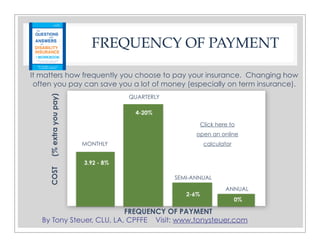

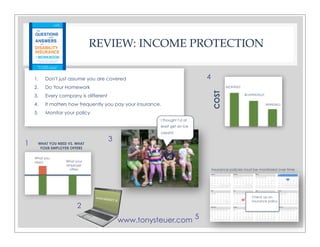

The document is a comprehensive workbook on disability insurance authored by Tony Steuer, aimed at educating readers about the importance of income protection against disabilities. It covers various aspects including the need for disability income insurance, types of coverage, evaluating needs, choosing an advisor, and maintaining insurance policies. Key statistics and actionable advice are provided to help individuals plan financially for potential disabilities.