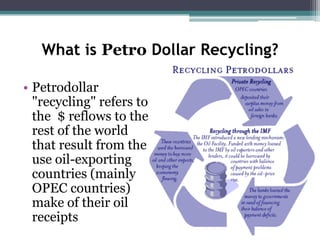

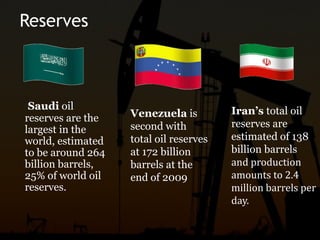

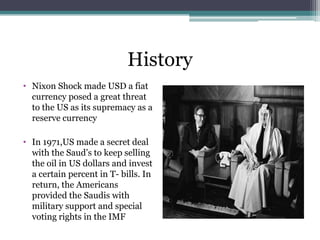

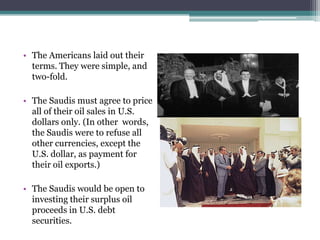

The document discusses the history and implications of the petrodollar system. It explains that in the 1970s, OPEC agreed to price oil in US dollars, and invest surplus profits in US treasury bonds, in exchange for military protection. This created consistent global demand for US dollars and debt. Countries like Iraq and Libya later sought to challenge the petrodollar by pricing oil in euros, which US opposed through military force. Iran, Russia, India and others also took steps to reduce reliance on the US dollar for oil transactions. The future of the petrodollar system and US dollar dominance is uncertain as alternatives emerge.

![Since the agreements of 1971 and

1973[1], OPEC oil is exclusively

sold in US dollars.](https://image.slidesharecdn.com/petrodollargold-130316183403-phpapp01/85/Petro-dollar-gold-20-320.jpg)

![Petrodollar warfare

• The phrase petrodollar warfare refers to a hypothesis that one of the

driving forces of United States foreign policy over recent

decades[when?] has been the status of the United States dollar as

the world's dominant reserve currency and as the currency in which

oil is priced.

• . The term was coined by William R. Clark, who has written a book

with the same title.

• The phrase oil currency wars is sometimes used with the same

meaning.](https://image.slidesharecdn.com/petrodollargold-130316183403-phpapp01/85/Petro-dollar-gold-25-320.jpg)