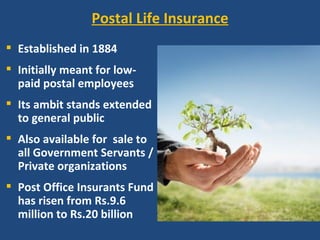

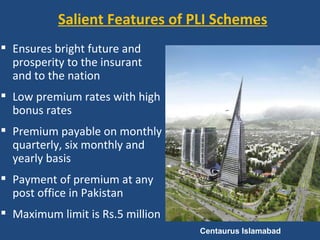

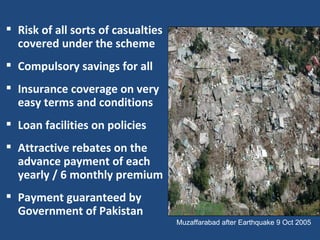

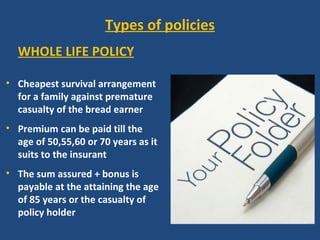

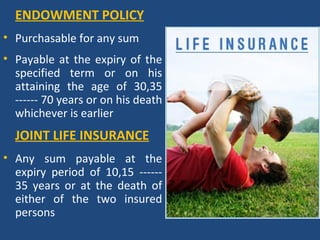

Postal Life Insurance (PLI) is a state-run life insurance program established in 1884 to provide insurance to postal employees. It has since expanded to serve the general public and government employees across Pakistan. PLI offers various whole life, endowment, accident, and child protection policies with low premiums and high bonus rates. Premiums can be paid flexibly and claims are guaranteed by the Government of Pakistan. PLI has a strong administrative network through Pakistan Post offices across the country, over 125 years of experience, and the confidence of the public.