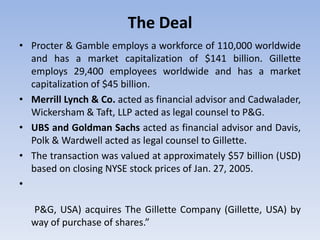

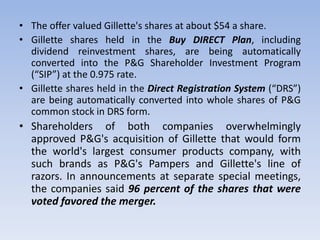

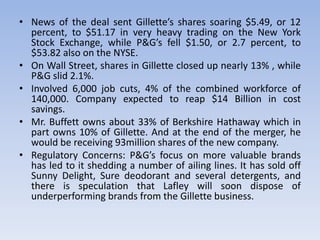

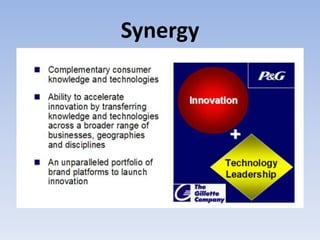

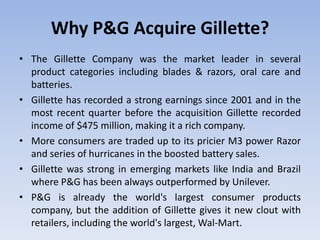

This document provides information about Procter & Gamble's (P&G) acquisition of Gillette in 2005. It discusses the key details of the deal, including that P&G acquired Gillette for $57 billion, with Gillette shareholders receiving 0.975 shares of P&G stock for each of their Gillette shares. The acquisition created the world's largest consumer products company and was expected to generate $14 billion in cost savings through synergies and 6,000 job cuts. While the deal boosted P&G's brand portfolio and global presence, its stock has underperformed competitors since the acquisition due to challenges integrating Gillette and economic headwinds impacting Gillette's razor business.