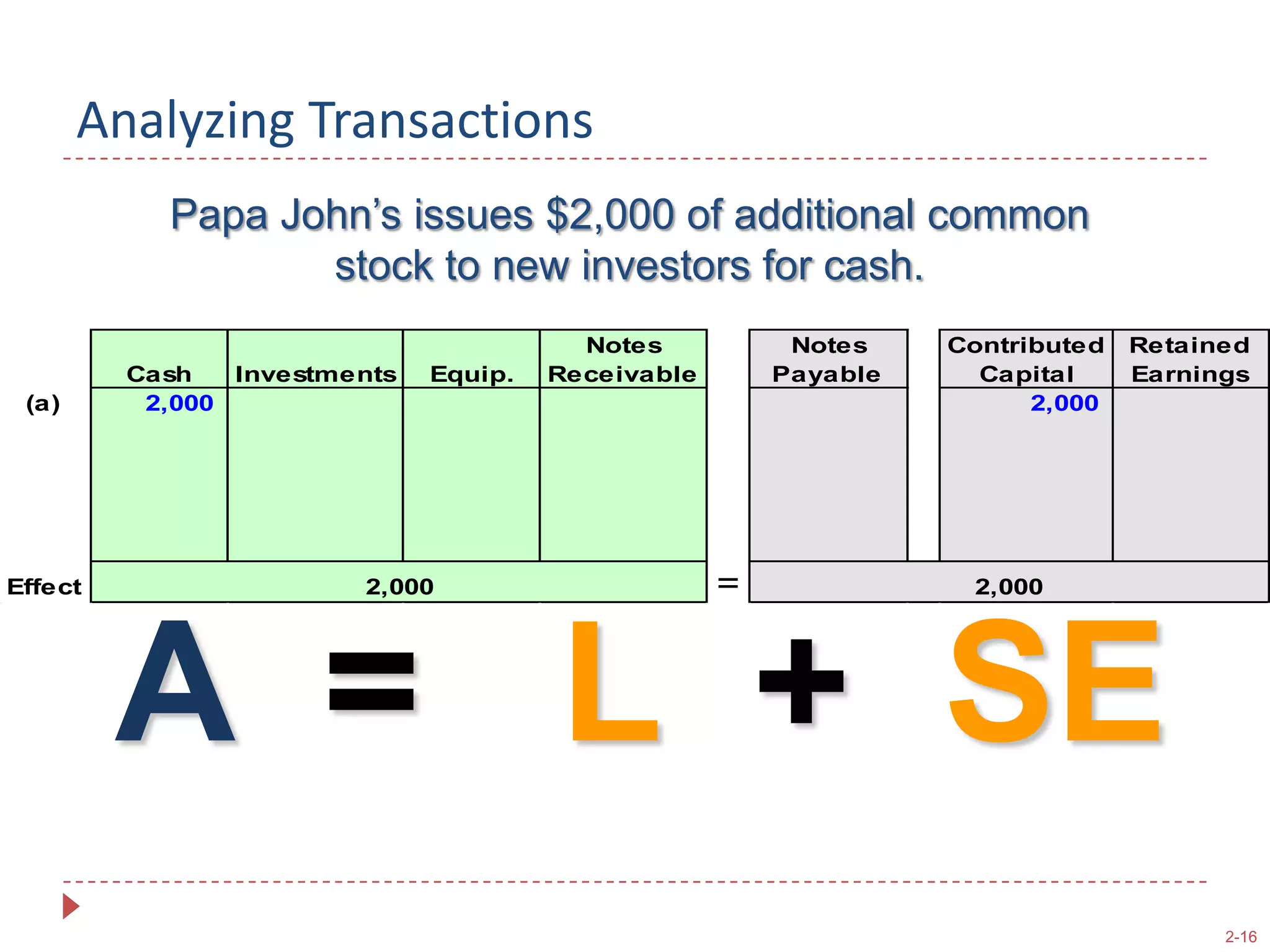

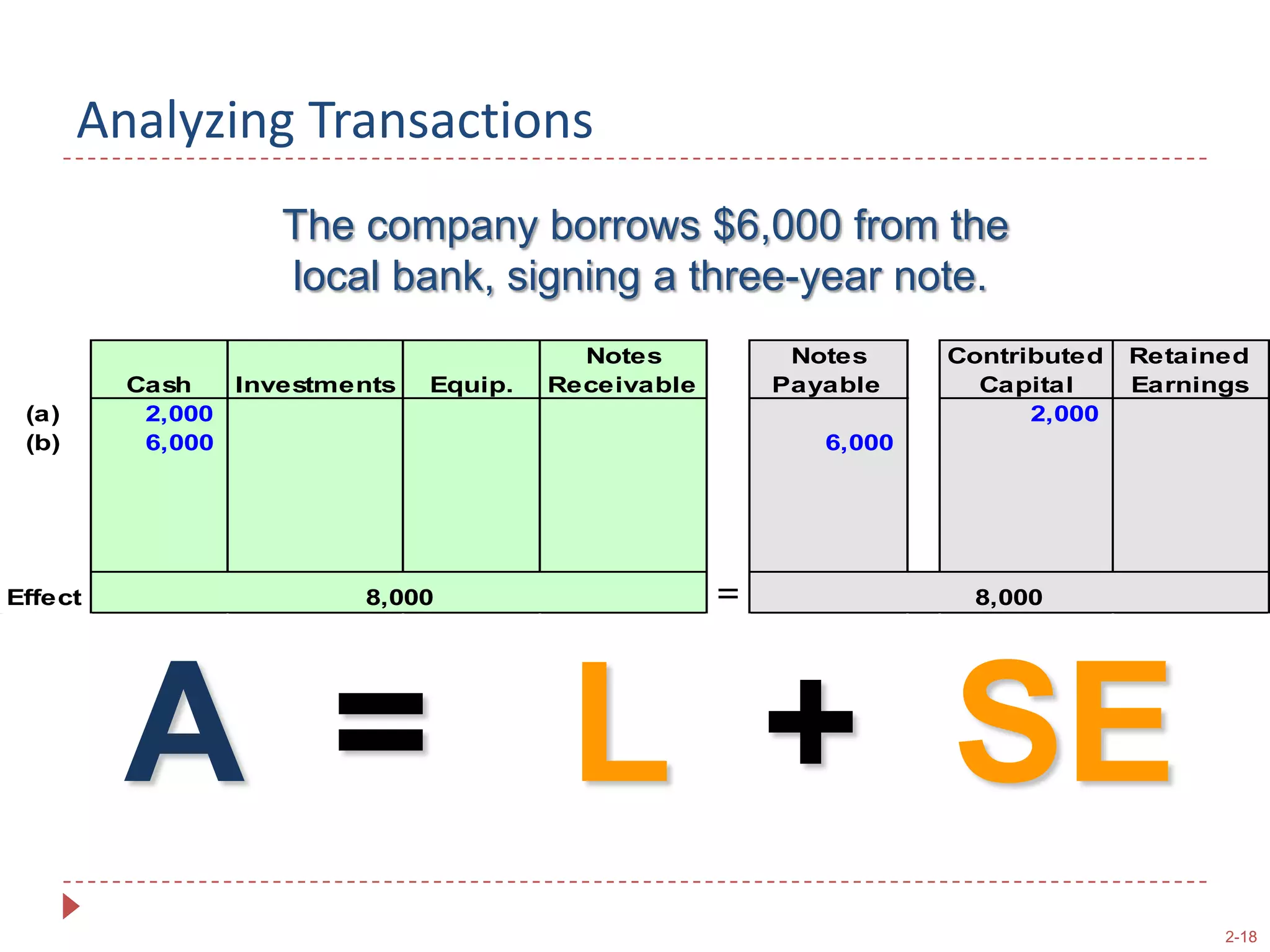

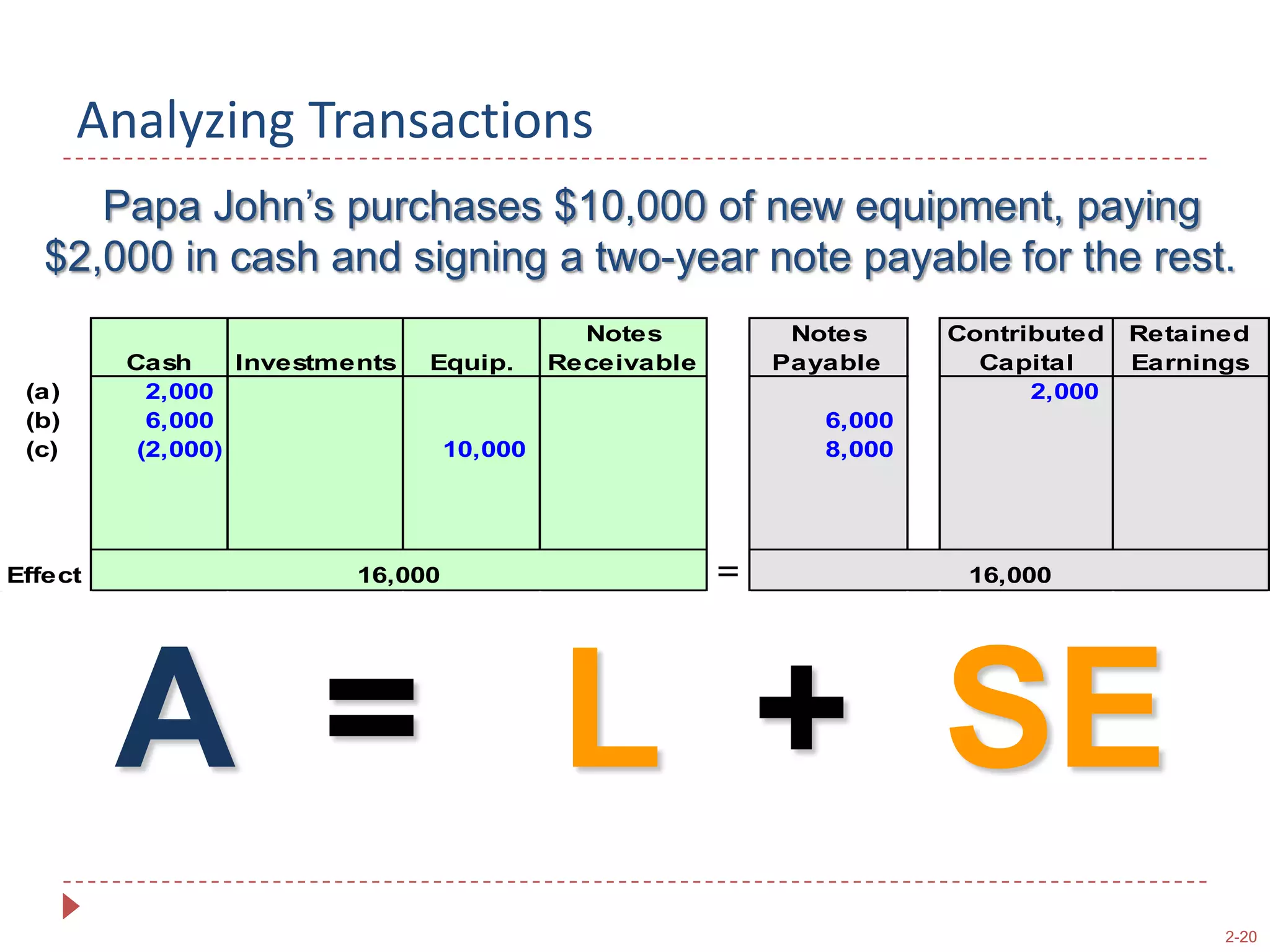

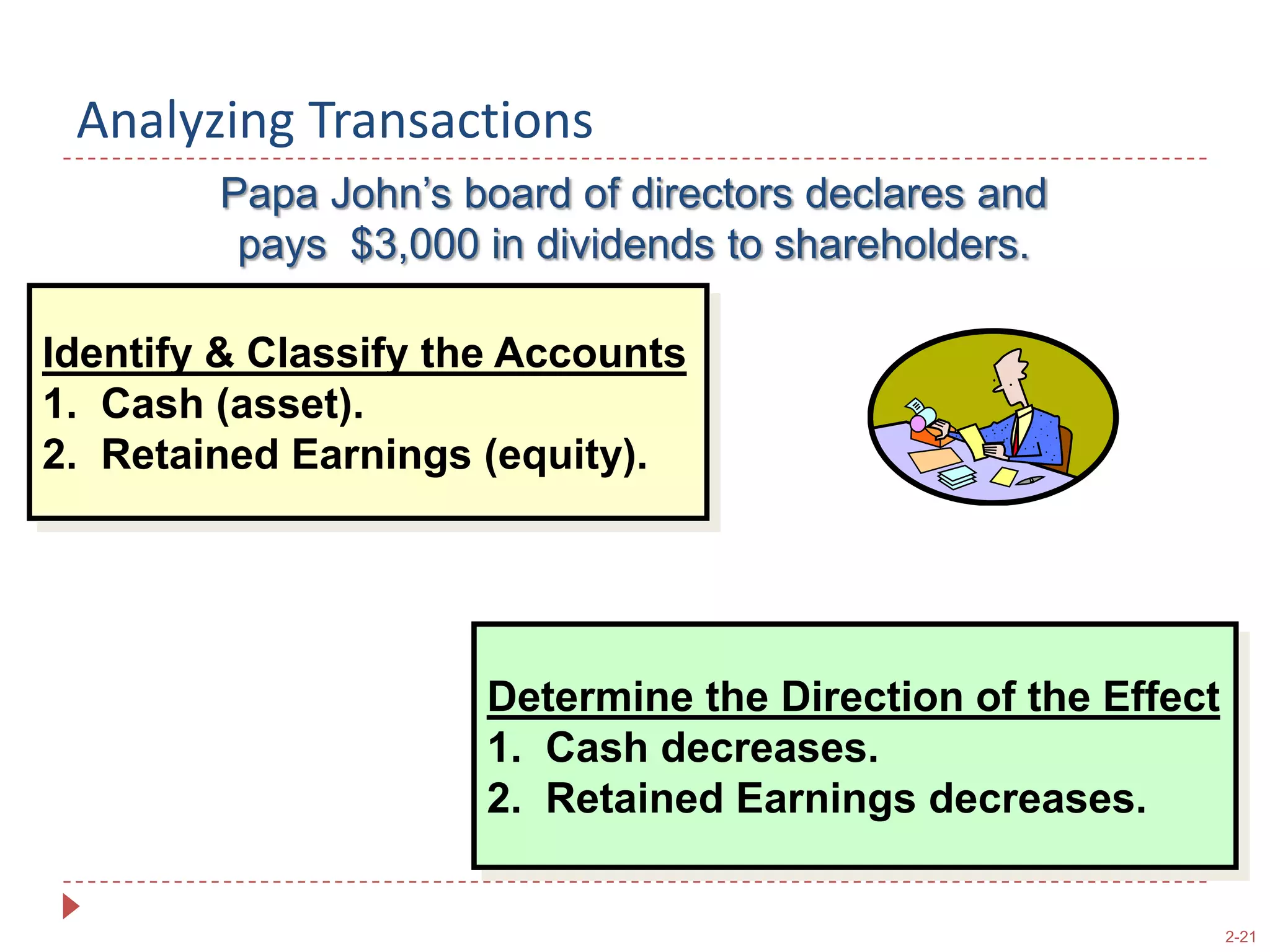

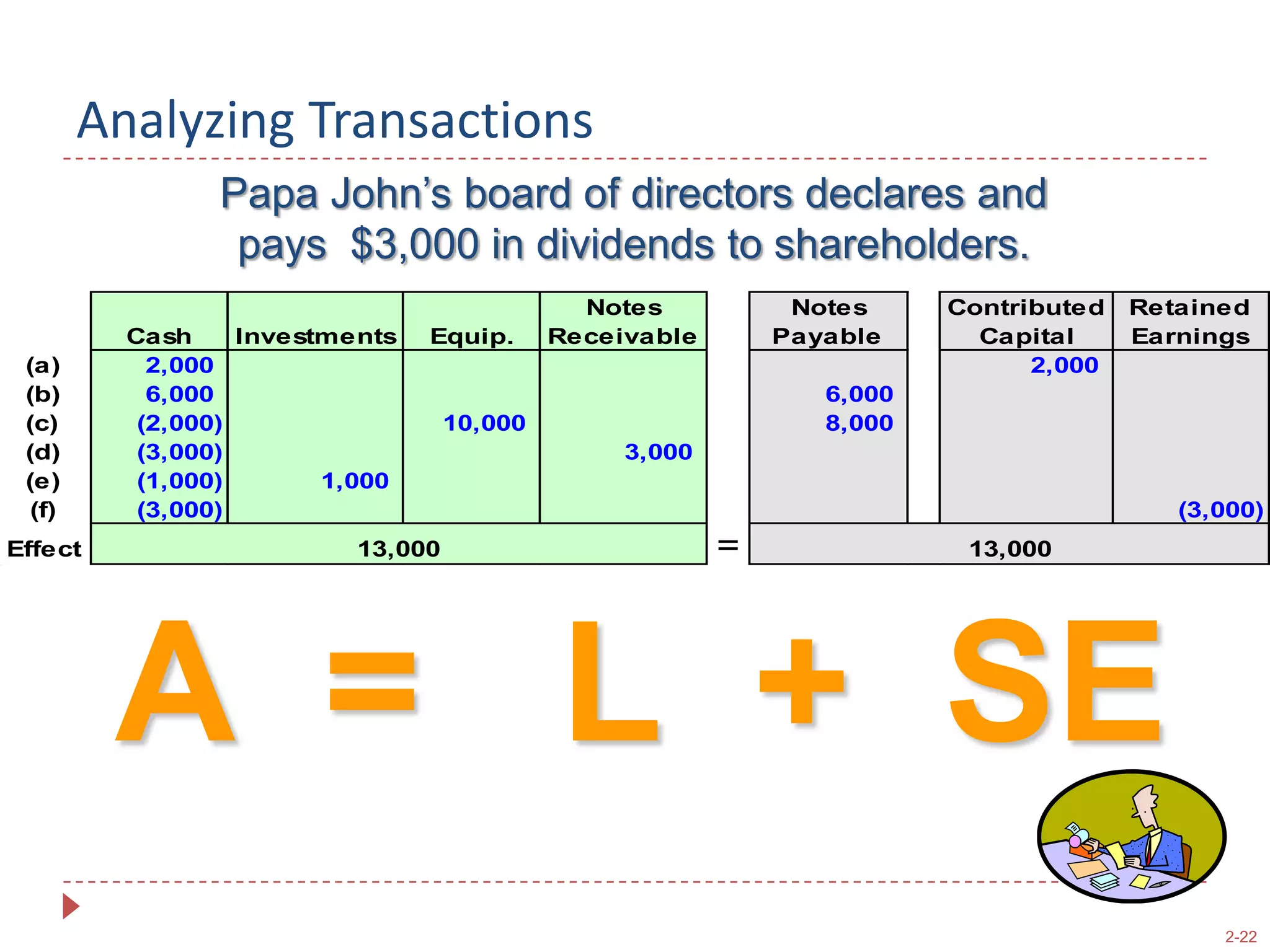

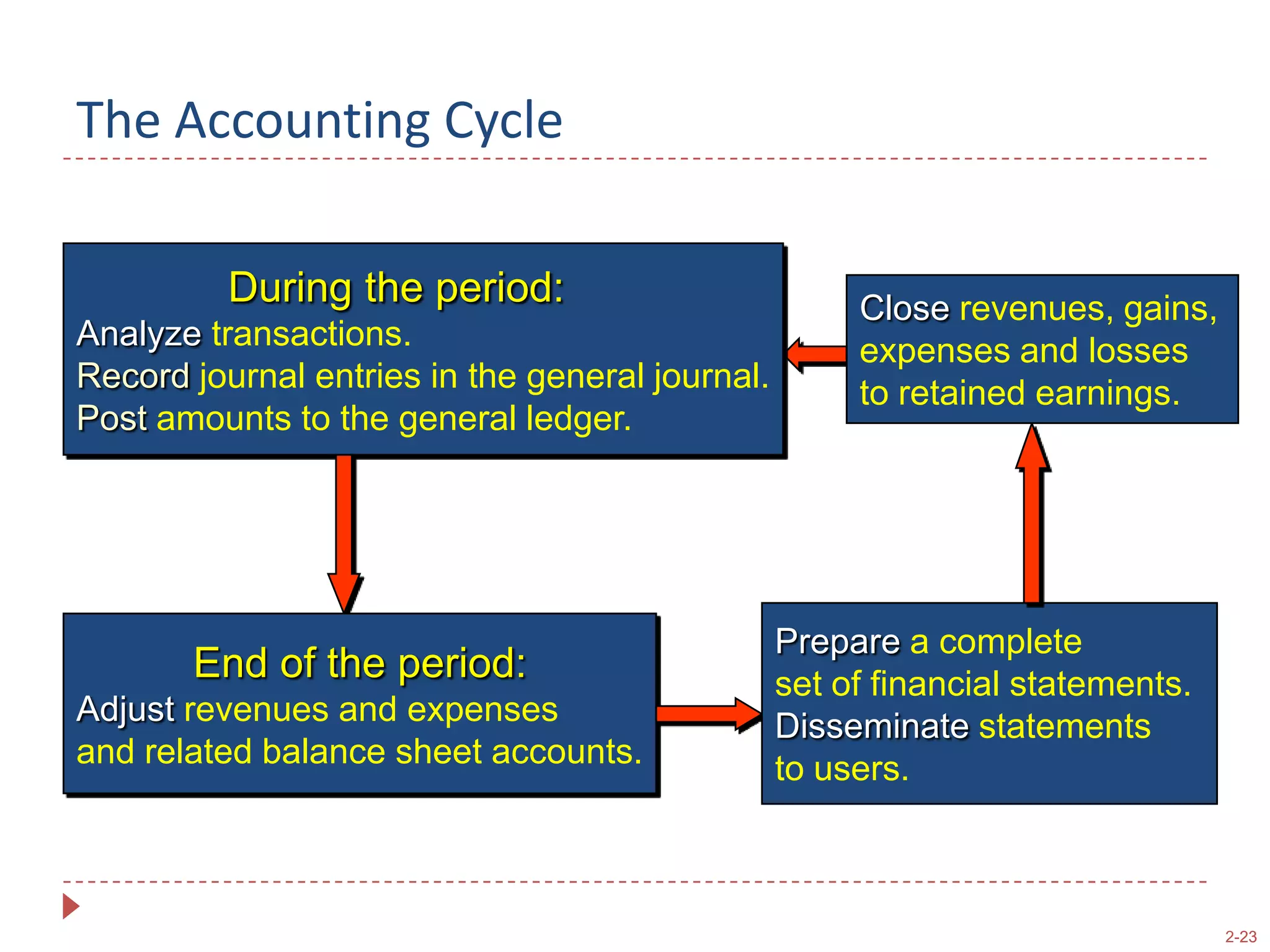

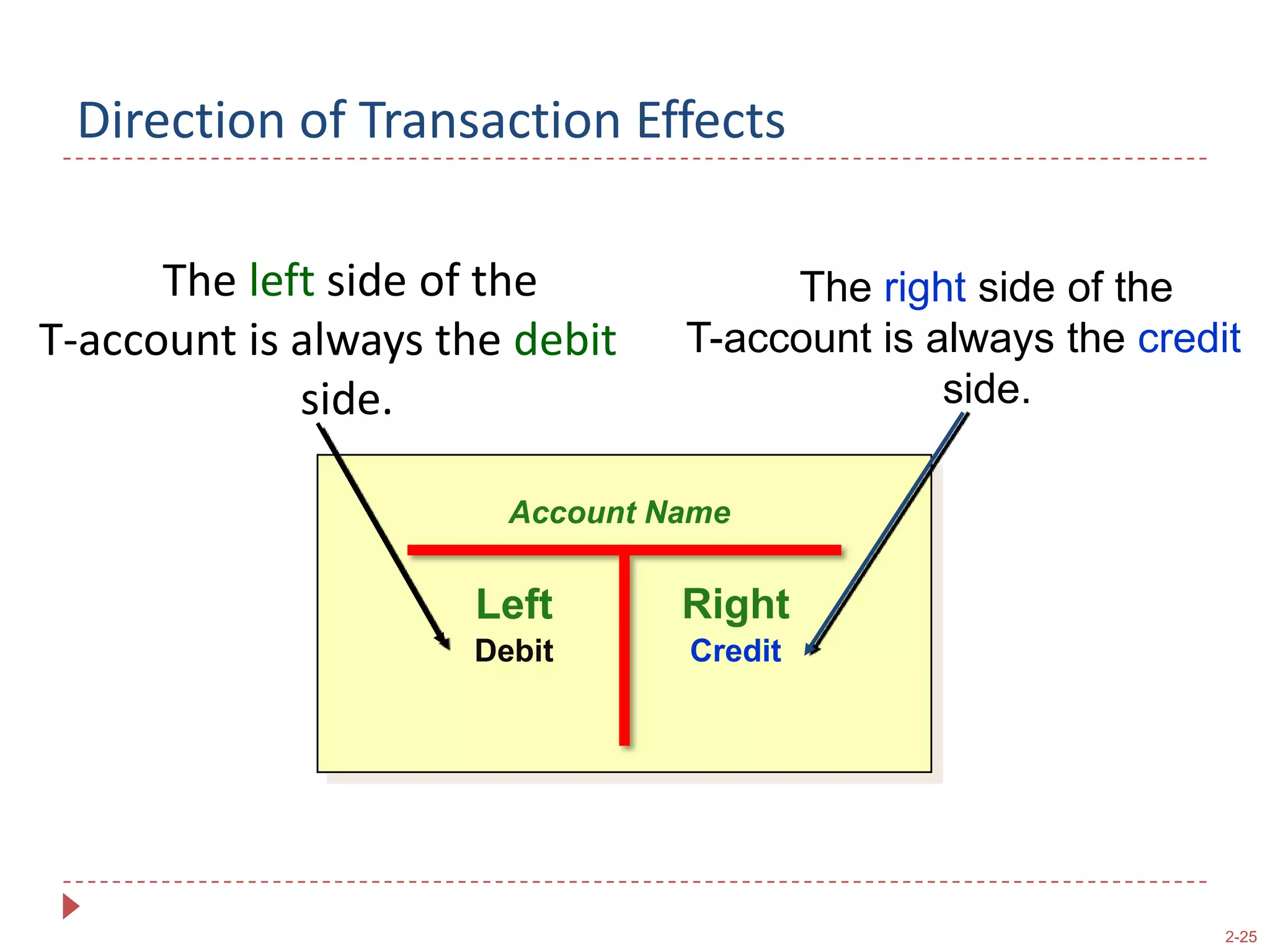

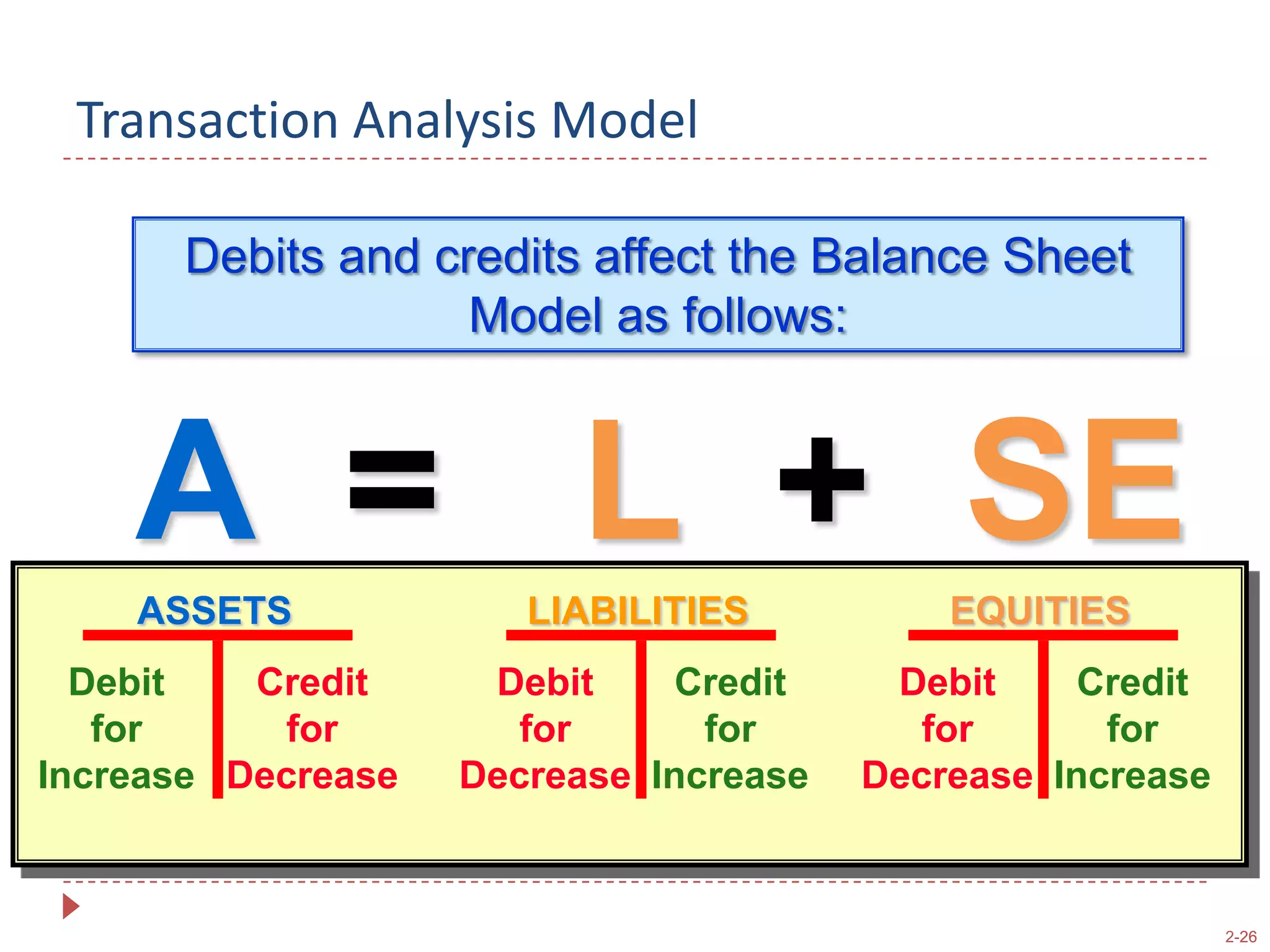

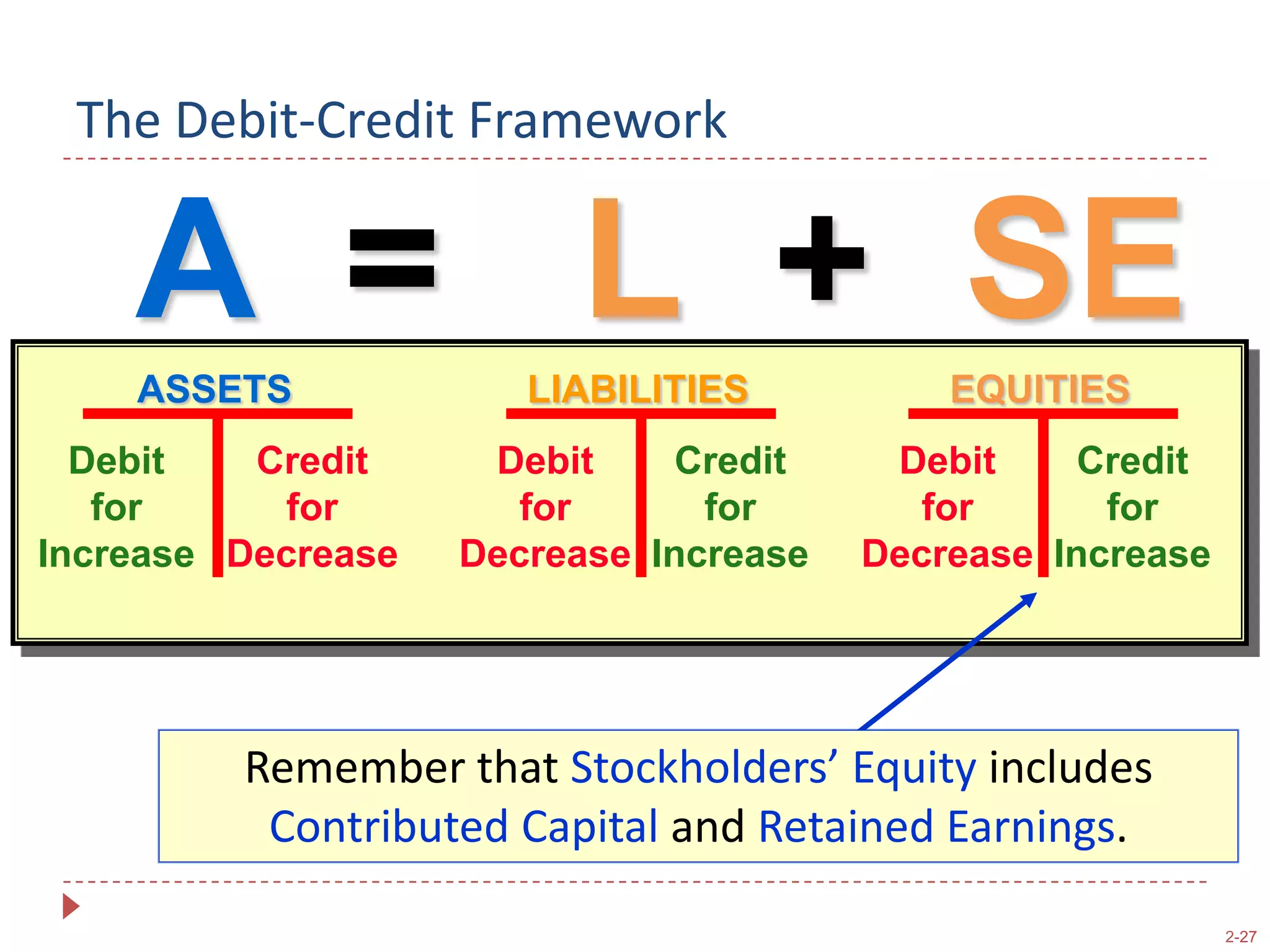

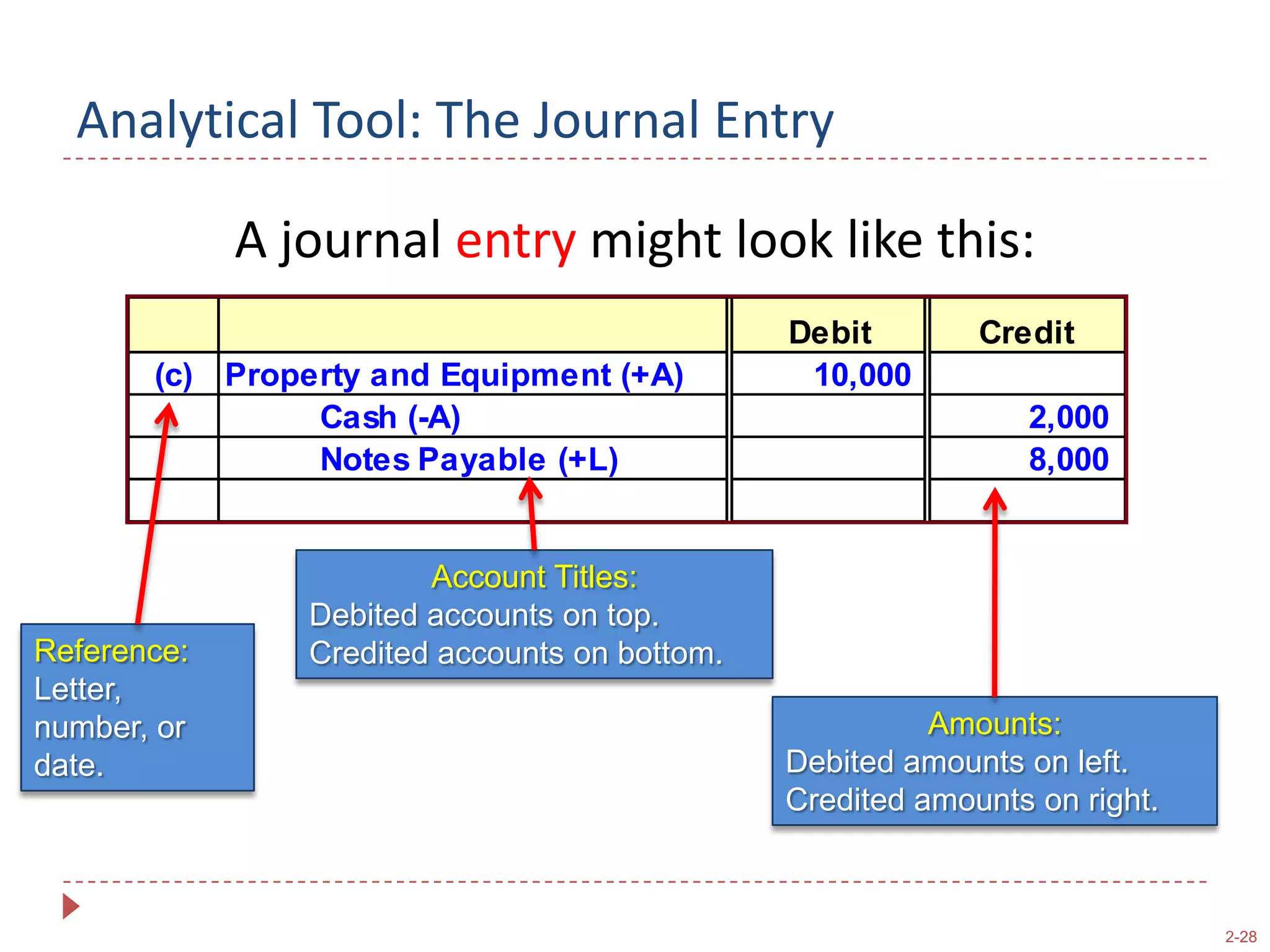

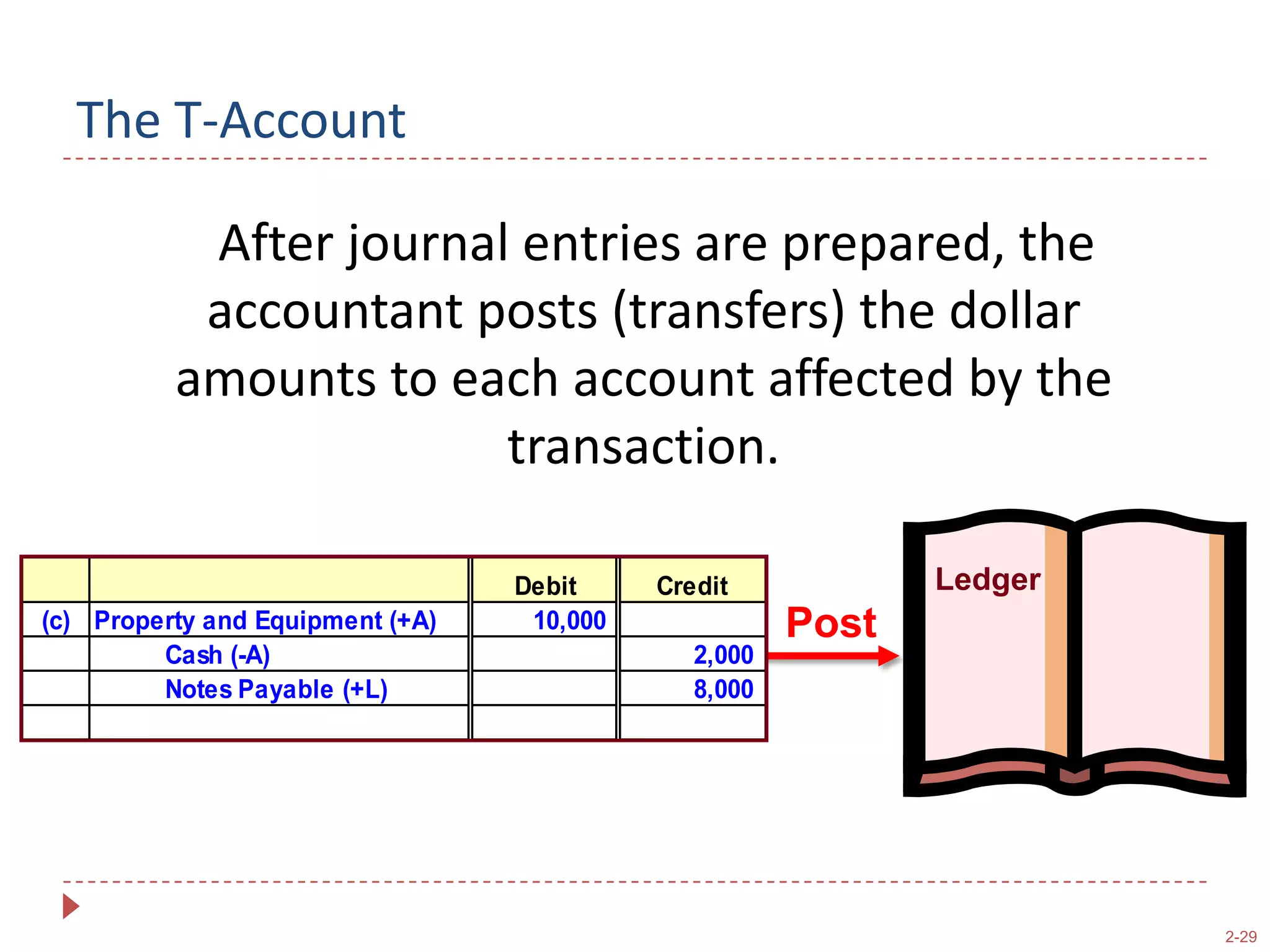

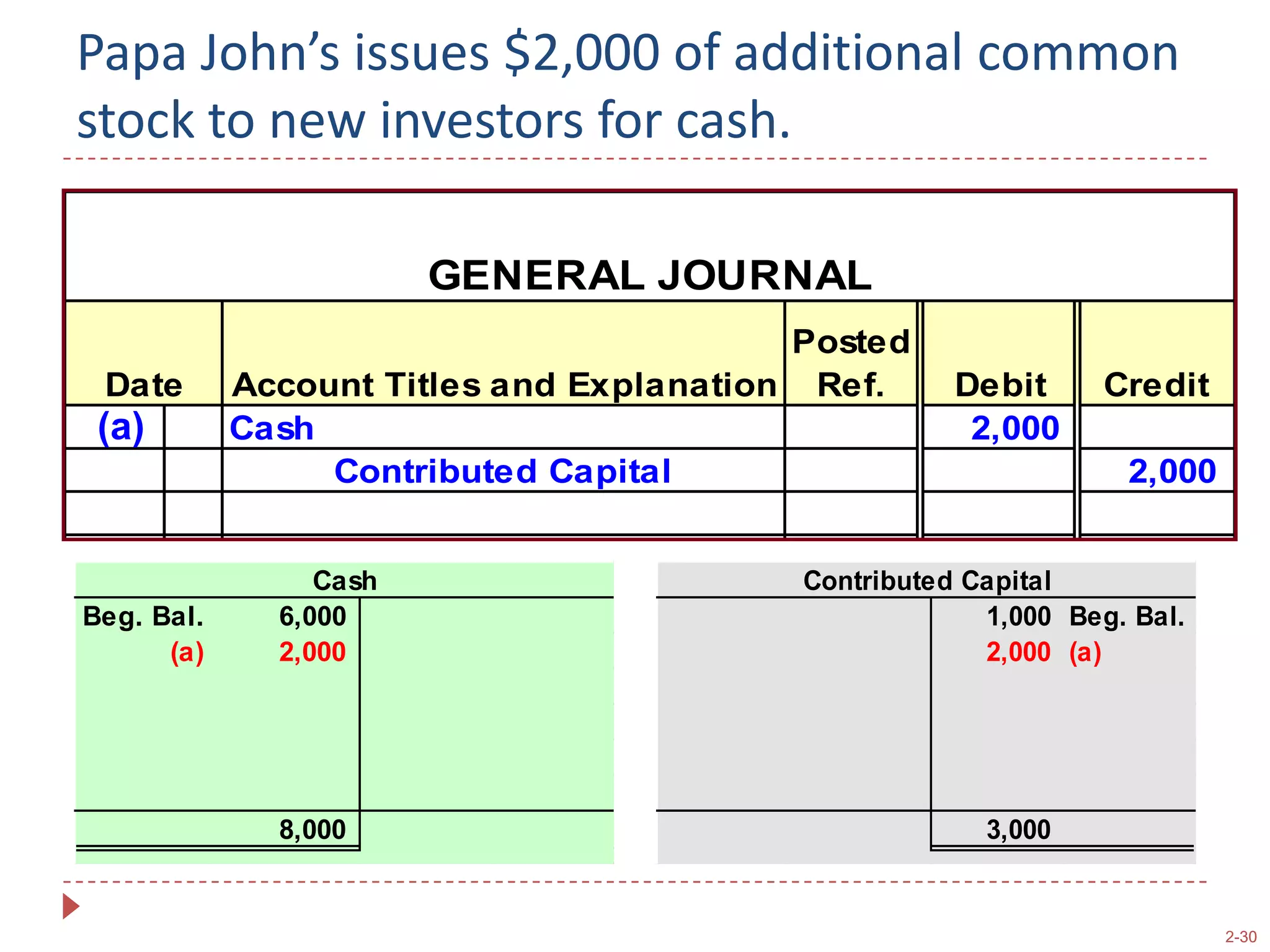

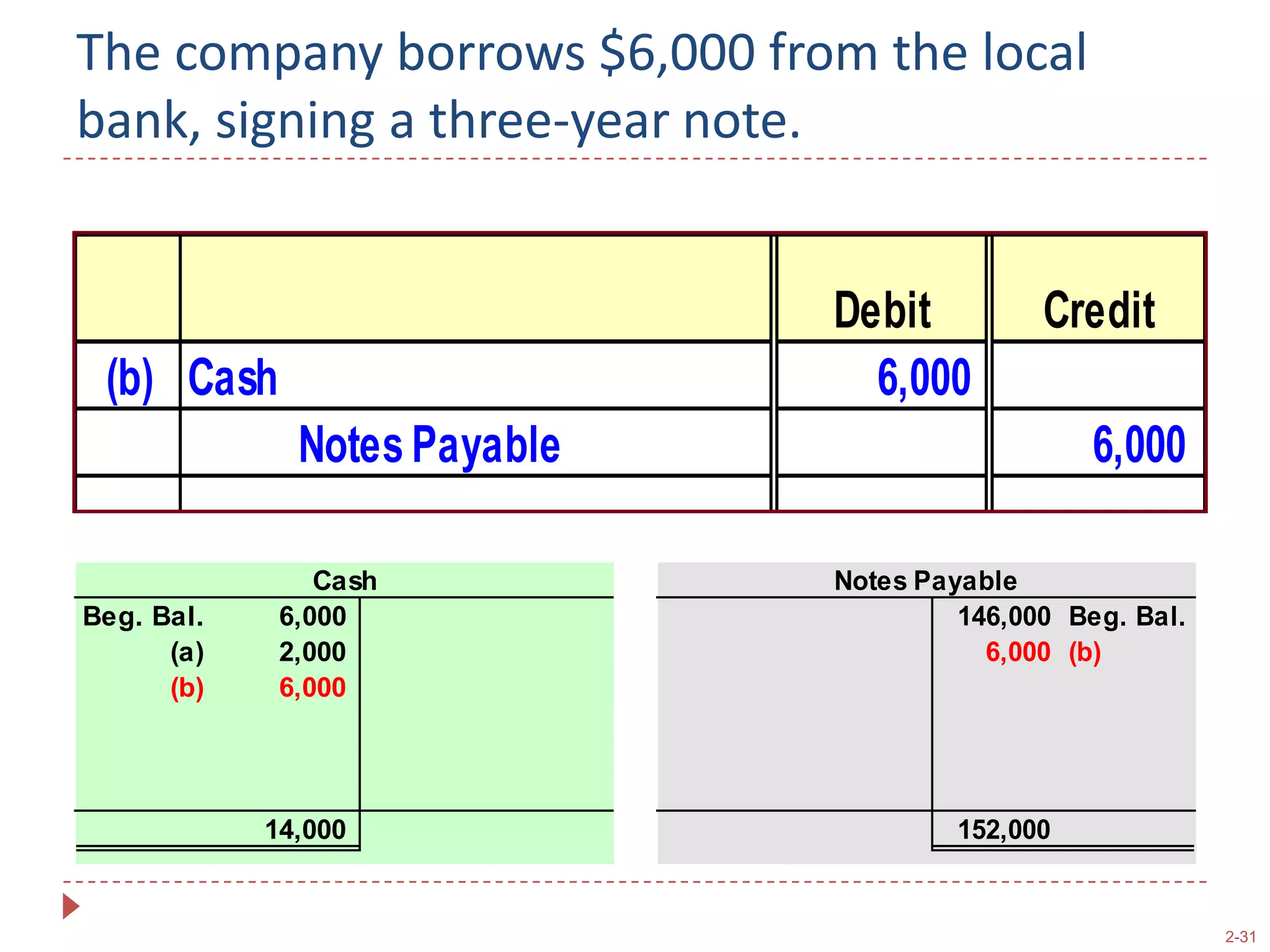

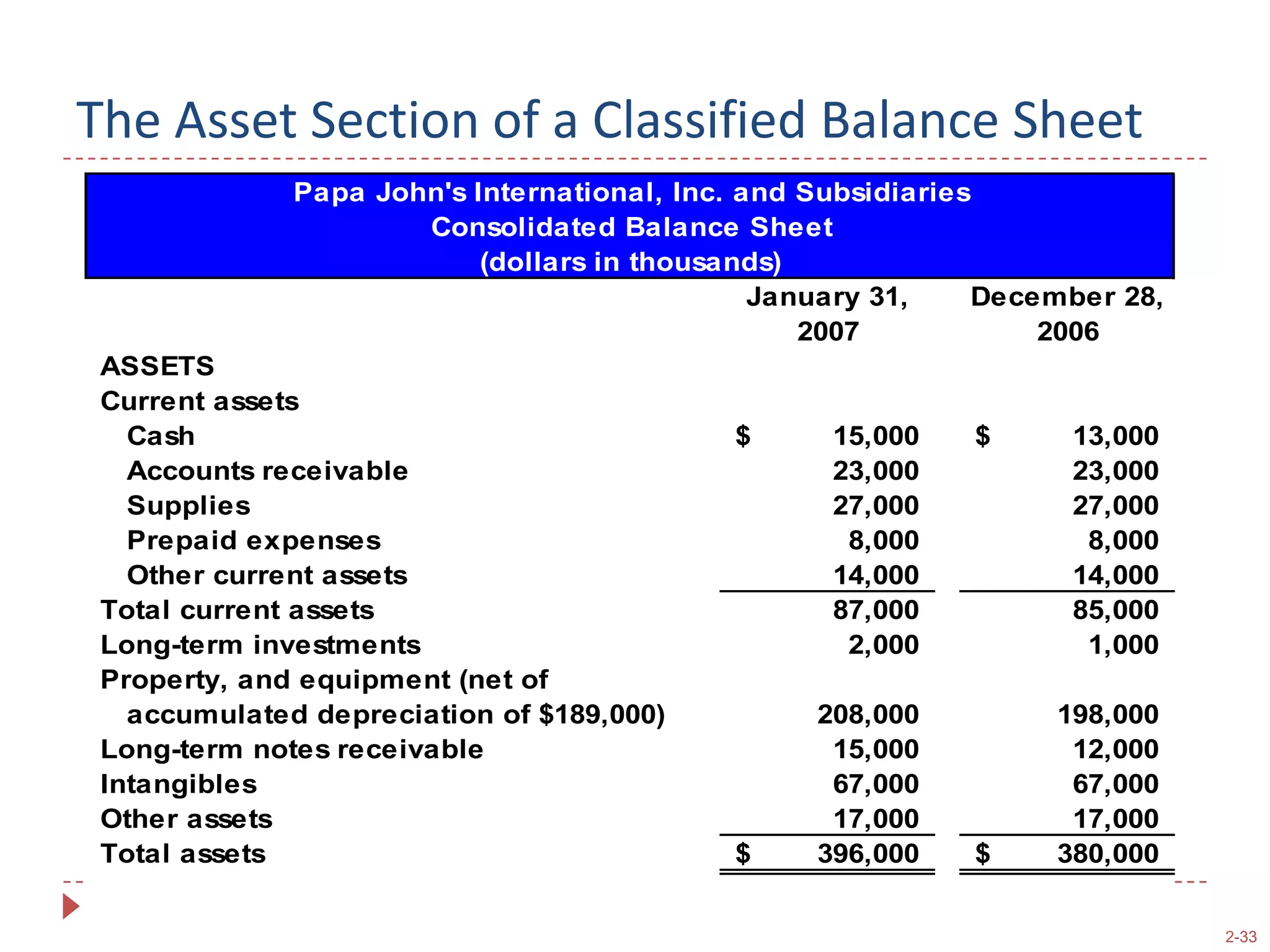

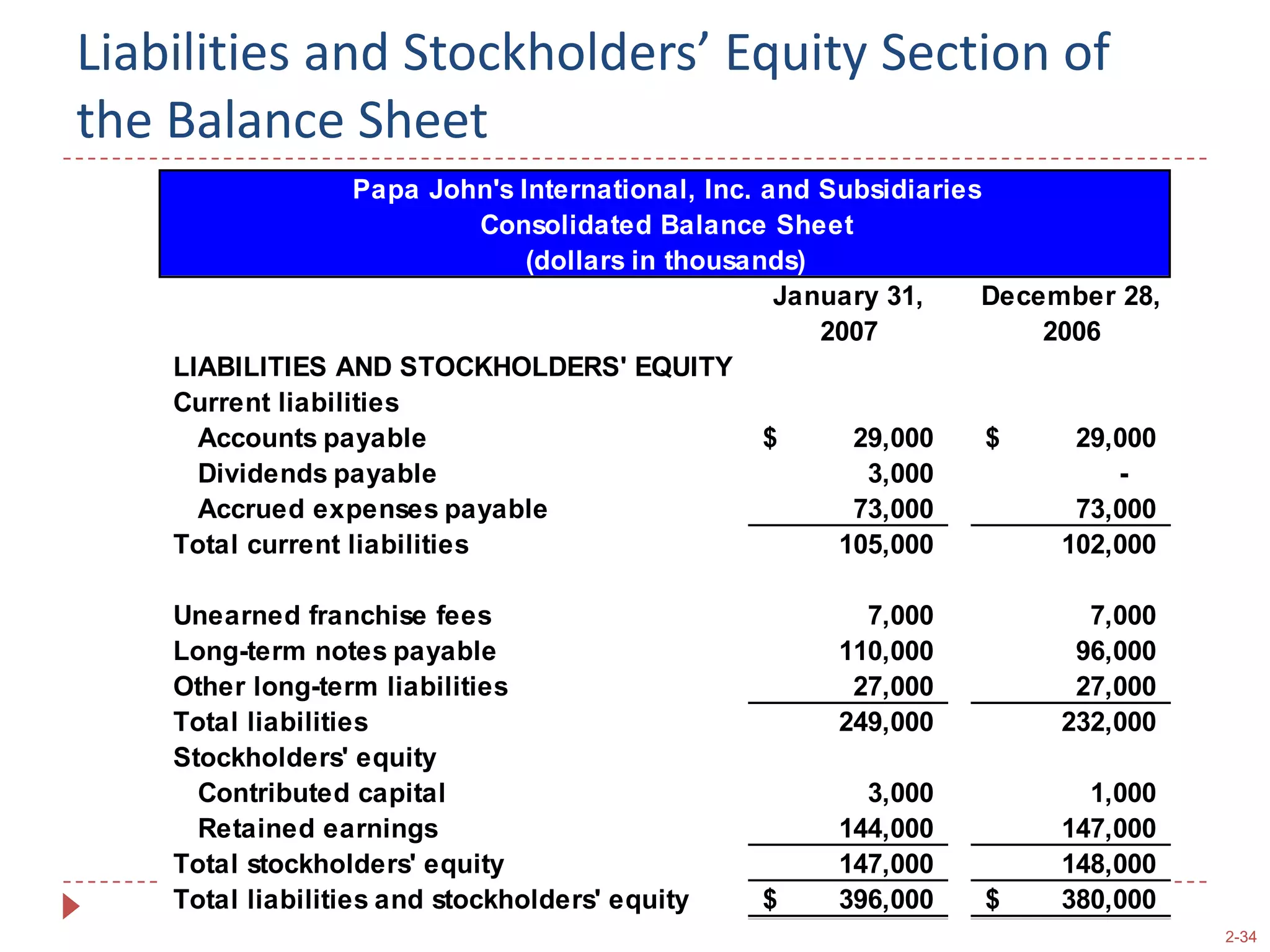

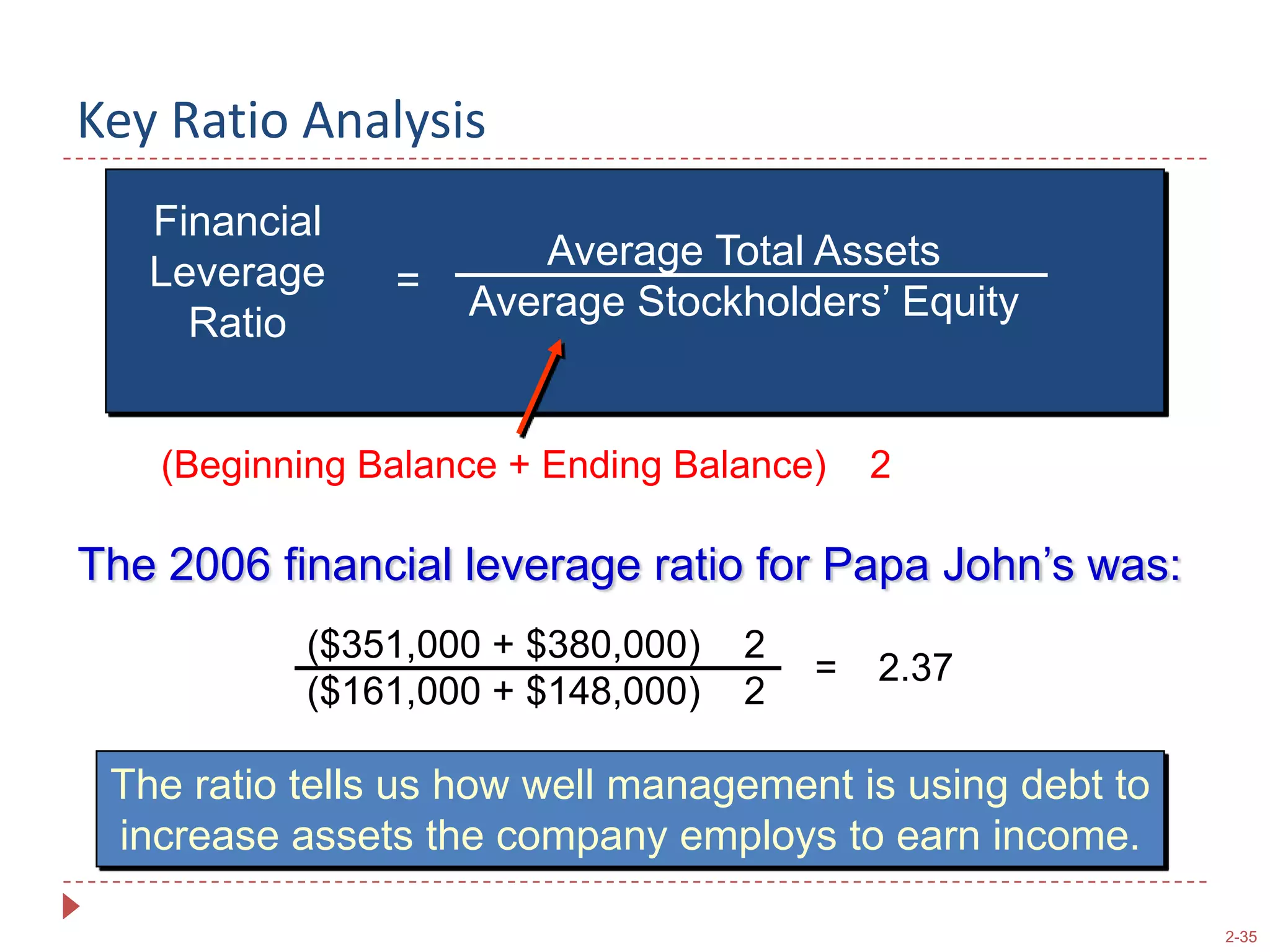

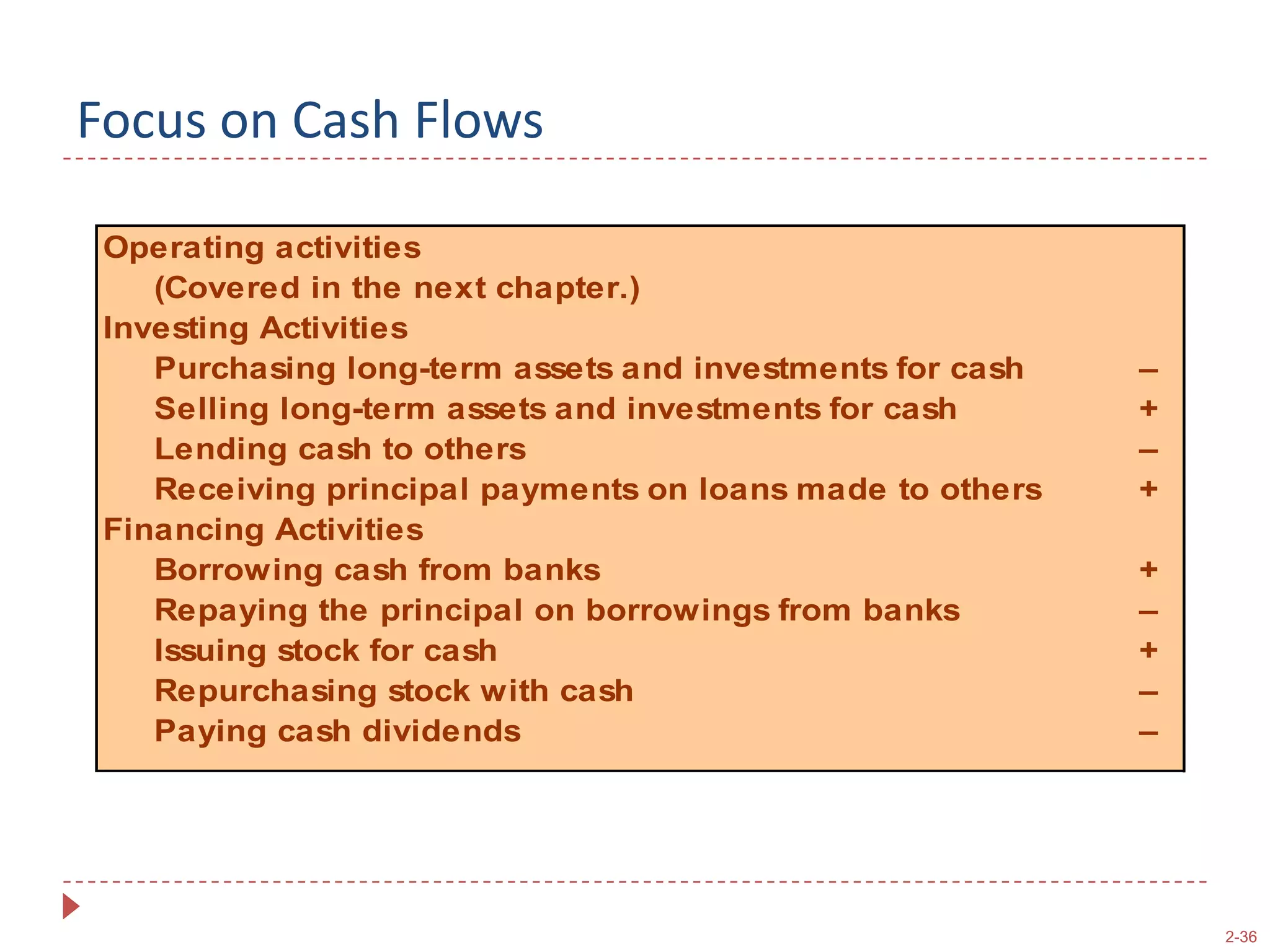

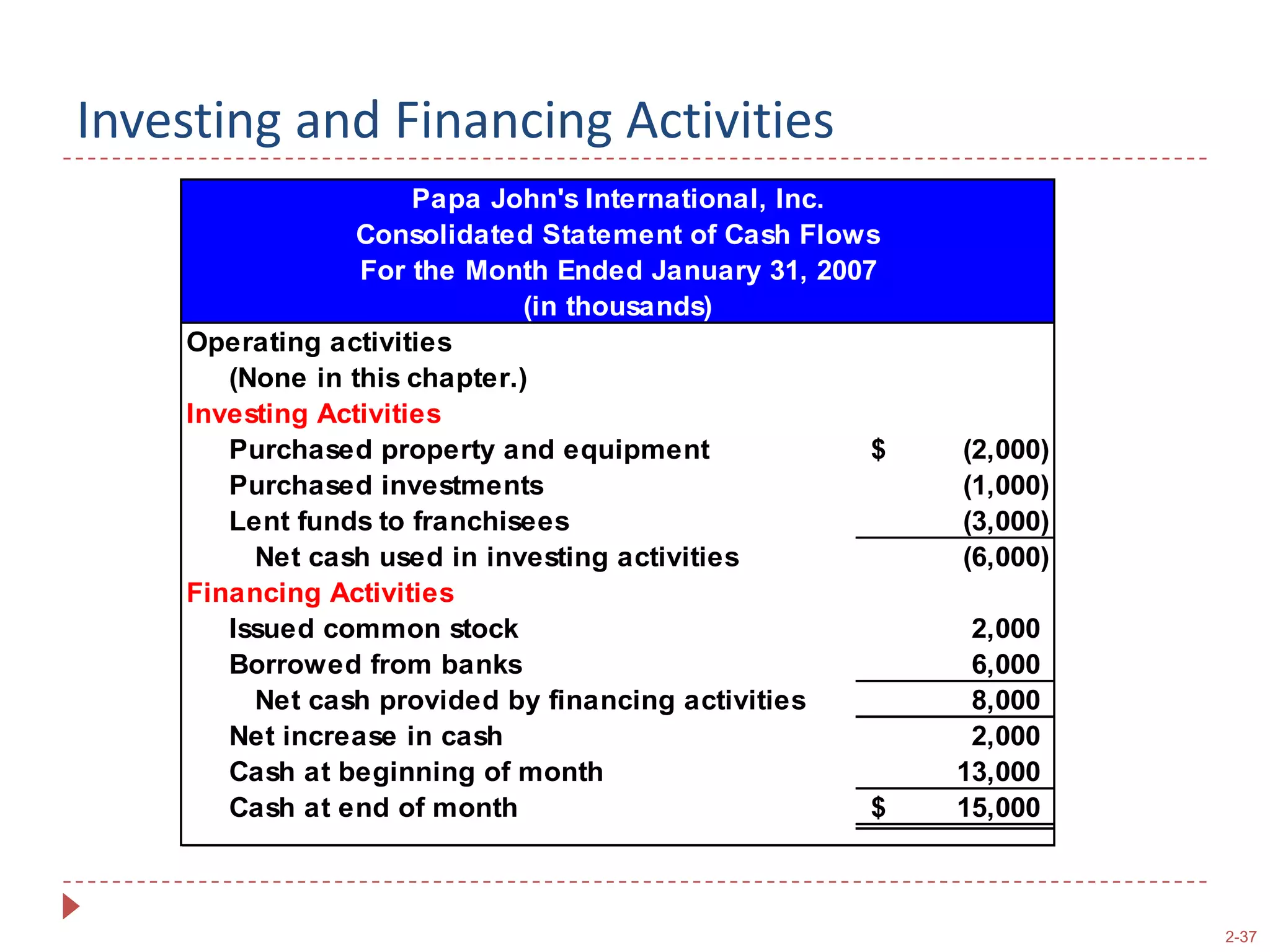

This document discusses key concepts for understanding a company's balance sheet, including the activities that cause changes and how specific activities affect balances. It covers the conceptual framework for financial reporting, including elements of financial statements, qualitative characteristics, and the objective of providing useful information to external users. Key aspects of the accounting cycle are also summarized, such as analyzing transactions, recording journal entries, and preparing financial statements.