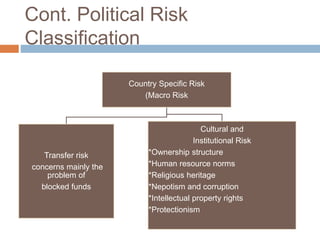

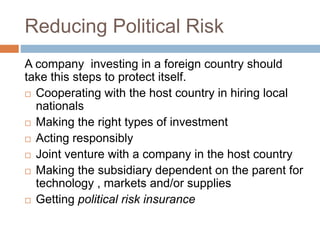

Political risk refers to risks faced by multinational companies from political actions in foreign countries they invest in. Such risks include laws requiring a certain percentage of local hires, investment in social projects, currency restrictions, discriminatory practices like higher taxes/fees, and expropriation. Political risk must be assessed based on the stability of the host government, prevailing political views, likely views of future governments, efficiency of government processes, economic stability, and strength of legal system. Political risks are classified as firm-specific, country-specific like transfer risk of blocked funds, cultural/institutional risks, and global risks affecting companies globally like terrorism. Reducing political risk involves cooperating with host countries, making appropriate investments, acting responsibly