This document discusses the key steps and concepts in portfolio management, including:

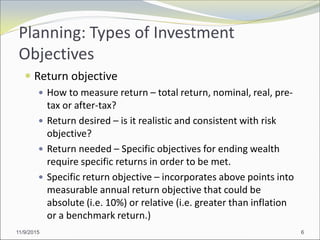

1) Identifying investment objectives like risk tolerance and return targets as well as constraints like time horizon and liquidity needs through creating an investment policy statement.

2) Developing strategic asset allocation by considering capital market expectations and the investment policy statement.

3) Implementing the portfolio through selection of specific assets and ongoing monitoring including performance evaluation and rebalancing.