Embed presentation

Downloaded 10 times

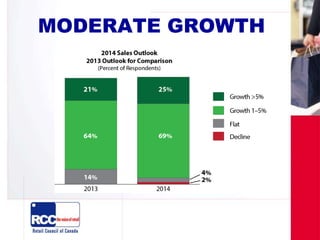

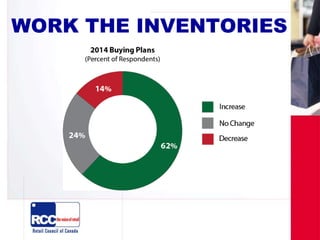

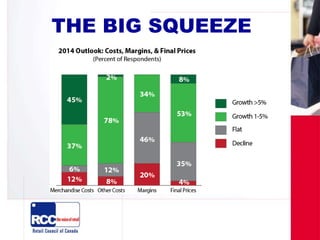

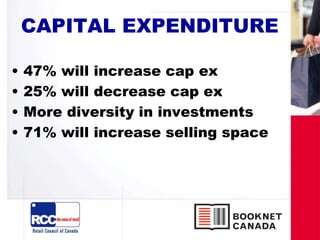

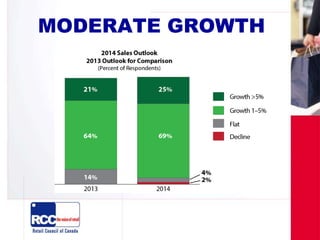

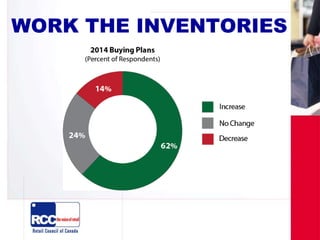

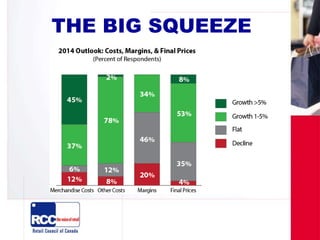

The 2014 Retail Outlook highlights modest growth for the retail sector at 3.8%, driven by tough competition and cautious consumer behavior. Key trends include the emergence of new players with innovative business practices, increased capital expenditures, and a shift towards larger competitors. The document emphasizes the importance of retail brand power and the challenge of customer-driven shopping in an increasingly international marketplace.