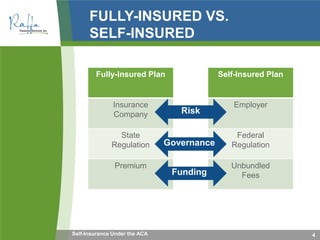

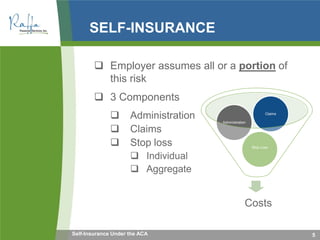

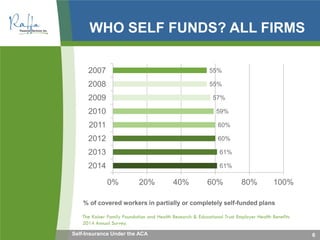

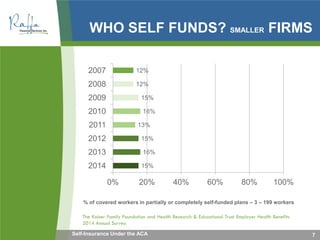

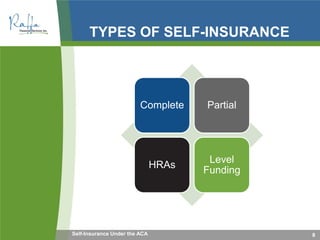

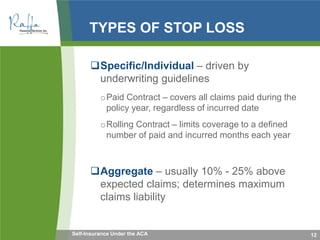

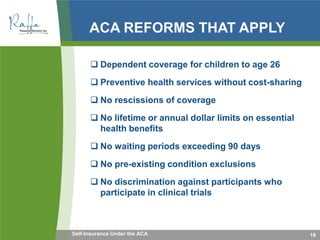

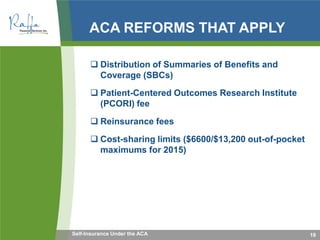

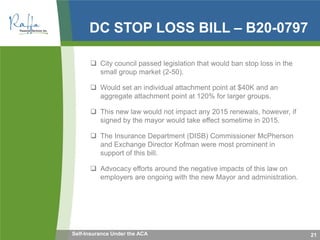

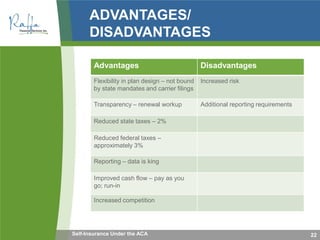

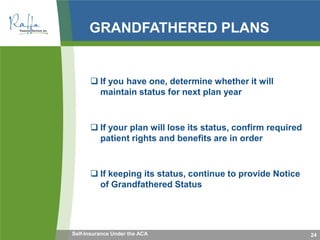

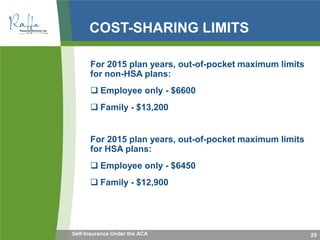

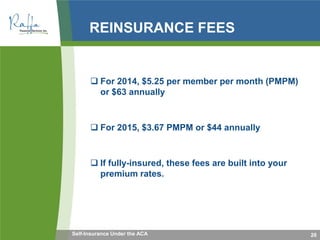

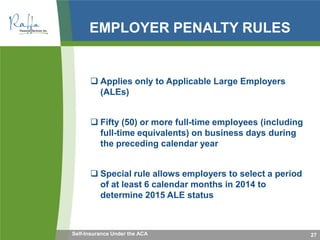

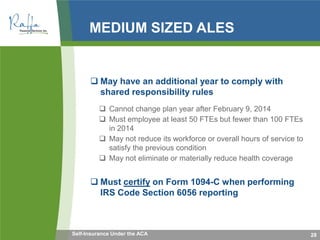

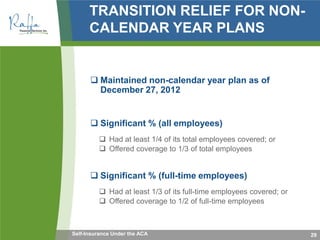

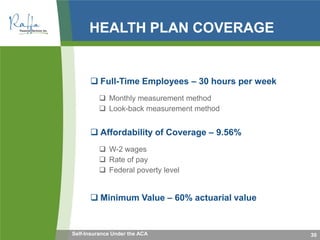

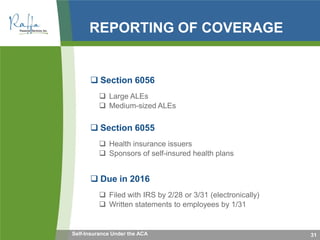

This document summarizes a presentation about self-insurance under the Affordable Care Act. The presentation discusses what self-insurance is, the impact of the ACA on self-insured plans, advantages and disadvantages of self-insurance, and updates about ACA requirements. It provides an overview of stop loss insurance, cost-sharing limits, reinsurance fees, employer penalties, and reporting requirements under the ACA. The presentation aims to educate companies on health care reform and compliance obligations for self-insured plans.