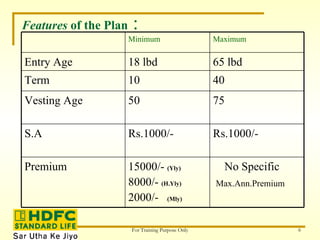

This document summarizes the features and benefits of the HDFC Pension Super plan, which allows policyholders to receive fixed payouts after retirement. Key highlights include:

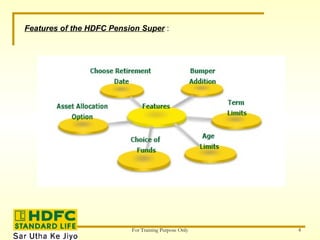

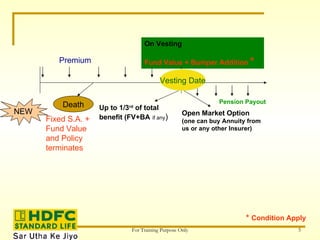

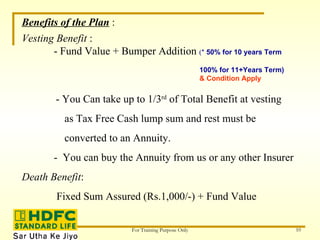

- Fixed sum assured plus fund value are paid out at vesting, with the potential for bonus additions depending on policy term

- Policyholders can withdraw up to 1/3 of total benefits at vesting tax-free and must use the rest to purchase an annuity

- Death benefits provide fixed sum assured plus fund value

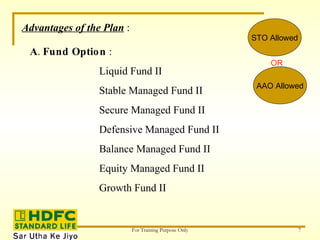

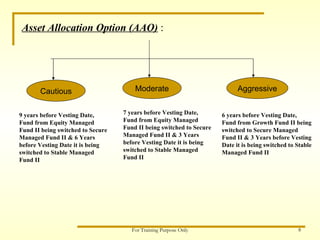

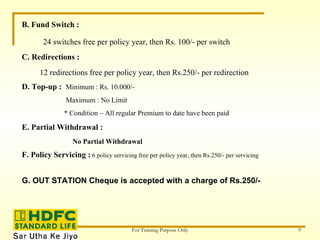

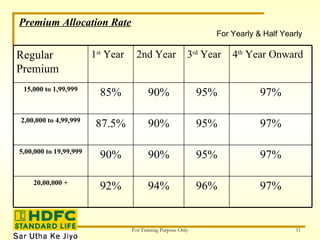

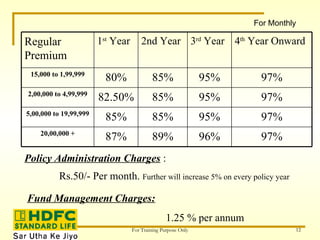

- Policy offers multiple fund and asset allocation options to invest premiums