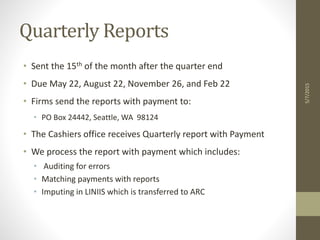

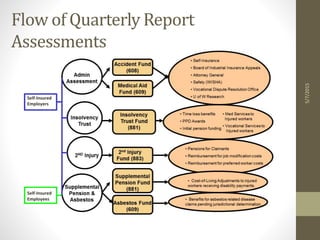

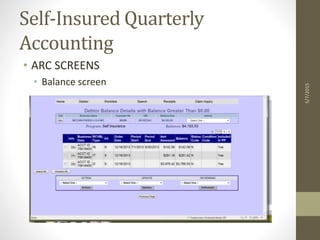

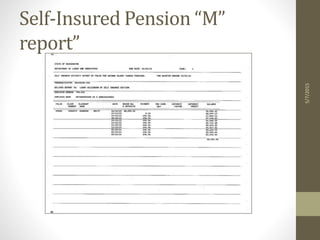

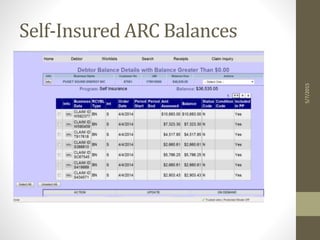

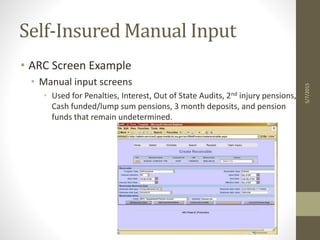

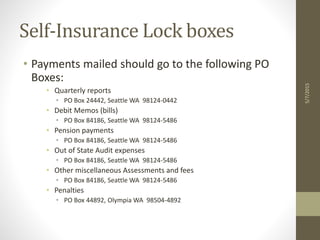

Self-insurance involves firms managing their own workers' compensation claims rather than using a state fund. The document discusses the various units that regulate self-insured firms, the requirements to become self-insured including financial standards, the application process, required documentation, and the flow of funds including quarterly reports, pensions, penalties, and various payment options. It provides details on the accounting processes through the LINIIS and ARC systems to record payments and debts.